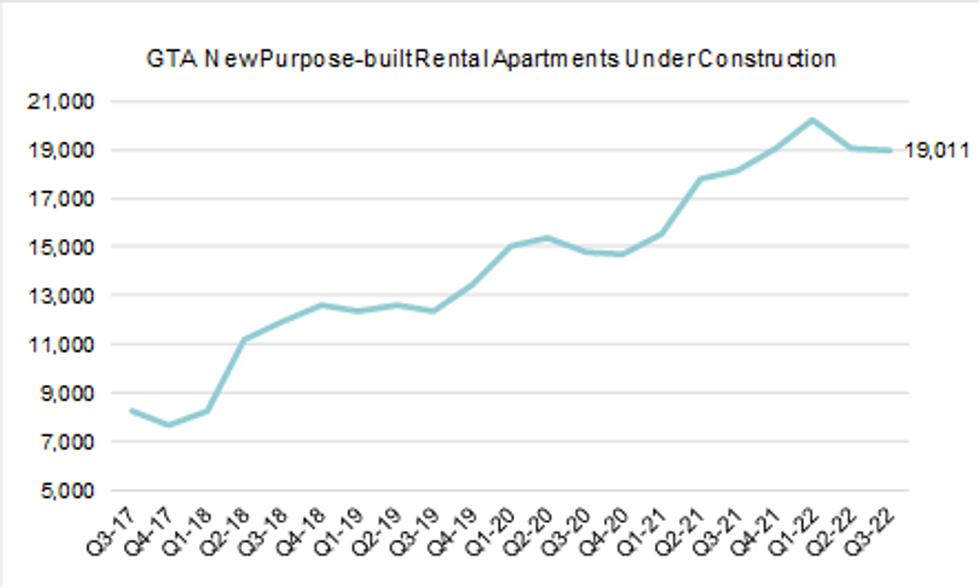

While rental demand continued to build in the GTA, rental construction plunged 72% in the third quarter of this year. Total year-to-date starts fell to 1,709 units, and total rentals under construction fell to 19,011 -- down from 20,215 units in Q1-2022 -- with only one project breaking ground in Q3.

This is according to the latest findings on the GTA condominium and rental apartment markets from Urbanation Inc., released today, which attributed the rental sector heat to students and faltering home-buying demand in the high interest rate environment.

Urbanation’s report also noted that though condominium lease activity was down 11% year over year in Q3 2022 -- after reaching an all-time high in 2021 -- “this was a function of supply rather than demand.”

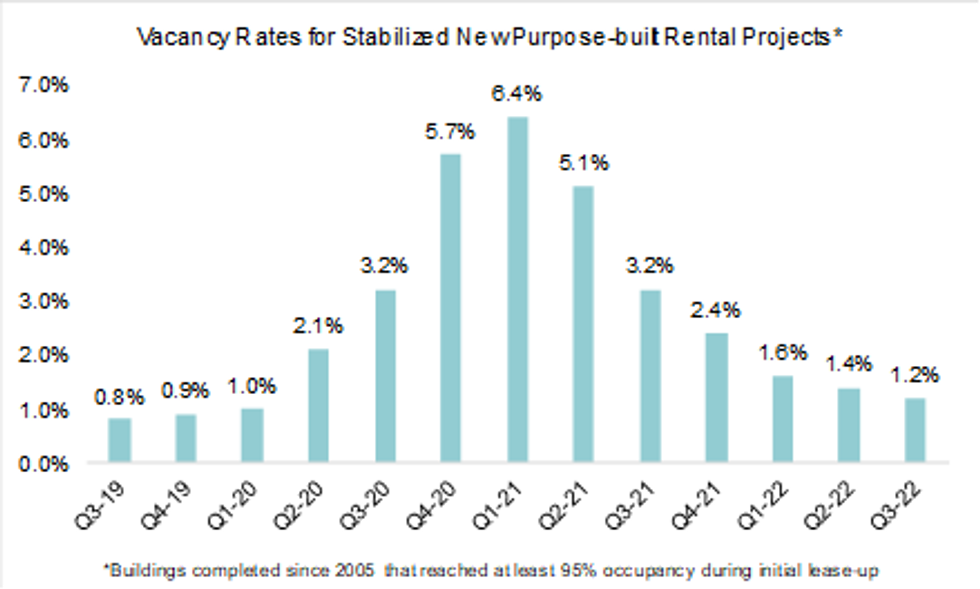

Active listings were also down in Q3, falling 20% from the year prior. The proportion of active listings was 6% below the 10-year average. Additionally, the average vacancy rate in the region dropped to 1.2%, down from 3.2% a year ago and 6.4% during the pandemic high (in Q1-2021), indicating that average vacancy has returned to a pre-pandemic low.

With the GTA’s rental sector facing a severe inventory shortfall, units were snatched up at a record pace last quarter. On average, rental units sat on the market for ten days. Meanwhile, a lofty 36% of condo rentals leased for above-asking rent -- a $129 monthly markup on average.

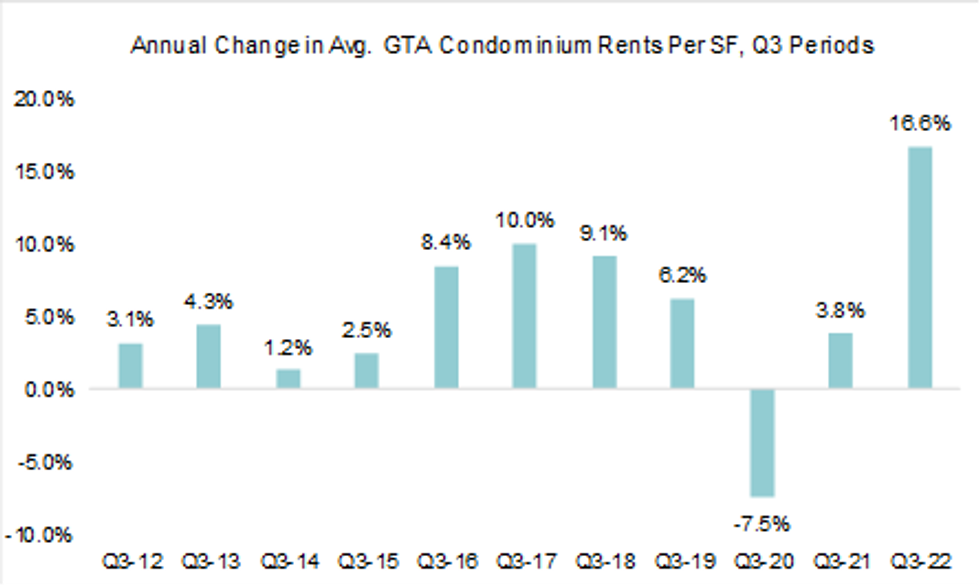

Compounded by those realities, average condo rents rose to a record high of $2,733 ($3.86 psf) from the second to third quarter of the year. This brings average rents up 14.5% over the past six months, up 16.6% over the past year, and 11.9% over the pre-pandemic high of Q3 2019.

In keeping with the trend from past quarters, the smallest unit types saw the most dramatic annual rent increases. Studio units led the pack, with a 21% YoY increase to an average of $2,123 ($5.18 psf). One-bedrooms increased 19% YoY, two-bedrooms increased 15%, and three-bedrooms (and up) increased 12%.

“It’s clear that rental demand and new construction are moving in very different directions, which is going to continue placing strong upward pressure on rents over the long-term,” says Shaun Hildebrand, President of Urbanation. “While a more moderate pace of rent increases may be in store in the coming months as the economy slows, record high levels of immigration and low ownership affordability should keep the rental market undersupplied.”

Urbanation’s data is in line with the national trend, which saw housing starts across Canada’s largest cities decline by 5% in the first half of this year, according to the latest Housing Supply Report from the Canada Mortgage and Housing Corporation (CMHC).

While the CMHC described rental construction across Canadian CMAs as “generally resilient,” its Toronto-specific data also reflected that fewer purpose-built rental apartments have broken ground this year due to mounting affordability issues.