Land Transfer Tax

Learn what land transfer tax is in Canadian real estate, how it’s calculated, and how it affects your closing costs and overall homebuying budget.

May 22, 2025

What is Land Transfer Tax (LTT)?

Land Transfer Tax (LTT) is a provincial tax that buyers must pay when purchasing property in most parts of Canada, calculated as a percentage of the purchase price.

Why Land Transfer Tax (LTT) Matters in Real Estate

Land Transfer Tax (LTT) is a significant closing cost that buyers must budget for when purchasing real estate. Each province with LTT sets its own rates and calculation method. In Ontario, for example, rates increase progressively with the property’s price, and the City of Toronto imposes an additional municipal LTT.

First-time homebuyers may qualify for partial or full rebates, depending on the province. It’s important to calculate this cost early in the buying process to avoid surprises at closing.

The tax applies to all property types – residential, commercial, and vacant land – and is due upon closing. It is separate from legal fees, inspections, and other transaction-related expenses.

Understanding LTT helps buyers plan their total budget and ensures compliance with provincial real estate regulations.

Example of Land Transfer Tax (LTT) in Action

A buyer in Ontario purchases a $600,000 home. Their Land Transfer Tax is approximately $8,475, which must be paid at closing.

Key Takeaways

- Paid by buyers on property purchases in many provinces.

- Calculated based on the property's purchase price.

- Rebates may be available for first-time buyers.

- Can significantly impact closing costs.

- Must be paid on or before the property closes.

Related Terms

- Closing Costs

- First-Time Home Buyer Rebate

- Municipal Tax

- Title Transfer

- Appraisal

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

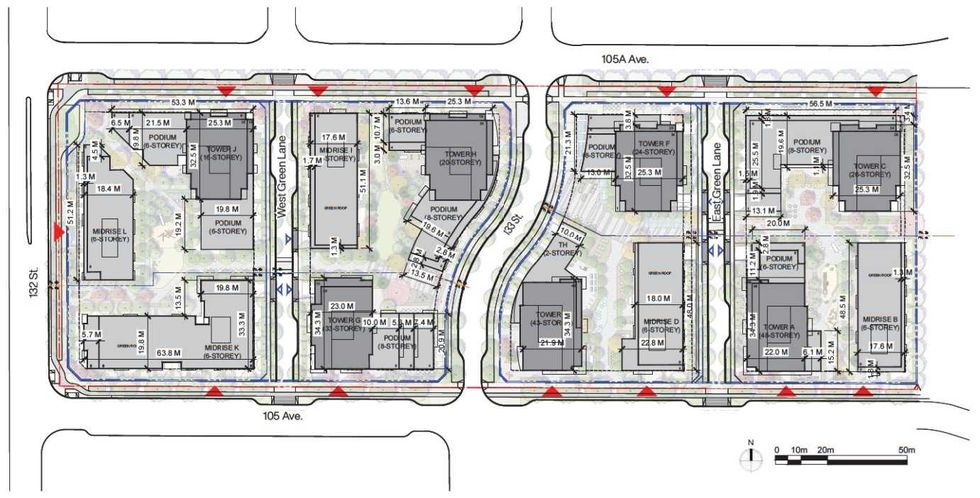

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)