In a climate of sky-high grocery bills, there’s some good news on Canada’s economic front. According to RBC Senior Economist Josh Nye, inflation is slowly (key word) starting to retreat from multi-decade highs, thanks to falling energy prices and -- in some cases -- government relief programs.

In a report titled “Past the Peak,” Nye highlights how oil prices are now at year-to-date lows as global growth concerns mount and Russian supply holds up in the face of fresh sanctions. “Fading energy base effects will see headline inflation rates continue to ease in 2023,” writes Nye. “Core inflation is proving stickier and wage growth has picked up as labour markets remain resilient, suggesting it’s too early for central banks to declare victory in their campaigns to quash inflation.”

With that said, “with economic activity slowing and more attention being paid to the lagged impact of rate hikes,” Nye predicts that peak policy rates are (finally) in sight and that the Bank of Canada (BoC) will be the first to move to the sidelines in January. Last week's 50-base-point hike, signals "that their tightening cycles are nearing an end,” writes Nye. “Along with the RBA we don’t see these central banks raising rates beyond the first quarter of 2023.”

According to Nye, as central banks approach terminal policy rates, they’re likely to follow the U.S. Fed’s cue and emphasize the need to keep monetary policy restrictive for a period of time.

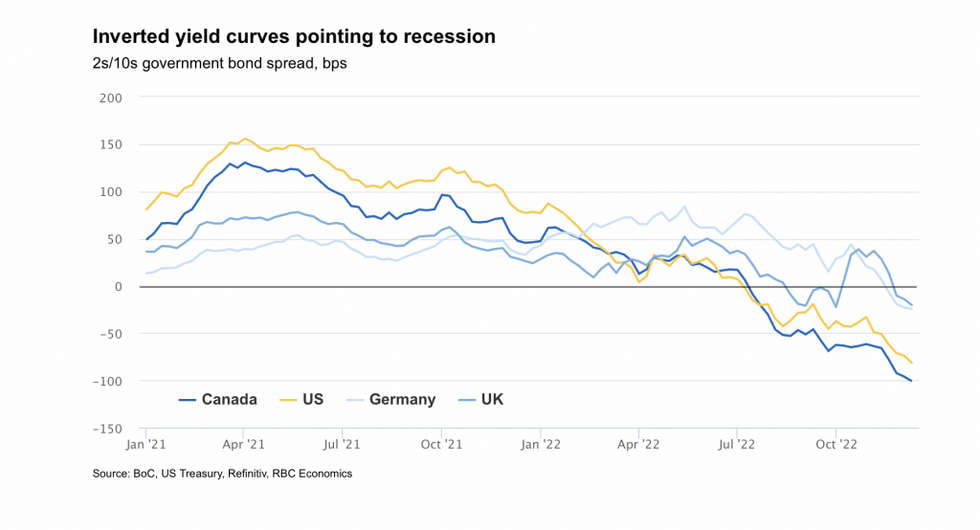

“With above-target inflation delaying any response to an economic slowdown, we think most central banks will be on hold throughout next year,” writes Nye. “The Fed, having taken its tightening cycle the furthest, will likely be the first to cut rates in late-2023. Longer-term government bonds have already started to rally and we think the short-end will do so next year as market focus shifts from remaining rate hikes to eventual cuts. That will reverse some of the curve flattening seen in recent months—yield curves are now deeply inverted in the US and Canada, and more recently in the UK and Germany, as at least a mild recession now looks unavoidable.”

Even though Canada is expected to fall into a recession in the first half of 2023, “excess demand and above-target inflation will keep the BoC from reacting to that slowdown as quickly as it has in past cycles,” writes Nye.

As evidence mounts that inflation is “turning a corner,” Nye highlights how Canadian inflation has remained fairly steady in recent months, with headline CPI stuck around 7% and core inflation generally closer to 5% year-over-year. But monthly inflation readings have started to slow, with core measures running below 4% on an annualized basis, Nye points out.

“In its December policy statement the BoC pointed to that as ‘an early indicator that price pressures may be losing momentum,’” writes Nye. “Diffusion measures also suggest the breadth of inflation has started to narrow, a sign that widespread inflationary pressure isn’t becoming entrenched. With economic activity slowing, we think those trends will continue in the coming months, supporting a pause by the BoC in January.”

But returning inflation to its target won’t happen overnight. RBC doesn’t see core inflation getting back to the BoC’s 1-3% target range until 2024. RBC expects the Bank of Canada to hold its rate at 4.25% throughout 2023 before cutting 50 basis points (bps) in the first quarter of 2024. By the end of 2023, it predicts the rate will be down to 3%. “Headline inflation will come down faster as base effects from rising food and energy prices fade -- we think all items CPI will be close to 2% by the end of next year,” writes Nye.