Although economists widely predict interest rate cuts are in the cards for 2024, the average Canadian mortgage holder will still face a significant increase in their monthly payments in the year ahead.

In a new report from TD Economics, Maria Solovieva, Economist, predicts that there will be “no escape from higher rates” for Canadians facing mortgage renewal in the years and months ahead.

By the end of 2023, nearly 50% of all mortgage holders will see their monthly payments increase in comparison to February 2022, the month before the Bank of Canada (BoC) embarked on its rate hike campaign. By the end of 2024, that share rises to 65%.

For some Canadians, the increase to their monthly payments will be "substantial," Solovieva said, which will in turn weigh on discretionary spending.

"The fastest increase in interest rates in decades means Canadians with mortgages are renewing at rates they likely did not expect at the beginning of their mortgage terms," Solovieva said. "With interest rates likely to remain higher for longer, families will need to devote more of their budgets towards debt payments."

Since the mortgage stress test was introduced in 2018, all uninsured borrowers at federally regulated banks have had to qualify at an interest rate that is either 2% above their negotiated rate or 5.25%, whichever is higher. The same rules have applied to insured borrowers since 2021.

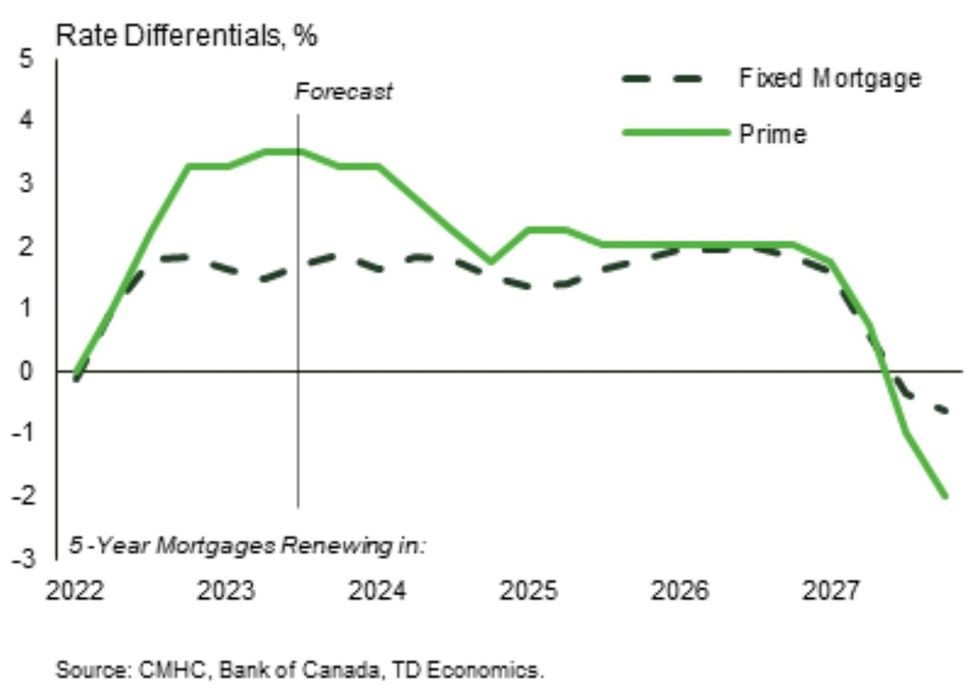

After the BoC raised interest rates from 0.25% to 5% in 16 months, which spiked mortgage rates roughly 300 basis points, many Canadians are now facing in their stress-tested reality. For those who haven’t locked in their rates, the shock is even higher, Solovieva said.

The report illustrates this by imagining different payment scenarios for someone who bought an average-priced property, for $486,000, in July of 2018 with 20% down and a five-year mortgage.

Upon renewal in 2023, someone who opted for a fixed-rate mortgage would have seen their payments increase from $2,138 to $2,438 — or by $300 per month — if they renew at 6%. While those who opted for a variable-rate mortgage would have started off with a lower payment of $1,835, their payments would increase by $570 per month for fixed payments, and $540 per month for variable payments, upon renewal this year if they lock in at 6%.

"About half of mortgages that were outstanding before the tightening cycle began have yet to be impacted by higher rates. We expect borrowing costs to come down over the next few years, but to remain higher than their pre-pandemic and pandemic era lows," Solovieva said. "Under our rate forecast, all mortgages entered between 2018 and 2022 will face higher borrowing costs."

While the exact increase will depend on the type of mortgage, the amount of the original loan, and, in the case of variable payment variable rate mortgages, the path of interest rates, Solovieva expects the average mortgage holder will see their monthly payments increase by nearly 30% by the end of 2024.

Although this will lead to more Canadians cutting back on spending — a trend that has already begun to weigh on growth in real consumer spending — the mortgage renewal cycle will not be enough to trigger an economic crisis on its own.

With a relatively resilient job market in comparison to past economic downturns, nearly $140B in excess deposits sitting in Canadian banks, and the fact that the majority of all mortgages initiated in the past five years have undergone the stress test, Solovieva noted there should be enough supports in place for the average Canadian to manage higher monthly mortgage payments.