In contrast to hearty construction activity in 2021, housing starts across Canada’s largest cities saw a 5% decline in the first half of this year. Apartment construction, which fell 9%, was to blame for the overall decline.

This is according to the latest Housing Supply Report from the Canada Mortgage and Housing Corporation (CMHC) -- a deep dive into housing construction trends, costs, and timelines in Toronto, Vancouver, Calgary, Edmonton, Ottawa, and Montreal.

Of the markets examined, “housing starts were mixed,” notes Francis Cortellino and Eric Bond, Senior Specialists for housing market analysis for CMHC, with construction gains in Toronto, Calgary, and Edmonton offset by declines in Vancouver, Montreal, and Ottawa. “Rental construction was generally resilient, due to strong demand for this type of housing, while developers took a more cautious approach to starting new condominium apartment projects, due to the higher interest-rate environment. Increases in construction costs and materials shortages were also felt across markets, impacting construction times and the affordability of the housing delivered.”

Toronto Had the Most Housing Starts of Any CMA Examined

Over the first six months of 2022, Toronto’s housing starts clocked in at 19,520, up 7% from the year prior and reaching a record high (91,148 units) in June. Apartments -- and most notably, condominiums -- made up 69% of Toronto’s total starts. This is attributed to strong pre-construction sales of condominium apartment units in the past year and a half.

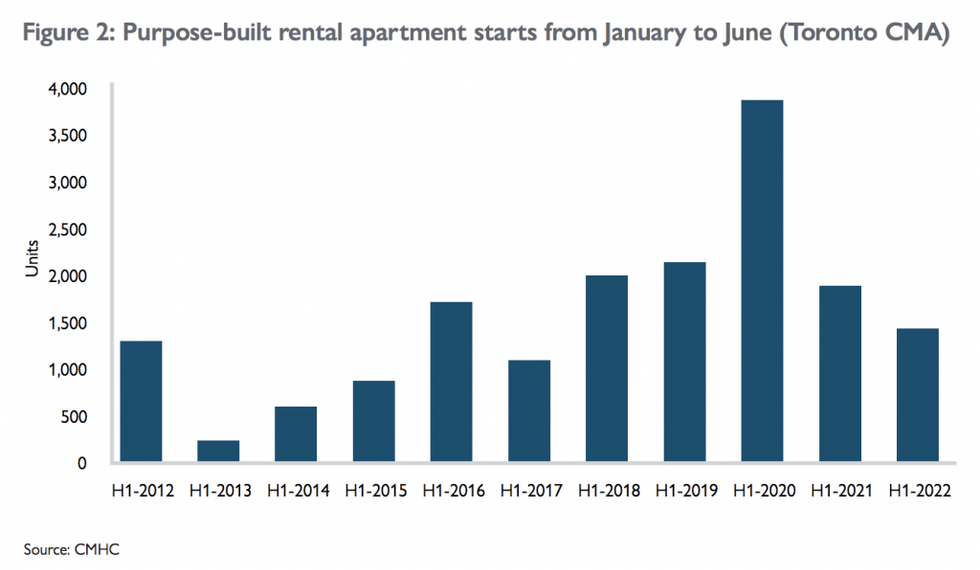

Row house and townhome construction also saw upticks over the aforementioned six-month period. Meanwhile, the construction of single-detached and semi-detached homes declined, reflecting the dwindling purchasing power of today’s home-buyers, and fewer purpose-built rental apartments broke ground, also pointing to affordability challenges.

Despite the frequency of apartment starts this year, CMHC warns of headwinds to come.

“Higher construction costs and interest rates could lead to project cancellations or delays in project launches and dampen homebuying activity,” the report explains. “The cost to build a high-rise apartment building (five or more storeys) in the second quarter was up 22%, year over year, while weak homebuying activity was evidenced by a steep 31% decline in pre-construction sales for new condominiums over the same period.

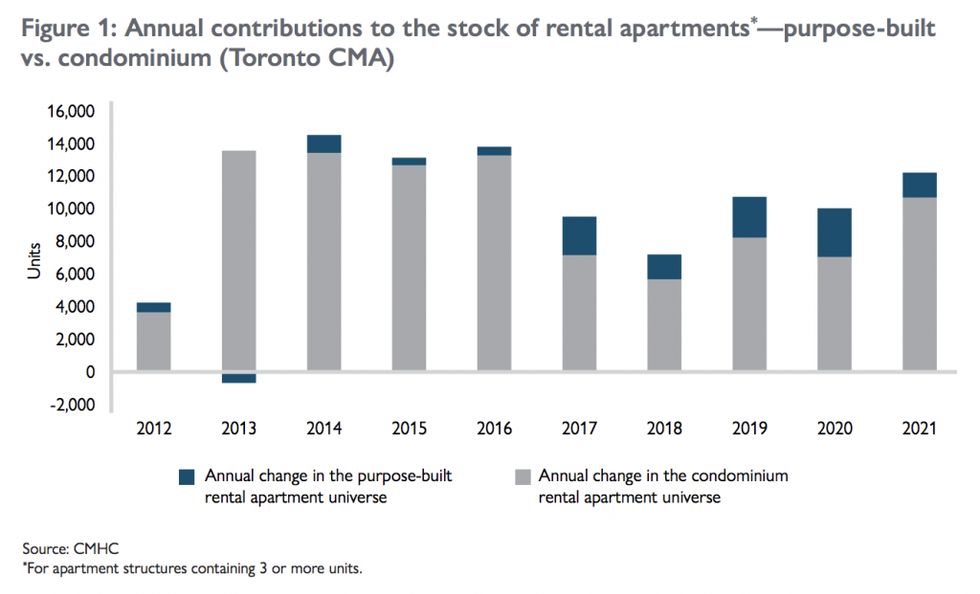

“Cancelled or delayed projects and easing pre-construction sales may mean fewer options for homeownership in the future as well as fewer rental options, since investor-owned condominiums are an important source of rental supply for the region.”

Vancouver Saw Starts Decline, Led by Condominium Apartments

Total housing starts in Metro Vancouver fell 23% in the first six months of this year compared to the same timeframe in 2021. Much of the drop is chalked up to the region’s condominium apartment segment (which saw a 46% decline), and the semi-detached segment (starts for which nearly doubled), in combination with the reality that many developers are taking a pause.

“With home prices coming off early–2022 highs across the region, some developers are taking a more cautious approach to starting new condominium projects,” the report iterates. “Others, particularly those who purchased development sites at recent elevated prices, may be looking to time the market in order to achieve desired returns.

“Municipalities have started reporting growing numbers of developers of approved projects that are choosing to wait to start construction. It remains to be seen whether some developers will let their permits expire and cancel their projects due to current market conditions.”

Developers in the rental segment, however, were less hesitant. As such, rental starts saw an 18% increase in the first six months of this year compared to last, reaching a multi-decade high. However, further interest rate hikes may stifle some of this activity in the coming months, and render some planned projects financially unviable.

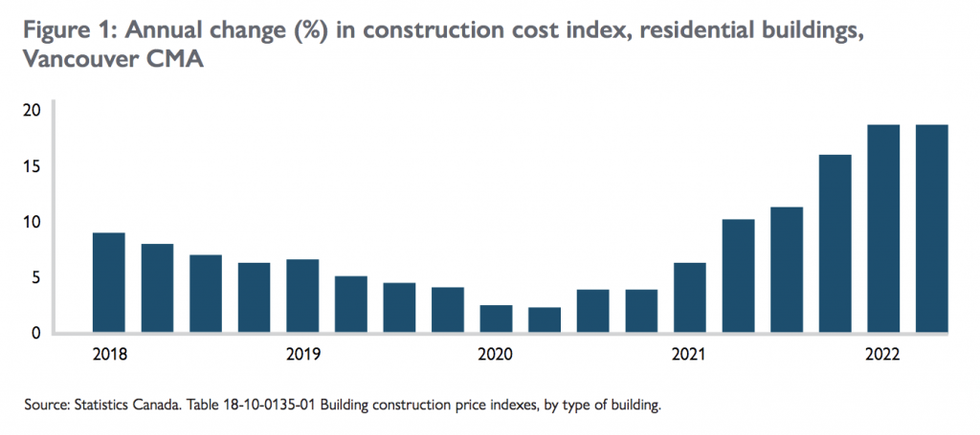

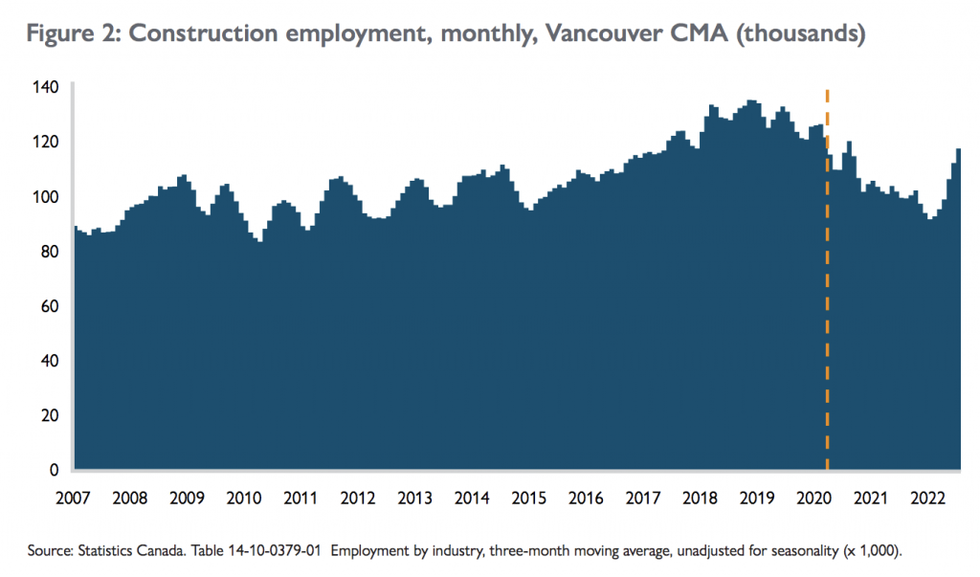

Other headwinds facing Vancouver include material shortages and steepening construction costs. On the flip side, construction employment has rebounded in the region, which has helped to level out wages. Still, more trained labour will be needed to meet the needs of current and future residents

Starts in Calgary Outpaced Levels from 2021

In Calgary, housing starts in the first half of this year transcended levels from last year, and this was true across all housing types. But most notably was apartment starts, which expanded by almost 30%. Of the apartment starts, rental starts accounted for almost half, climbing to an all-time high.

“Greater construction activity in Calgary is occurring at the same time as observed cost inflation and higher financing costs,” the report explains. “This optimism is supported by strengthening expectations stemming from economic growth and expected sustained migration flows into Alberta.”

Another trend observed in Calgary’s market was a decrease in construction times. This was driven by the reality that many smaller projects have been set in motion, “since they present less risk while also allowing developers to be nimble. By building on less-expensive land on the outskirts, developers are also able to build more low-rise apartments, which are easier and less costly to build."

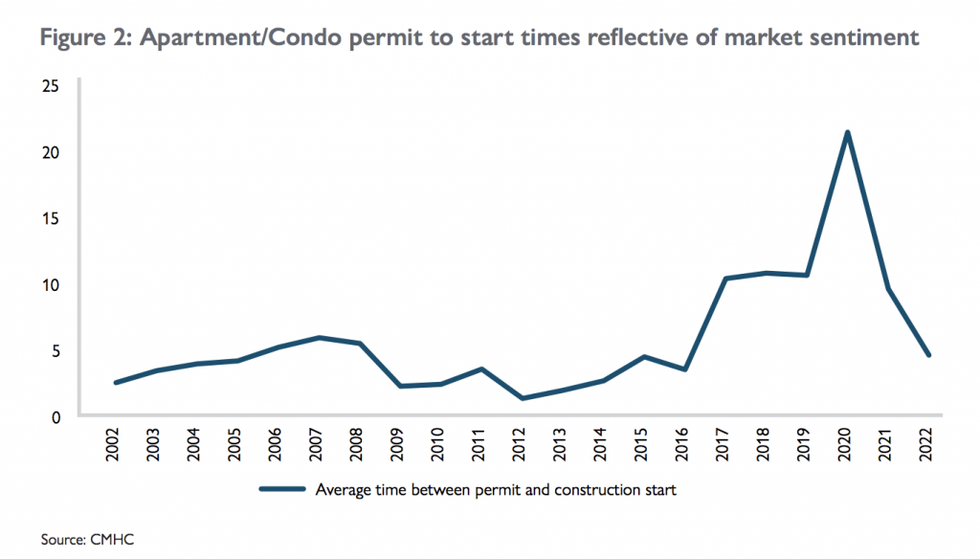

At the same time, Calgary’s market saw a longer duration between permit approval and construction start, which correlates with weaker market sentiment.