Canada's soaring inflation may have dipped slightly in July, but it's far from having returned to normal. And although Canadians across the board are feeling the heat from sky-high inflation, middle-income households are particularly feeling the burn.

Canada's Consumer Price Index (CPI) fell from 8.1% to 7.6% in July, still sitting well above the Bank of Canada's (BoC) target rate of 2%. With inflation now having remained above 5% for seven consecutive months, Canadians are seeing their wallets drained from higher prices, particularly when it comes to two major expenses: transportation and food.

"Together they account for roughly half of the growth in prices over the last year, punching well above their weight in the consumer basket," a new report from TD Economics says.

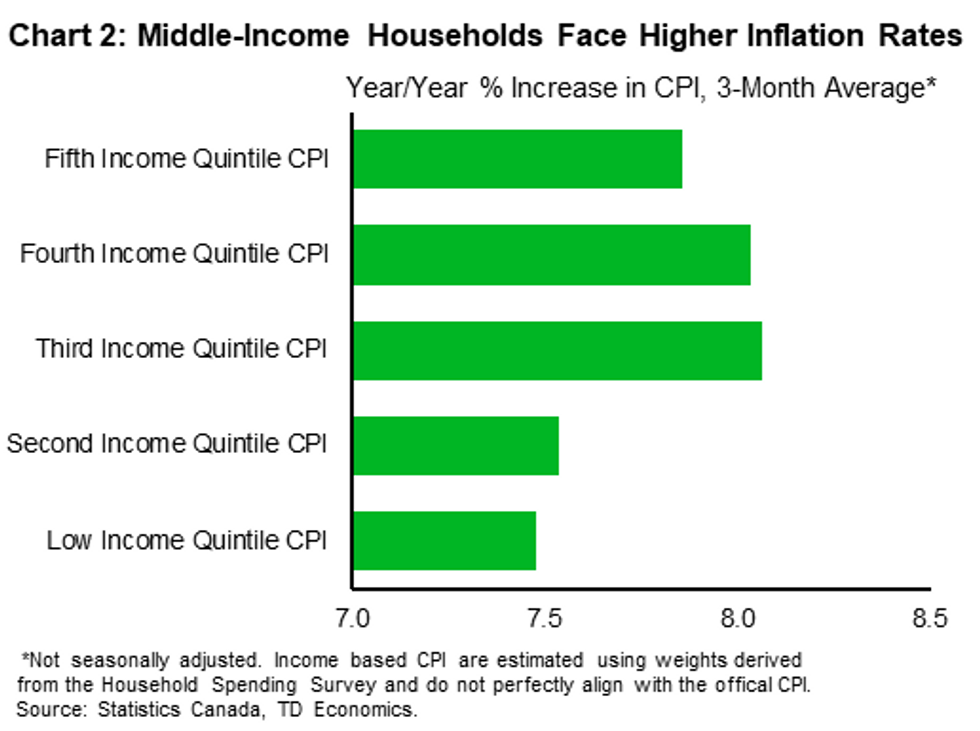

Because middle-income households spend a larger percentage of their earnings on food and transportation when compared to other income groups, they're "closest to the line of fire," the report says. In fact, these households tend to spend nearly a fifth of their budget (19.4%) on transportation alone. As a result, the inflation rate for middle-income households averaged a higher 8.1% over the three months ending in July 2022.

This heightened effect is due, in part, to changes in consumption patterns brought on by the COVID-19 pandemic.

"With health concerns amplified, people took to their cars and eschewed public transit," the report says. "At the same time, disrupted supply chain crippled the auto sector’s ability to produce vehicles, sending vehicle prices skyward."

It's no secret that gas prices have soared over the past year, currently sitting up 35.6%. These higher fuel costs alone accounted for more than 30% of July's inflation rate. And with fuel-induced price pressures having made private transportation more expensive than public, it's only further contributed to the financial pain felt by middle-income households.

Jacked up transportation costs are also part of the reason food prices have skyrocketed. Transportation costs, combined with droughts and the war in the Ukraine, pushed food inflation to 9.2% in July. When it comes to the proportion of income being spent on food, although low-income households spend the most, middle-income households spend almost as much, the report notes, "also leaving them vulnerable.

The one area where higher-income households have felt more of the burn is housing costs. Shelter inflation has grown fastest for owned residences, which are most often owned by high-income earners. But with the BoC implementing several interest rate hikes, housing markets across Canada have cooled and owned accommodation CPI dropped slightly in July to 6.3%. Meanwhile, rental inflation, which is most likely to burden lower income earners, rose in July to 4.9%.

"Elevated inflation is hurting everyone, but, given their relatively higher share of spending on food and transportation, middle-income households are likely facing the highest inflation rates," the report reads. "Fortunately, there are signs that this is moving in the right direction. Energy prices have declined in recent months and global supply shortages appear to be easing. As these items retrace, the disproportionate impact on middle-income families should dissipate. The sooner that the inflationary temperature can be brought to normal the better Canadians of all walks of life will be."