Interest Rate Differential

Explore how interest rate differential (IRD) penalties work in Canada, when they apply, and how to avoid costly surprises when refinancing or selling early.

May 22, 2025

What is Interest Rate Differential?

Interest Rate Differential (IRD) is a prepayment penalty charged by lenders when a borrower breaks a fixed-rate mortgage before the term ends, calculated based on the difference between the original and current rates.

Why Interest Rate Differential (IRD) Matters in Real Estate

In Canada, breaking a fixed-rate mortgage early—such as to refinance or sell the home—can trigger substantial penalties. The IRD is designed to compensate lenders for lost interest income.

IRD is generally calculated as:- (Original rate - Current rate) × Mortgage balance × Remaining term

This often results in a higher penalty than the alternative 3-month interest fee. Borrowers should carefully review prepayment clauses and ask lenders how IRD will be calculated before signing a mortgage agreement.

Some lenders use posted rates instead of actual contract rates in their IRD formulas, which can inflate the penalty.

Understanding the IRD is crucial for homeowners considering early refinancing or relocation. Comparing mortgage flexibility—not just interest rates—can lead to significant savings in the long run.

Example of Interest Rate Differential (IRD)

A homeowner breaks a fixed mortgage with 2 years remaining. Because rates have dropped, the lender calculates an IRD penalty of $5,400 based on the difference between the contract rate and the current rate.

Key Takeaways

- Penalty for breaking a fixed-rate mortgage.

- Based on rate difference and term remaining.

- Can be higher than 3-month interest.

- Calculation varies by lender.

- Should be reviewed before signing mortgage.

Related Terms

- Prepayment Penalty

- Fixed Rate Mortgage

- Refinance

- Mortgage Term

- Blended Rate

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

Christine Boyle and Gregor Robertson. (Government of British Columbia)

Christine Boyle and Gregor Robertson. (Government of British Columbia)

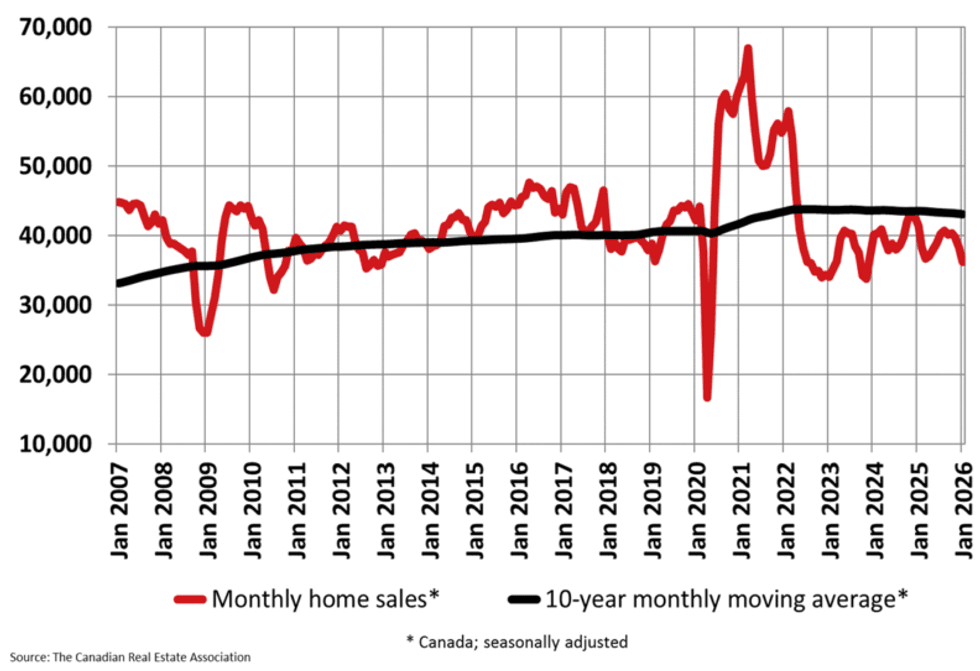

CREA

CREA