While it seems as if headlines and group chats are filled with discussions of how Canada's housing market is cooling, many fail to mention that the moderation we're currently seeing stems from the serious lack of new supply.

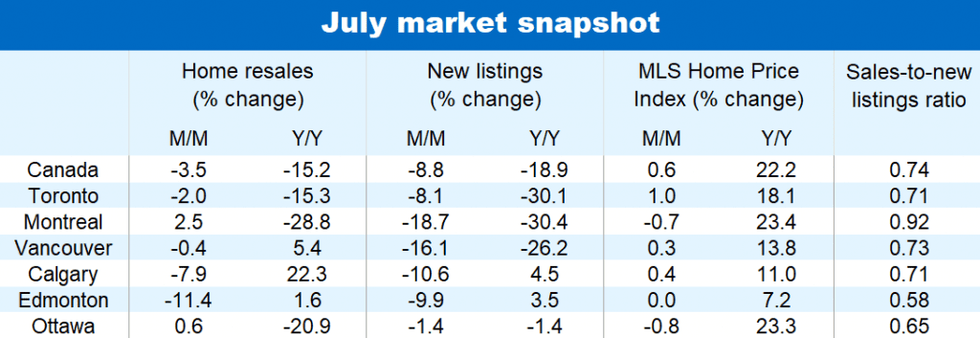

For the fourth-straight month in a row national home sales moderated in July -- falling 3.5% from June to a still-strong 584,200 units -- after reaching what RBC economist Robert Hogue describes as "extreme" and "unstable" levels earlier this year.

Of course, there are a few factors at play that are impacting demand: the easing of pandemic restrictions, rising home prices, and the latest tightening of the mortgage stress test.

However, the main factor that continues to slow the once feverish pace of demand is easily the lack of new supply.

READ: Canadian Home Sales Continued Cooling in July as New Inventory Sits at Record Low

New listings fell notably again last month on a national level (down 8.8% m/m), leaving buyers with even fewer options to choose from.

Despite the moderation in activity, demand-supply conditions remain exceptionally tight in the vast majority of markets across the country.

"This generally provides solid support for prices though bidding wars aren’t as frenzied as they were just a few months ago. Buyers increasingly resist upping the ante—likely limited by budget constraints or concerned the market has passed its peak," said Hogue, in a new research note.

Last month, supply fell in all but a handful of local markets. Montreal saw the greatest drop (-18.7% m/m), followed by Quebec City (-18.2%) and Vancouver (-16.1%. On the other hand, Winnipeg (up 7.9% m/m) and Saskatoon (up 4.6%) were among the only few cities that recorded an increase.

Hogue noted that while demand is expected to cool "somewhat" in the period ahead, more supply will be needed to rebalance Canada's housing market and stabilize prices.

"We expect to see more sellers to come out of the woodwork this fall as pandemic disruptions further ease. Completion of units under construction will also gradually boost supply in some markets later this year or early next. Yet there remains a great deal of uncertainty about the supply response," said Hogue.

READ: GTA Home Prices Forecast to Rise Another $50,000 Between July and October

With new supply down, prices continued to rise in July. However, while peak activity was reached in the first quarter, Hogue says, "we have yet to see peak prices."

The composite MLS Home Price Index (HPI) for Canada rose further in July -- both on a month-to-month (up 0.6%) to $730,800 and up 22.2% on a year-over-year basis. However, the monthly pace has slowed significantly in the past five months, and July marked the first easing of the annual rate in 15 months.

"These suggest a cyclical top could be getting closer. Our view is national aggregate prices will flatten early next year when supply-demand conditions are better balanced. This could happen sooner in some local markets," said Hogue.

Looking ahead, there's a chance that the fourth wave could keep potential sellers on the sidelines, and supply chain disruptions could delay construction timelines. For buyers hoping for a price break, Hogue says, "more patience might be required."