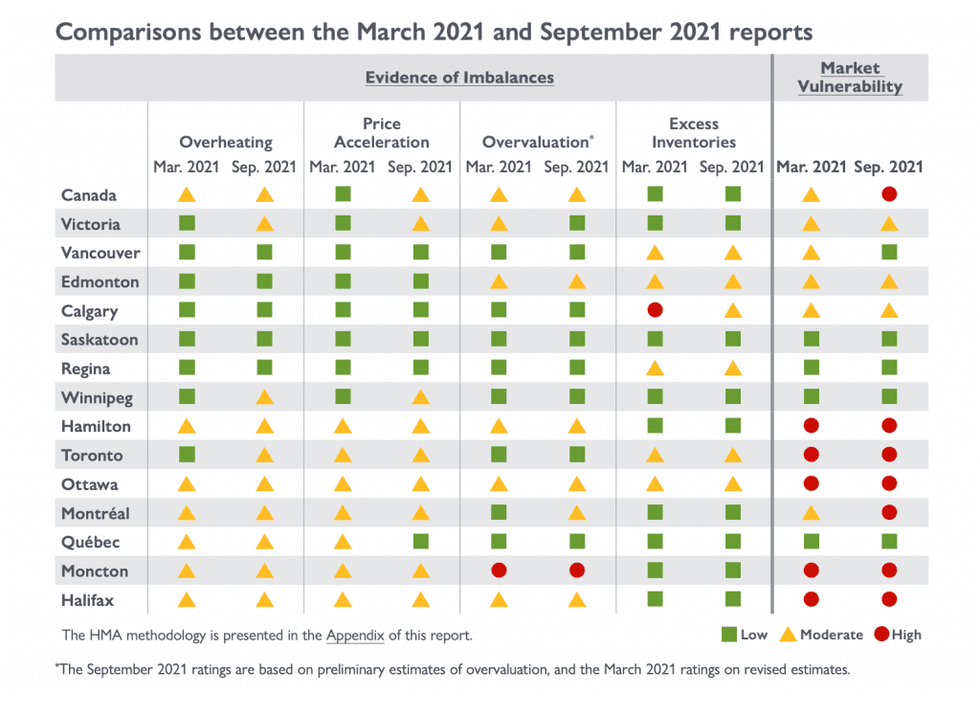

Canada Mortgage Housing Corporation (CMHC) has finally acknowledged a high level of vulnerability in the national housing market.

According to CMHC, the degree of vulnerability in the Canadian housing market moved from moderate to high during the second quarter -- a direct result of national price acceleration and persistent overvaluation imbalances.

The federal housing agency says the high level of vulnerability felt across the country reflects the problematic conditions in several local housing markets throughout Ontario and Eastern Canada, including Toronto, Ottawa, and Montreal. In contrast, Vancouver's level is currently low.

On Tuesday, CMHC released its National Housing Market Assessment, the second of this year. The assessment is a comprehensive report that identifies the level of stability in the housing markets of larger Canadian cities.

The quarterly evaluation assigns low, moderate or high vulnerability ratings to the entire country and 14 cities based on four factors: overheating, price acceleration, overvaluation, and excess inventories.

READ: ‘High Degree of Vulnerability’ in Toronto’s Housing Market: CMHC

According to CMHC, a high degree of vulnerability means the housing market is more vulnerable to a potential downturn, with more significant consequences if the downturn happens, such as homeowners not paying their mortgages.

At the start of 2021, historically low interest rates coupled with government support and the rollout of mass vaccination programs provided Canadians with higher purchasing power, disposable income levels, and employment. However, CMHC says these improving housing market fundamentals did not fully explain recent home price growth.

"Exceptionally strong demand and home price appreciation through the course of the pandemic may have contributed to increased expectations of continued price growth for homebuyers in several local housing markets across Ontario and Eastern Canada," said Bob Dugan CMHC's chief economist. "This, in turn, may have caused more buyers to enter the market than was warranted."

The number of home sales in Canada reached a historic high in Q1-2021, with demand far outpacing the supply of available homes. However, sales moderated in the second quarter, albeit still to a historically elevated level.

CMHC says it found moderate degrees of vulnerability when it examined the country's risks of overheating, price acceleration, and overvaluation. It also said there is low evidence of excess inventories in the national housing market, which means there is not an unusually high level of vacant, newly built, and unsold housing units. As well, the rental apartment vacancy rate is not significantly above normal levels.

Despite this, the national housing agency said that high market vulnerability is still detected at the national level.

As it stands, there are only five Canadian cities with a low risk of vulnerability, including Vancouver, Saskatoon, Regina, Winnipeg, and Quebec.

When looking at Vancouver, CMHC said the city's rating was reduced from a moderate to low degree of market vulnerability. This comes as young adult employment improved considerably in the past two quarters as more businesses opened. At the same time, price growth has eased in pace with sales in the market slowing. Homeowners have also listed their homes in more significant numbers than usual, lessening the competition among buyers.

According to CMHC, home sales peaked toward the end of Q1-2021 but have since returned to more typical levels. At the same time, new listings were also substantial, and the housing agency says the sales-to-new listings ratio (SNLR) in Vancouver didn't exceed the threshold of 75% -- which is used to indicate evidence of overheating during the past two quarters. In comparison, in past cycles of high sales in Vancouver, new listings don't typically change that much.

"In recent quarters, we've observed new listings at levels that haven't been recorded in recent memory. This could indicate a large share of move-up buyers who first listed and then sold a unit in order to make a down payment on their next home," said Braden T. Batch, senior analyst, economist for CMHC.

"This differs from periods dominated by first-time buyers or out-of-town buyers who do not create a local listing when purchasing a home," added Batch.

CMHC's evaluation found low degrees of vulnerability when it examined Vancouver's risks of overheating, price acceleration, and overvaluation. But on the other hand, it found a moderate risk of excess inventories.

Batch explained that a higher vacancy rate was found in CMHC's purpose-built rental market survey in the fall of 2020 that triggered a rating of moderate evidence in excess inventory. He says the high vacancy is likely related to a disruption of immigration and non-permanent residency in Vancouver amid the pandemic.

The economist also said the region continues to face a shortage of rental housing options suitable for households with different income levels, and additional new supply will be "crucial" to improve housing affordability.

There also remains uncertainty about immigration levels into the city, which has lead to a drop in rental demand, causing CMHC to detect evidence of excess inventories in the rental market.

'The other measure considered for inventories is the rate of completed and unsold units in the homeownership market. With inventories of new units remaining at low historical levels, there is more evidence of a shortage of units than an excess in the home ownership market," said Batch.

The National Housing Market Assessment comes on the heels of the recent federal election, in which all parties agreed that housing affordability and the housing crisis were of top concern.