As uncertain economic times prevail, countless Canadians from coast to coast have no choice but to adapt... or fall behind. This is especially true in regions with notoriously high housing costs, like British Columbia (BC) and Ontario. The latest Market Pulse Consumer Credit Trends and Insights Report from Equifax Canada drives this reality home with telling new data.

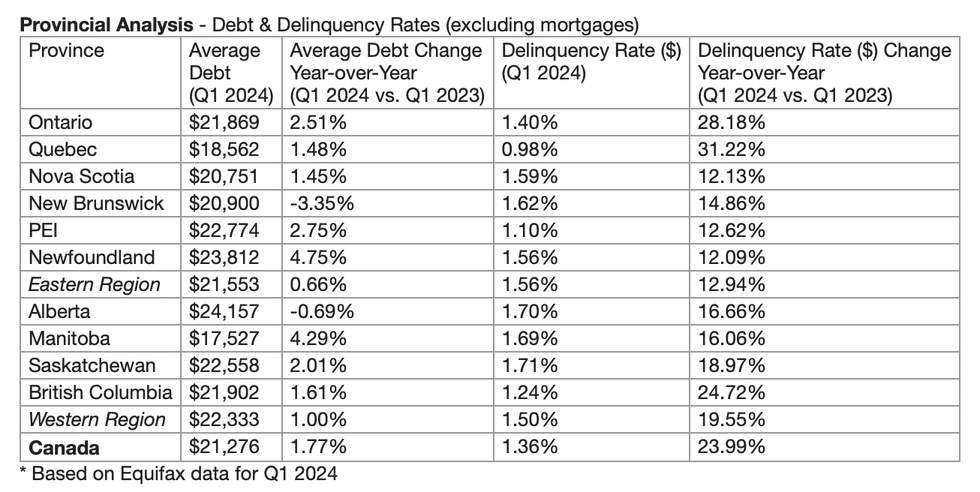

According to the report, in a climate of perpetually high interest rates, Canadian consumer debt rose to $2.46T at the end of Q1 2024, marking a 3.5% increase from the previous year. Throughout the first quarter of the year, mortgage delinquency rates continued to climb in Ontario and BC. Furthermore, according to the report, missed payments on non-mortgage debt returned to pre-pandemic levels.

“These are challenging economic conditions and as financial stress increases we are seeing consumers adapting their credit decisions to help manage through this period,” said Rebecca Oakes, Vice President of Advanced Analytics at Equifax Canada. “Many are extending their mortgage length to reduce their payments and mitigate the impact of payment shocks, despite the penalty of longer loan commitment terms. People are also seeking better deals and rates, leading to relatively more lender switching and more consumers actively checking their credit scores – a nearly 19% rise in the number of Equifax Canada credit score checks compared to the same period last year.”

Delinquency rates, indicating missed payments on credit products, continued to rise in Q1, says Equifax. While overall Canadian mortgage delinquencies remain lower than pre-pandemic levels, Ontario and BC have seen the most significant increases. In Ontario, the total mortgage balance reaching severe delinquency (defined as 90 days or more without payment) exceeded $1B for the first time. This is double the level seen pre-pandemic.

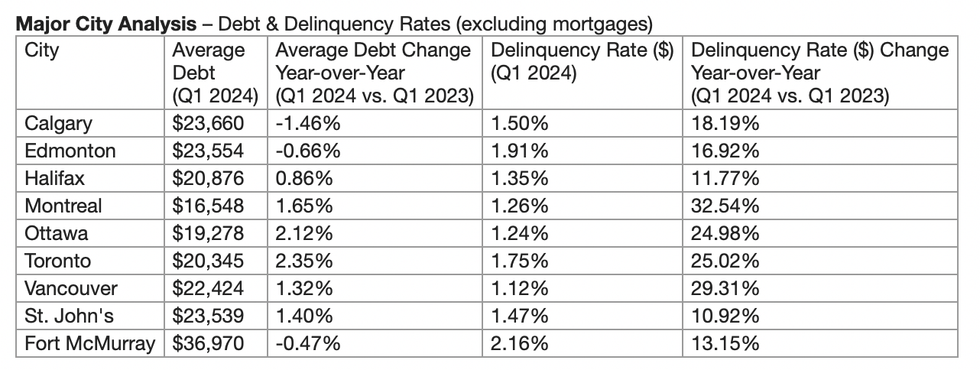

As the report highlights, both Toronto and Vancouver now have higher delinquency rates (90+ day balance) than in Q1 2020. Delinquencies for mortgages over 90 days past due rose in the infamously expensive City of Toronto from 0.09% to 0.14%, and in Vancouver rose from 0.11% to 0.14% between Q1 2020 and Q1 2024.

If you’ve missed a recent payment, you’re not alone – far from it. A total of 1.26 million consumers missed at least one payment on some form of credit commitment in the first quarter of the year. This marks the highest level since 2020 and is up 137,358 (12.2%) compared to the first quarter of 2023. Ontario, BC, and Quebec had above average jumps in the number of consumers missing a payment, with an increase of 14.6%, 13.4% and 15.2% respectively compared to 2023.

“The introduction of mortgage stress testing in 2016 has helped to mitigate against the full effect of sustained high interest rates, but we still saw more than 34,000 consumers missing a payment on their mortgage in Q1, which is up 22.7% compared to 12 months ago,” said Oakes. “It’s not just homeowners feeling the strain. Whether you own or rent, the high cost of living remains a heavy burden for many.”

Of course, the impact of high interest rates is compounded by high inflation that renders everything from gas to groceries more expensive.

Defeated by sky-high housing costs, Canadians are packing up and moving out of Ontario and BC, setting their sights on the more affordable pastures of other provinces. “As high home prices and reduced affordability continue in some geographies, more consumers are making the decision to relocate to more financially accessible regions,” said Oakes. “In the last 12 months, the number of individuals who moved from Ontario and British Columbia to other provinces exceeded those who moved to Ontario. Almost 71% of all interprovincial movement to Alberta came from those two provinces alone.”

The good news is that there was finally some relief on Canada’s interest rate front last week, when the Bank of Canada cut its policy rate by 25 basis points. According to the country’s top economists, we can expect further rate cuts in the not-too-distant future – albeit at a cautious, slow, and (hopefully) steady pace.