Even at the time, everyone knew cottage country's red-hot real estate frenzy that began three years ago -- not long after the onset of the pandemic -- was an anomaly.

And that’s certainly reflected in the region’s real estate activity as of late. However, the outlook isn’t that bad -- it comes down to finding perspective in the stats.

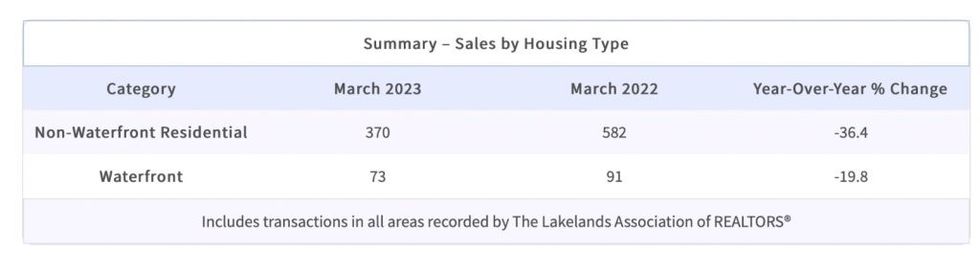

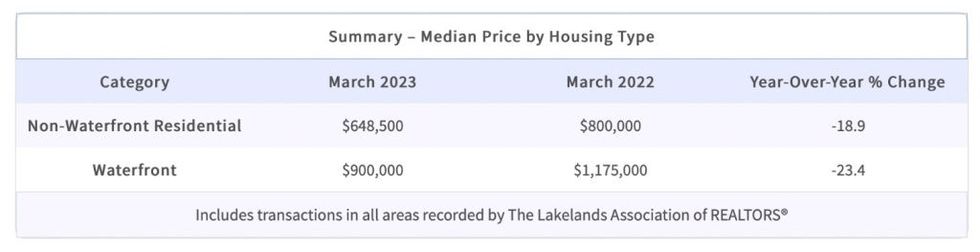

According to new CREA figures, residential non-waterfront sales activity recorded through the MLS System for the Lakelands region totalled 370 units in March 2023. This was down 36.4% from the same period in 2022. Residential non-waterfront sales came in 29.5% below the five-year average, and 25.9% below the 10-year average for March. On a year-to-date basis, residential non-waterfront sales totalled 827 units over the first three months of the year, down 36% from the same period last year.

Sales of waterfront properties (i.e. most likely cottages) reached 73 units in March 2023, a lowering of 19.8% from the same period in 2022. Waterfront sales came in 27.3% below March's five-year and 22.8% below March's 10-year average. On a year-to-date basis, waterfront sales came to 134 units over the first three months of the year. This was a notable drop of 39.1% from the same period in 2022.

For Lakelands North specifically -- which includes the coveted Muskoka region -- only 45 waterfront properties sold in the area in March 2023. This figure is down 33.8% compared to March 2022. Furthermore, the waterfront properties dollar volume was only $56,203,111 in March 2023, down 36.2% from last March.

The good news for those in the market for a breezy piece of Muskoka real estate is: there are options. The 258 active listings last month mark a 134% increase over the same month last year. Months of Inventory saw a dramatic increase to 5.7 months this year, versus 1.6 months in March 2022.

March 2023's average sale price of $1,248,958 was down only 3.5% from March of 2022. With that said, the $970,000 median price of waterfront properties was down 15.7% from last year. The sale-to-list-price ratio was down as well, reaching 94.6%, its lowest level since 2013.

March 2023's average days on market stat of 27 increased by 17 days year-over-year.

The 85 waterfront properties sold in the Lakelands North region year-to-date represents a 40.1% drop over the same year-to-date period at the end of March 2022. Furthermore, the year-to-date sales volume of $93,191,410 represents a 50.6% decline over the same period last year. New active waterfront listings were up 18.5%, hitting 269. The year-to-date months of inventory saw a dramatic increase to 6.9 months, versus just two months at the same time last year.

But there is room for optimism, says Ross Halloran, Broker and Senior VP Sales for Halloran & Associates, Sotheby’s International Realty Canada.

“Sellers should be encouraged to learn that the number of active waterfront listings is still well below prior year averages, and well-priced properties should sell in what will be a traditionally strong spring/early summer market in 2023,” says Halloran.

The year-to date average sale price of $1,096,350 was down 17.5% year-over-year. Over the same period, the median price of $846,200 for a waterfront property was down 6.4% year-over-year, while the year-to-date list price ratio was down by more than 106.7% year-over-year. The ratio hit 94.3%, the lowest level since 2018.

Finally, from a year-to-date perspective, the average days on market increased to 26 days in March 2023; the same time last year saw a 10.5 day average.

But while the numbers may look a bit grim, it’s not all doom and gloom for those looking to sell in the region. Halloran says that, on a year-to-date basis, the Lakelands North waterfront statistics further support the bottoming out of the year’s correction.

“While March 2023 average and median prices are down year-over-year, the percentage drop is lower than previous months, indicating that negative correction seems to be slowing down and waterfront property values are slowly stabilizing,” Halloran explains.

This means slow movement towards a more balanced waterfront market in the Muskoka region.

“Sale-to-list-price ratios have dropped down to 2013-2016 levels of around 94%; months of inventory increased from just two months in March of 2022 to an average of seven months, year to date, in March 2023,” highlights Halloran.

“In addition, days on market statistics has increased by more than 15 days, reflecting the 2022 shift from a seller's market to more of a buyer's market. However, as previously predicted, unfulfilled buyer demand during the 2020-2021 pandemic period has resulted in an increased number of buyers bidding for a limited number of coveted properties -- which is maintaining pricing levels, despite the past year's correction.”

Cover Image: Emma Harper/Unsplash

This article was produced in partnership with STOREYS Custom Studio.