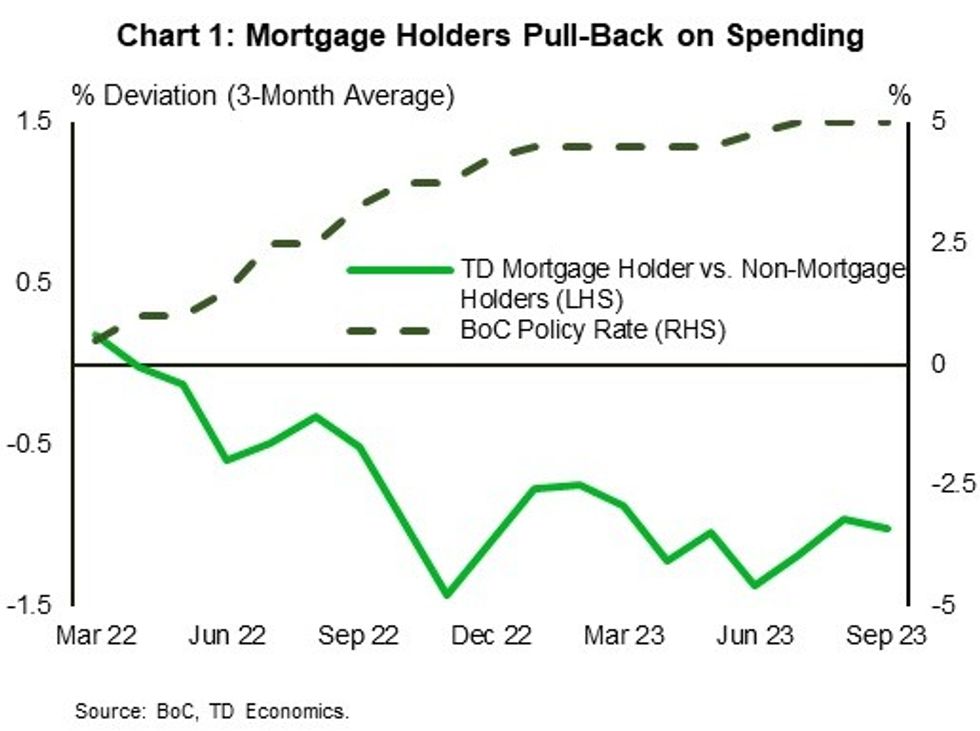

Under the strain of high interest rates and mounting debt, Canadian mortgage holders have pulled back their spending.

Since March of 2022, the Bank of Canada has raised the overnight rate from 0.25% to 5%, which has led mortgage rates to spike 300 basis points.

Mortgage debt now accounts for 74% of Canada’s $2.9T total household debt, and consumers are allocating 15.4% of their income to service their debts, up from 13.6% in 2020. In comparison, when Americans were at their peak indebtedness right before the Global Financial Crisis in 2008, they were utilizing 13.2% of their income to service their debts.

To determine how Canadian mortgage holders are responding to higher interest rates, TD Economics analyzed anonymous internal mortgage and credit card data to assess how spending patterns have changed.

"High household debt is the biggest vulnerability of the Canadian economy," the report from James Orlando, TD’s Director of Economics, reads. "As more homeowners reset their mortgages at higher rates, less disposable income is available to maintain consumer spending."

Based on TD’s data, mortgage holders have pulled back their spending by approximately 1% compared to those without a mortgage. This has resulted in a $6B reduction in spending across the economy. In the absence of higher mortgage rates, TD said growth in real consumer spending would have come in at approximately 1.9% year over year in Q3. Instead, it came in at 1.5%.

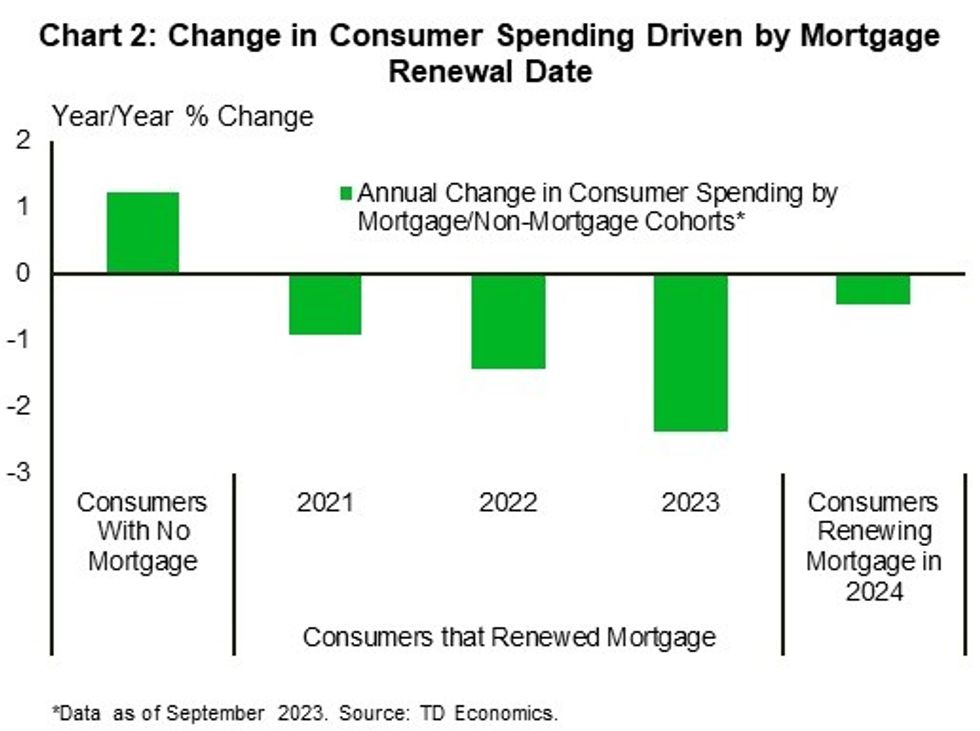

Further differences in spending patterns emerged when TD broke down mortgage holders’ actions based on their year of renewal; those who reset in 2023 have had a "very different experience" than those who are still locked into a low rate rate from 2020.

As of September, mortgage holders who renewed in 2021 have pulled back their spending by 0.9% year over year, while those who renewed in 2022 have cut down by 1.4%. Those who renewed in 2023 have made the most significant cuts, having reduced their spending by 2.4% annually. In comparison, Canadians without a mortgage have increased their spending by 1%.

Meanwhile, mortgage holders who are facing renewal in 2024 have pulled back their spending by just 0.5% annually, which TD notes is likely a "precaution," as they await a potentially sizeable payment shock.

According to the Bank of Canada, 47% of all mortgages will have renewed at a higher rate by the end of 2023. By the end of 2024, that figure will rise to 65%.

The so far slight spending slowdown on the part of the 2024 renewal cohort indicates that they will reduce their spending further next year, putting increased "downward pressure on overall consumer spending."

"Given that the 2024 cohort looks set to renew their mortgage at rates 200 basis points higher than they are paying now, they will be experiencing a similar payment shock to the 2023 cohort. In this case, total spending within the economy would be pulled down by an additional 0.5 percentage points," the report reads.

“While it does not look like this mortgage reset will be enough to tip the economy into recession, the Canadian consumer is becoming increasingly stressed by high interest rates."