Saving for a home is no easy feat in Canada’s housing market. With the backdrop of high inflation, high home prices, and an unstable political climate, it’s taking longer for first-time homebuyers to save for a down payment. In the just-released Desjardins Affordability Index (DAI): Finding Shelter From the Trade War Storm , Desjardins economist Kari Norman highlights the factors behind this reality and how tariffs could impact housing affordability.

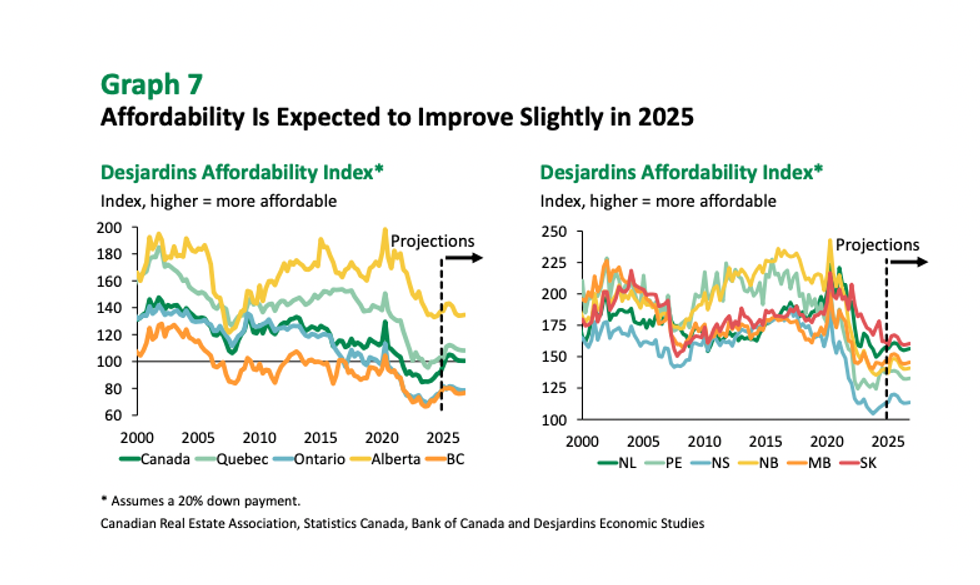

The DAI compares the average household after-tax disposable income with the income needed to qualify for a mortgage on an average-priced existing home, using the five‑year fixed mortgage rate and a 20% down payment and no mortgage insurance as a baseline scenario. “The Desjardins Affordability Index (DAI) remains near historically low levels of affordability despite recent easing in mortgage rates and, in some locations, falling home selling prices,” writes Norman.

To rewind slightly, the challenges to achieving the ‘Great Canadian Dream’ of homeownership have been both daunting and discouraging in recent years, especially in pricey (and increasingly unattainable) cities like Toronto and Vancouver. Not that any recent would-be homebuyers need the reminder, but this includes everything from rapidly climbing home prices, inflation, high interest rates, insufficient construction, and economic uncertainty.

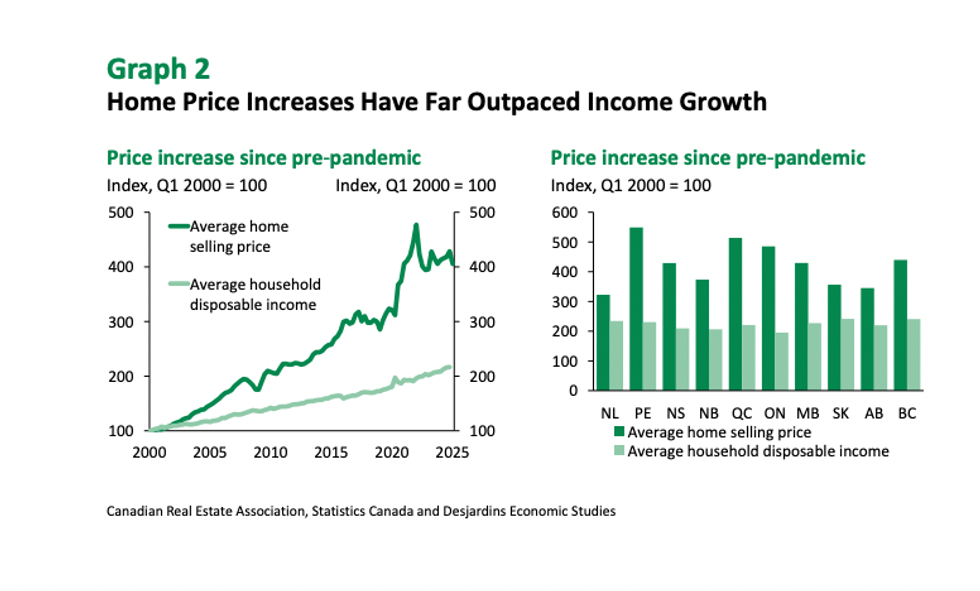

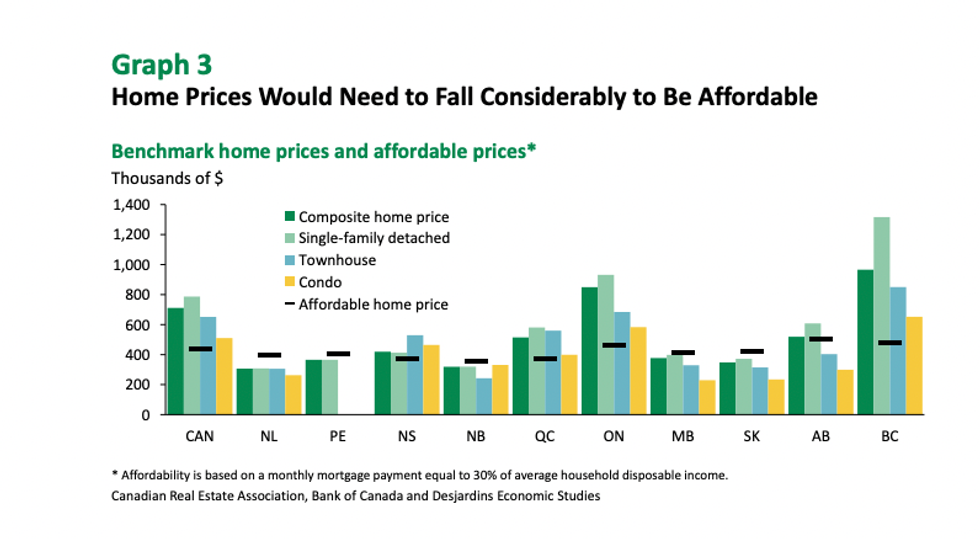

As Norman highlights, over the past quarter of a century, the cost of a home in Canada has “ballooned by more than four times.” Meanwhile, Canada’s average disposable income has just over doubled. It doesn’t take a mathematician to understand why benchmark home prices now consistently exceed what the average household can afford in several provinces.

“As a result of the widening gap between home prices and income gains, paired with high rent inflation between 2022 and 2024, it takes potential homebuyers significantly longer to save up for their down payment,” writes Norman.

Average Home Prices Remain Unaffordable

Especially in Canada’s large urban centres, home prices remain high. Norman highlights this reality, stating that the country’s housing affordability hasn’t significantly recovered from the challenges of the past five years.

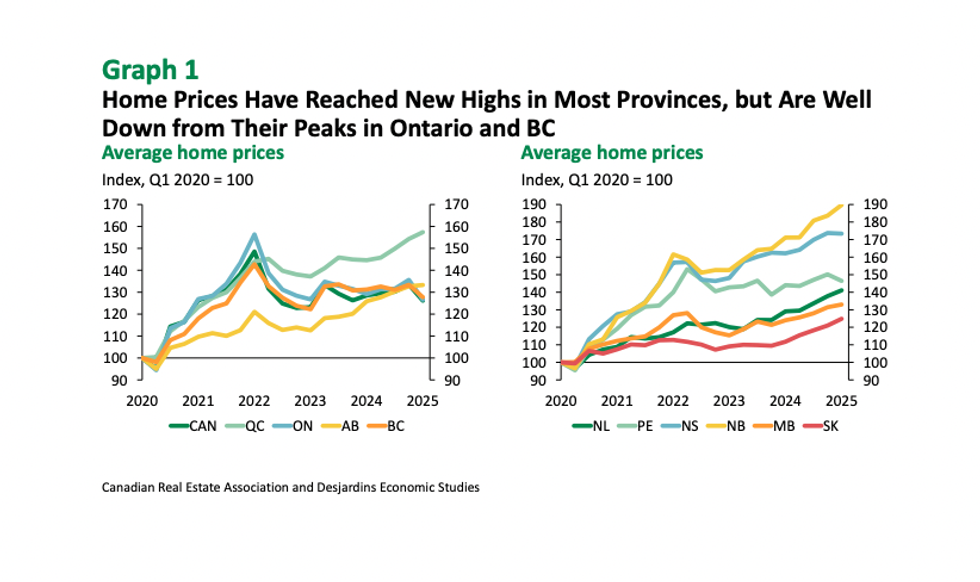

“Following the sharp run-up in home prices during the pandemic and the subsequent rise in interest rates, Canadian households entered 2025 still facing stretched budgets,” writes Norman. “Although average home prices have moderated in some provinces, notably Ontario and British Columbia (BC), most provinces’ prices have reached all-time highs.”

Thanks to the widening gap between Canada’s home prices and Canadians’ income gains, it takes potential homebuyers significantly longer to save up for their down payment, writes Norman. “Assuming households earning the average income save 20% of their disposable income in an account earning 3%, it would take about 6 years to accumulate a 20% down payment for an average home in Canada (graph 4),” writes Norman.

Naturally, she acknowledges that this timeline is longer in places like Ontario and BC, where home prices are higher. Conversely, this timeline is shorter in the Prairie provinces and most of Atlantic Canada. In any case, Norman points out how rent inflation between 2022 and 2024 added a further barrier to the ability to save for a down payment.

“Renters have increasingly struggled with their personal finances, with their likelihood of missing a debt payment now sitting at one in three, presumably hobbling their ability to save up for a down payment,” writes Norman.

Norman points to recent federal government policies that are designed to help Canadians enter the housing market faster. “The First Home Savings Account (FHSA) had nearly 740,000 new accounts with an average value of just under $4,000 by the end of 2023, its inaugural year,” reads the report. She also notes the federal government’s December 2024 increase in price cap for insured mortgages, a move that now allows buyers to purchase homes of up to $1.5 million with less than a 20% down payment.

“That said, policies such as these—and the proposed GST exemption for first-time homebuyers on new homes up to $1 million—may lead to increased demand, which could then drive up selling prices,” writes Norman.

Tariffs Add Insult To Injury

Would-be homebuyers can’t catch a break, as rising global trade tensions enter the equation to compound the country’s housing affordability crisis, leaving Canadians “bracing for a storm of uncertainty,” writes Norman. She says the trade war could have “mixed impacts” on housing affordability.

Norman notes that the resale housing market typically reacts faster than residential construction to economic shocks. “Monthly home sales figures fell sharply in the first quarter of 2025,” she writes. “It is likely that many of those waiting on the sidelines in 2024 for mortgage rates to come down hesitated due to the economic uncertainty of a trade war.”

Norman notes how Canada’s homebuilding industry – which has responded to tariff threats as “unwarranted and reckless” – is about to get “hammered by tariffs and retaliatory tariffs” over the next couple of years. “Our baseline economic outlook continues to point to a downturn,” she writes. “While Canada came out better than expected on ‘Liberation Day,’ a deeper downturn south of the border and elsewhere could be a drag on our economy.”

A Few More Rough Years In Store

Despite a softening of home prices, lower interest rates, rising disposable income, and aforementioned government policies, the DAI outlook clearly points to continued challenges ahead.

“Affordability is unlikely to improve meaningfully over the next two years,” writes Norman. “Due to the growth impacts of the global trade war instigated by the US, interest rates are expected to continue their downward path, helping to lower mortgage costs in our baseline outlook. However, rising unemployment will likely weigh on households’ disposable incomes. And while home sale prices should remain soft in 2025, we expect to see a return to growth the following year, with variations by province.”

The reality is, that, while Norman says the DAI isn’t likely to worsen in the near term, the softening of home prices in places like Ontario and BC won’t make houses affordable again in these notoriously pricey provinces. A lengthy savings period introduces further challenges to affordability.

“As down payments take longer to amass, the moving target created by rising home prices can keep homeownership always just out of reach,” writes Norman. “Those lucky enough to have family who can help are increasingly turning to them for financial assistance. Others are moving to less expensive cities, moving back into the family home or foregoing the dream of homeownership entirely.”

So, is now a good time to buy for the lucky set who do have a down payment? While she acknowledges that considerations vary widely from household to household, Norman tells STOREYS there are pros and cons to purchasing a home right now.

"Mortgage rates have come down significantly from a year ago, reducing monthly mortgage payments," Norman tells STOREYS. "First-time buyers can take advantage of some of the new policies rolled out late last year, such as 30-year amortizations and an increase in the cap on insured mortgages to $1.5 million, but they may want to hold out for the GST cut on newly built homes priced up to $1 million promised in the Liberal election platform. Average home selling prices have come down significantly in Ontario and BC while new listings have risen, resulting in a buyer’s market. But prices remain elevated in most other provinces. And— I think this is probably the most important point —prospective homebuyers facing job uncertainty due to the trade war will likely choose to hold off on undertaking a large mortgage at this time."

The (Not-So-Simple) Solution? Supply

Clearly, the DAI conforms how unaffordable homeownership has become in some regions of the country. Naturally, both the economic climate and and solutions are complex. The bottom line, however, is that we need more supply.

Norman highlights, that, while the widening gap between the rise in home prices and disposable incomes was exacerbated by the pandemic, it has roots going back over 25 years. "Improving affordability for all, but particularly for first-time buyers, will take a combination of lower mortgage servicing costs and higher disposable incomes," she says. "The Bank of Canada’s policy rate is expected to continue to unwind through the rest of 2025, reducing monthly mortgage payments. Policies such as longer amortizations and reducing or eliminating government fees and taxes on new construction should help to slow price inflation or even decrease the cost of new homes. But policies such as these can boost demand overnight, long before new home construction has time to catch up. So, we continue to believe that that increasing the supply of housing is the primary path to meaningful improvement in homeownership affordability."

Norman says policymakers should recognize that housing affordability can’t be addressed in isolation, but rather is intertwined with broader macroeconomic conditions. “Policies should be carefully crafted to provide significant improvements to housing affordability without generating high demand that could drive up home prices," she says. "We remain firm in our belief that increasing housing supply is the primary path to meaningful improvements in homeownership affordability.”