Homeowners hurting from the pain of higher interest rates may not get their wished-for rate cuts any time soon as the Bank of Canada head cautions that another hike may be needed.

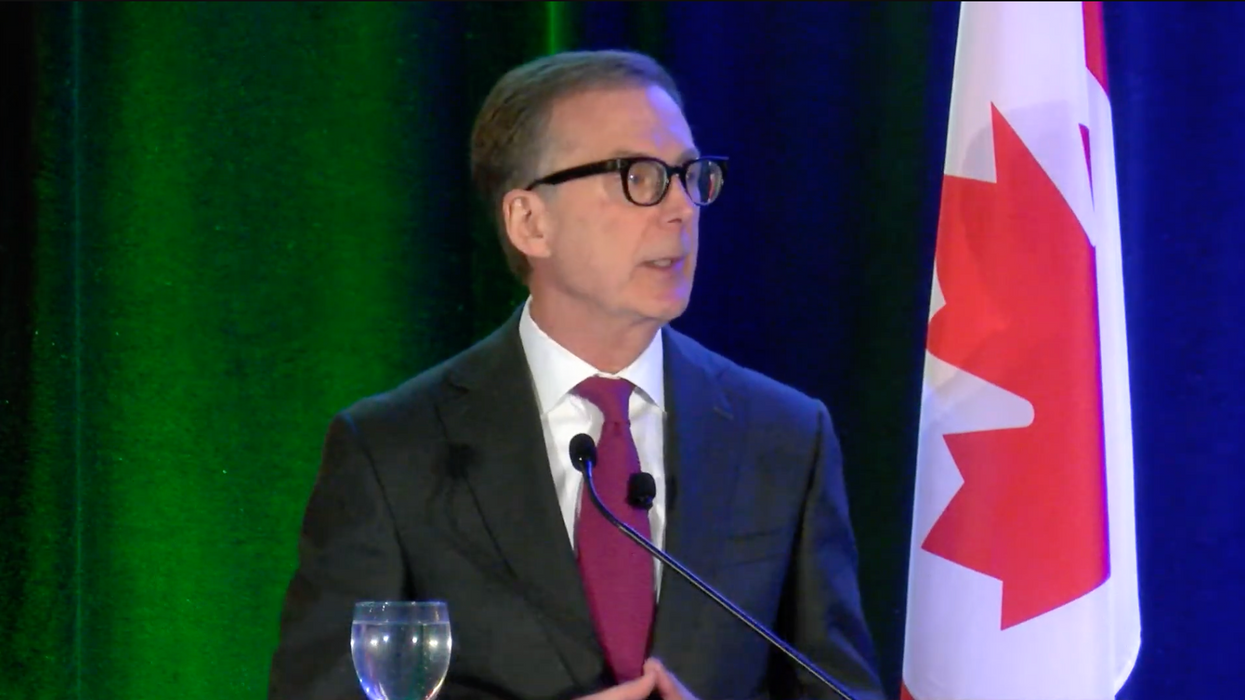

In a speech to the Saint John Region Chamber of Commerce on Wednesday, Bank of Canada (BoC) Governor Tiff Macklem defended the bank's methods for battling stubborn inflation — a series of 10 hikes that began in March 2022 and have brought the BoC's key interest rate to a 22-year high of 5%.

"This tightening of monetary policy is working, and interest rates may now be restrictive enough to get us back to price stability," Macklem said.

The rate hikes have dealt a large blow to homeowners, as well as would-be homeowners, severely restricting their affordability and purchasing power. Macklem acknowledged this, saying the BoC knows that "the higher interest rates that are working to bring inflation down are making things difficult for many Canadians." However, the alternative — "years and years of high inflation and then a deep recession," Macklem said — would be "much worse."

By making borrowing more expensive, and thus more out of reach for Canadians, the bank has been able to drive down demand and, in turn, prices. Recent inflation data from Statistics Canada found that inflation dropped to 3.1% in October, much closer to the BoC's target of 2% than the 8.1% inflation rate seen in June of last year.

Many experts have predicted that falling inflation may be enough to spur rate cuts at some point next year. Macklem said that the bank may be able to cut interest rates before inflation falls to 2%, but simultaneously warned that if high inflation persists, the bank is prepared to raise its policy rate even further. In fact, during a question and answer period following his speech on Wednesday, Macklem said "it is not time to start thinking about cutting interest rates."

"It ticked down yesterday but one month is not a trend," Macklem said. "We need to see a number of months to see clear evidence that we're on a path to 2% inflation. When we see clear evidence, [...] that will be a time to start thinking about cutting interest rates."

Macklem's speech comes as more focus is being placed on the riskiness of homeowners having to renew in a high-interest-rate environment. A recent RBC Capital Markets report notes that 60% of mortgages are set to renew in the next three years, with many of those in store for a "payment shock" as interest rates are not only up significantly from the historic low of 0.25% seen during the pandemic, but from the sub-2% rates seen in the years immediately before the pandemic.

The federal government drew more attention to the issue on Tuesday in its fall economic statement, outlining a new mortgage charter that dictates how lenders will deal with at-risk borrowers. The six-point plan, dubbed The Canadian Mortgage Charter, mandates that lenders contact homeowners four to six months before they are set to renew their mortgage to review their options, as well as allow temporary extensions of the amortization period for mortgage holders who are at risk.

Fees and costs that would have otherwise been charged for relief measures will be waived, and at-risk homeowners must be given the ability to make lump sum payments to avoid negative amortization or to sell their principal residence without any prepayment penalties. Additionally, interest cannot be charged on interest in the event that mortgage relief measures result in a temporary period of negative amortization.

Perhaps most importantly, for borrowers with an insured mortgage who are looking to switch lenders when it comes time to renew, a stress test will no longer be required — a likely relief to many borrowers who would likely no longer qualify for their mortgages had they had to pass a stress test.

In his speech, Macklem acknowledged that inflation is harshly, and disproportionally, affecting lower-income Canadians.

"People are working hard, but their salaries don’t buy what they used to," he said. "They can’t afford the things they need to live. It feels unfair and that feeling of unfairness eats away at the fabric of society.”