After disclosing earlier this month that it is taking a loss of $209 million on its investment, Toronto-based RioCan REIT (TSX: REI.UN) has now filed an application to place its joint venture with the Hudson's Bay Company (HBC) under receivership.

As previously outlined by STOREYS, the partnership between one of Canada's largest REITs and Canada's most iconic retailer was formed in 2015 with each partner contributing some of their real estate assets. Hudson's Bay contributed 10 properties — five it owned via freehold (inclusive of the land) and five it owned via leasehold (not inclusive of the land) while RioCan contributed a 50% co-ownership interest in the Georgian Mall and Oakville Place shopping centres — both located in Ontario — and cash.

The contributions translated to HBC holding a 79.8% stake in the joint venture entity, RioCan-HBC Limited Partnership, and RioCan holding a 20.2% interest. As of March 2025, when Hudson's Bay filed for creditor protection under the Companies' Creditors Arrangement Act (CCAA), the ownership split was 78.0136% and 21.9864%.

The 12 properties under the RioCan-HBC joint venture entity and the JV's ownership interests in them are:

- Square One - Mississauga, Ontario (Leasehold)

- Scarborough Town Centre - Scarborough, Ontario (Leasehold)

- Yorkdale - North York, Ontario (Leasehold)

- Carrefour Laval - Laval, Quebec (Leasehold)

- Les Promenades - St. Bruno, Quebec (Leasehold)

- Downtown Vancouver - Vancouver, British Columbia (Freehold)

- Downtown Calgary - Calgary, Alberta (Freehold)

- Downtown Montreal - Montreal, Quebec (Freehold)

- Downtown Ottawa - Ottawa, Ontario (Freehold)

- Devonshire Mall - Windsor, Ontario (Freehold)

- Georgian Mall - Barrie, Ontario (Freehold, 50%)

- Oakville Place - Oakville, Ontario (Freehold, 50%)

Tensions Mount After CCAA Filing

Cracks first started to emerge between RioCan and Hudson's Bay immediately after Hudson's Bay secured creditor protection on March 7. (RioCan was not an applicant, but the creditor protection was extended to the JV entity.)

Under the structure of the joint venture, the JV entity became the holder of the ownership interests in the properties and then leased the spaces to Hudson's Bay to operate its stores, with HBC then making rent payments to the JV entity. However, when Hudson's Bay secured creditor protection, it also secured the ability to stop paying rent to the JV entity, except to the third-party landlords of the five leasehold properties.

RioCan challenged this in court, as previously reported by STOREYS, calling the rent suspension "unprecedented." The two partners ultimately found a compromise that entailed HBC paying approximately 70% of its rent obligations to the JV — $7,000,000 of approximately $10,000,000.

The Receivership

In its application, dated May 29, asking the court to appoint a Receiver over the joint venture and its related entities, RioCan said that the Monitor-led lease monetization process over the last month or so resulted in no bids for Hudson's Bay's 78% stake in the joint venture or any of the leases held by the JV.

"Given the current circumstances of HBC, its wind-down pursuant to the HBC CCAA Proceedings and the results of the SISP and Lease Monetization Process, HBC has taken steps to disclaim certain of the JV Leases and otherwise cease paying monthly rents to the JV Entities," said RioCan in its application.

"The monthly rents payable by HBC under the JV Leases represented the main source of funds from which the JV Entities would fund operations, service their secured debt obligations and pay rent obligations owing to the JV Landlords under the head leases relating to the Leased Properties, among other things," they added. "Based on the current circumstances, the JV Entities will be unable to meet their secured debt obligations to the Secured Lenders and any other obligations owed to stakeholders from and after receiving the June rent payments from HBC."

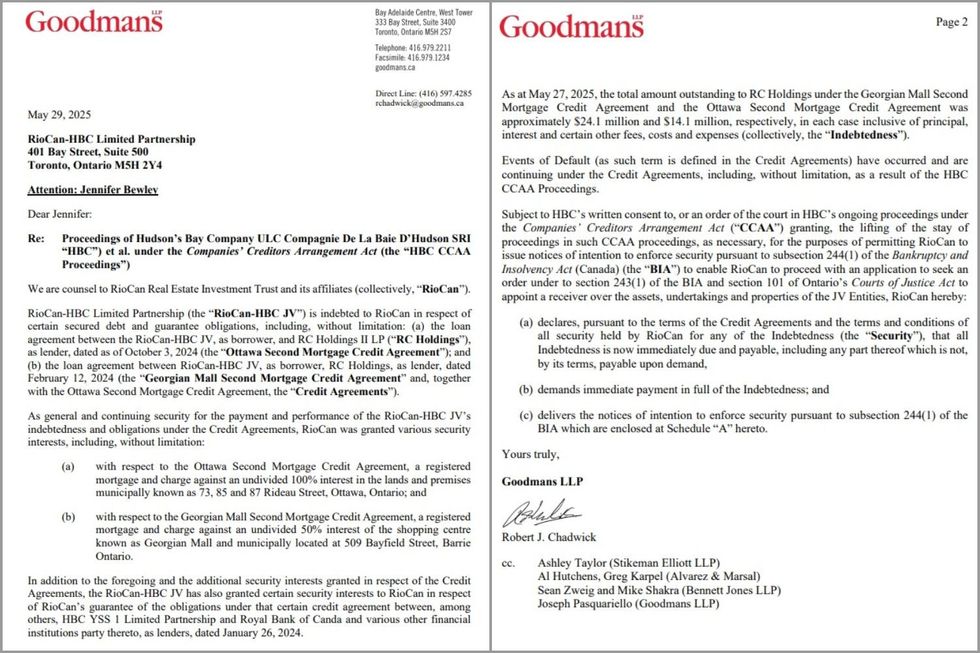

RioCan says that on May 29, it issued a letter to the JV declaring that all of the JV's obligations pertaining to the Georgian Mall and downtown Ottawa store are due and made a formal demand for payment. Those two obligations relate to, respectively, $24.5 million in second mortgage financing RioCan provided the JV in February 2024 and $16,650,000 in second mortgage financing RioCan provided the JV in October 2024. As security for providing those mortgages, RioCan was granted charges against some of the JV entities and its assets.

According to RioCan, the amounts owing as of May 27 were approximately $24.1 million and $14.1 million, including principal, interest, as well as various fees, costs, and expenses.

"RioCan believes that transitioning the JV Entities into receivership proceedings and appointing the Receiver is necessary and appropriate at this time given HBC's current circumstances and the results of the SISP and the Lease Monetization Process in order to preserve and maximize value with respect to the JV Entities and their assets," said RioCan, adding that actions it could take to maximize recovery could include "advancing various secured creditor credit bid transactions, conducting additional sale efforts in respect of certain of the JV Properties, seeking to identify new tenants and subtenants for the JV Properties on amended or new lease terms, and/or advancing potential redevelopment opportunities."

Legally, creditor protection proceedings entail a Monitor appointed to oversee the restructuring of an insolvent business, while a receivership allows a secured creditor to take more direct control towards recovery.

RioCan says it has consulted with HBC, the Monitor guiding the CCAA proceedings, and other secured lenders to develop a plan to smoothly transition the JV entities into receivership, including giving priority lenders options to terminate the receivership proceedings. RioCan says that it is also willing to finance the receivership and will allow the Receiver to borrow up to $20 million.

The receivership application will be heard by the Ontario Superior Court on Tuesday, June 3.