Just a few months after California-based medical technology company Masimo backed out of its deal to purchase the Nexus office building from Vancouver-based real estate developer Keltic Development, the project has become the subject of a receivership application, according to filings in the Supreme Court of British Columbia obtained by STOREYS.

The project is set for 220 Prior Street in Vancouver, immediately west of the new St. Paul's Hospital campus currently being constructed and north of Pacific Central Station. It is planned to be a 10-storey commercial building designed by MCMP Architects with over 102,000 sq. ft of medical office space, industrial space, and retail space.

In 2022, Masimo agreed to buy the entire building for $123 million and paid a deposit of $21 million. According to the purchase and sale agreement, the construction completion deadline was set for July 31, 2025. However, earlier this year, Keltic revealed that Masimo was backing out of the agreement and pivoted to marketing the project as a strata office project with a new name: Nexus.

Construction officially commenced in August 2022, but has yet to be completed, according to court documents. The property is beneficially owned by Keltic Development through Keltic (Prior) Development Limited Partnership under 1232616 BC Ltd. — formerly known as Keltic (Prior) GP Ltd. before the name was changed in 2023. BC Assessment values 220 Prior Street at $38,487,000 in an assessment dated to July 1, 2024.

220 Prior Street

The receivership application, which has yet to be granted by the Supreme Court, was filed on August 25 by SHAPE Capital Corp, which is the real estate lending arm of SHAPE Properties, the developer behind The Amazing Brentwood and The City of Lougheed master-planned communities in Burnaby.

According to SHAPE, they entered into a mortgage agreement with Keltic Development in November 2022, later amended several times, for a construction loan facility up to $62,000,000, a letter of credit facility up to $3,000,000, and a sub-facility for work-in-progress advances. The loan was guaranteed by Keltic Canada Development Co., Keltic Group Entities (2019) Ltd., Keltic Projects Development Ltd., and DDAW Holdings Ltd., as well as Rui "Anna" Wang and Wei Guo Li, all of whom are respondents in the filing. Wang and Li are an immigrant couple from China who together founded Keltic Development in 2016.

According to court documents, the trouble at 220 Prior started to occur around the time Masimo backed out of the deal to buy the building. That announcement was made in late-January and SHAPE issued a notice of default on February 7, informing Keltic that it had defaulted by failing to inject its initial equity requirement into the project, by failing to deliver an executed supplement to their mortgage agreement, and by failing to provide the required collateral security. The court filing does not mention Masimo and it is unclear whether Masimo's decision to back out of its purchase came before or after the default.

SHAPE then issued demand letters in May. The two sides reached a forbearance agreement extending enforcement until June 13, then again until July 4, when the forbearance agreement expired "without the Debtors providing the Lender with an adequately funded solution for the completion of the development of the Project."

Concurrently, SHAPE also discovered in February that Keltic had "misappropriated $3.2 million from the holdback account established for the benefit of the contractors on the Project." It then learned that Keltic made another unauthorized withdrawal in July. In August, the general contractor of the project, Syncra Construction, then issued its own notice of default, citing the unauthorized withdrawals and failure to make payments.

According to SHAPE, Keltic owed $2,148,892.57 to Syncra and $372,075.90 to BC Hydro. To avoid serious construction delays, SHAPE then advanced $2,520,968.47 to Syncra and BC Hydro on August 18. SHAPE says it is owed $61,905,222.01 as of August 25, with interest continuing to accrue.

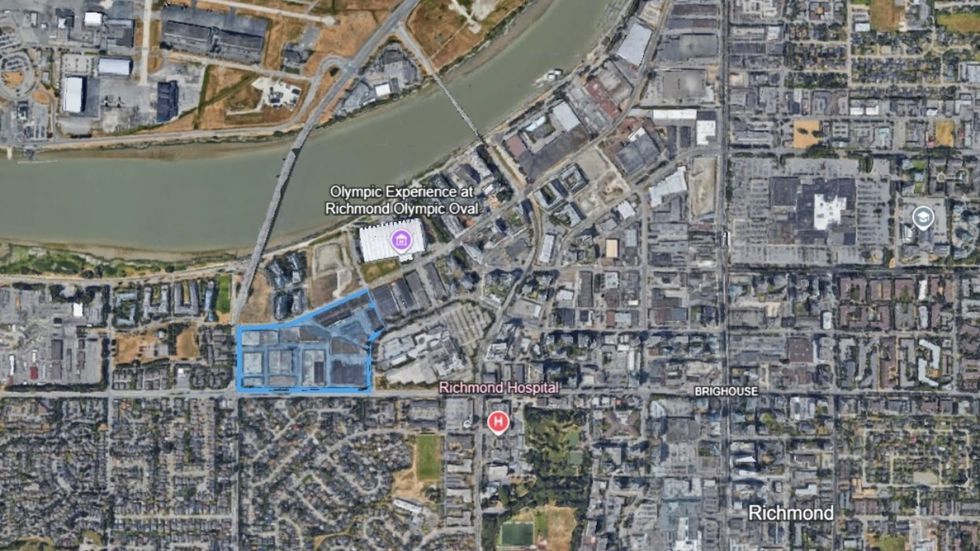

River Garden

Complicating the matter further is that Keltic Development also provided a property it owns in Richmond as security for the 220 Prior Street mortgage. This property is referred to as the River Garden lands and consists of 5900 No. 2 Road, 6191 Westminster Highway, 6311 Westminster Highway, and 6751 Westminster Highway in Richmond.

STOREYS reported in February that Keltic Development was gauging market interest in the aforementioned River Garden lands, which together with 6651 Elmbridge Way make up a 27-acre industrial property called the Brighouse West Business Park that Keltic acquired from QuadReal Property Group in 2021 for $300 million. Keltic has been planning to redevelop the site.

Notably, SHAPE says that a mortgage was registered on the property on May 13, 2025. Details of this mortgage were not provided, but SHAPE says that Keltic has also defaulted on this mortgage. Furthermore, SHAPE says that the owners of the River Garden lands, 1319188 BC Ltd. and Keltic (River Garden) Development Ltd., also served as guarantors for the 220 Prior Street mortgage.

Although Keltic has defaulted on the River Garden mortgage and also provided the property as security for the 220 Prior Street mortgage, SHAPE is seeking to appoint a Receiver over just the 220 Prior Street property. The lender also notes that "Syncra has stated its intention to cease work on the Project if the misappropriated funds are not returned to the holdback account."

As the project is already nearing completion, if the receivership application is granted, the Receiver will most likely work towards completing the project rather than selling the project as a whole. However, as Masimo had the building tied up until earlier this year, Keltic has not had much time to secure presales and the market for strata office units is not what it once was, adding to the challenge of resolving this situation.

STOREYS has reached out to Keltic Development for comment but has not received a response as of publishing.

Elsewhere in Metro Vancouver, Keltic Development is currently undertaking the big redevelopment of REVS Bowling at 5502 Lougheed Highway in Burnaby. In 2022, Keltic also acquired 4444-4488 Kingsway in Burnaby for $145 million, where it has proposed two high-rise towers. Also in Burnaby, it is currently nearing completion on the 30-storey O2 Metrotown condo tower at 6620 Sussex Avenue, which is expected to complete construction in 2026.