With 2023 just a few weeks away, Canadian real estate company Zoocasa is forecasting five trends for real estate in the coming year -- and, spoiler alert, the challenges that faced the housing market in 2022 are looking likely to stick around.

Interest Rates Will Continue to Weigh Heavily on Consumers

Going into 2022, Zoocasa forecasted that interest rates would be “top of mind” -- and they certainly were -- but as the company's latest report goes on to say, “few analysts planned for seven consecutive interest rate hikes.” Moving into 2023, the high rate environment is expected to weigh heavily on mortgage renewal decisions.

“Some homeowners that were up for renewal in late 2022 or 2023 chose to pull forward and break their mortgage early to lock in a lower rate and get ahead of the hikes,” says Lauren Haw, CEO of Zoocasa. However, any homeowners up for a mortgage renewal in 2023 can expect to be refinanced for a rate up to 3% higher than they received three to five years ago. “With inflation impacting the cost of groceries, childcare, and other day-to-day expenses, many homeowners will not be able to carry the burden of the new mortgage rates and will choose to sell.”

Landlords Will Feel The Pain Too

With interest rates on investment properties tending to be as much as 0.6% higher than that on a standard mortgage, housing providers may find themselves at a juncture in the new year, with mortgage rates for some landlords exceeding 7% when it comes time for renewal.

“The interest rate hikes may still outweigh the rental increase cap in many situations, forcing landlords to either pay out of pocket to hold onto their investment property or put it on the market,” says Haw.

If realized, this could be especially consequential for those dependent on rental housing.

“The demand for rental properties across the country is already surging as the dream of owning a home has become increasingly unaffordable for many Canadians,” Zoocasa’s report goes on to say. “If landlords choose to sell their investment properties, it will put even more pressure on an already exhausted rental market that in many city centres, can’t keep up with the demand.”

“The Year of the Sideline Buyer”

In stark contrast to the buying frenzy that defined the 2021 housing market, many Canadians chose to shelve their home-buying plans in 2022, even when home prices began to deflate in some areas. But in 2023, Zoocasa expects that those same buyers will consider jumping back into the market.

In fact, Haw forecasts it will be “the year of the sideline buyer.”

“Many prospective buyers chose to wait on the sidelines while interest rates rose, but whether they were planning to move because they wanted a bigger home, a new neighbourhood, to be closer to the office, they likely still need to move,” says Haw.

In 2023, consumers will have had a chance to reorient to the current interest rate environment and may be coaxed to finally make their home-buying decisions. The report adds, “Homeowners that will hit or exceed the maximum amount they can afford on a monthly and/or yearly basis will add to the demand in housing.”

Low Supply Will Persist Until “At Least” Early Summer

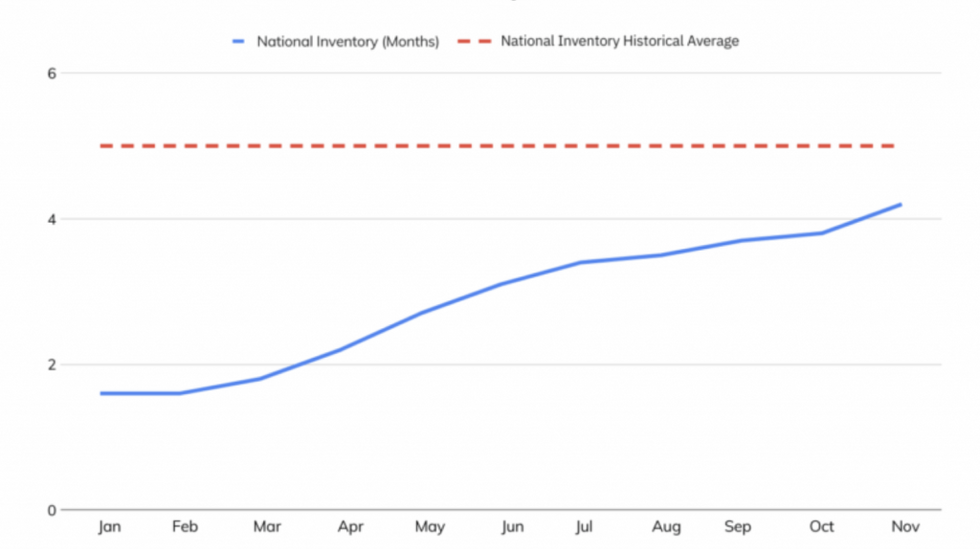

At the start of 2022, Canada saw inventory hit an all-time low of 1.7 months -- indicating that it would take a mere 1.7 months for all available housing stock to be sold -- then picked up to around three months of inventory for the rest of the year. The long-term national average is just over five months.

“Although we expect to see inventory rise because sellers can’t put their plans on hold any longer, inventory will likely still be low in the first half of the year,” writes Zoocasa, also cautioning that due to seasonally soft supply in the winter, inventory could “trend toward the lower end of the one month mark” in 2023, hitting a new all-time low.

Haw adds, ”This will make conditions difficult and competitive for in-market buyers that have a set timeline to purchase a home.”

As such, Canadians hoping to snag real estate early in 2023 should act fast, while those who can hold out until inventory picks up by early summer should do so.

Immigration Will Lead to Tighter Market Conditions

Earlier this year, the federal government announced record-high immigration targets that would see 1.5M new Canadians settling in the country by 2027. Haw says housing market conditions will undoubtedly tighten.

“Although the effects may be delayed, the added pressure on housing markets will be felt in the next two to three years,” she says. Chronic challenges facing Canadian housing, such as supply shortfalls and already-pent-up demand, will likely exacerbate the pressures felt by both major and smaller markets.

The report further explains, “Newcomers to Canada often settle in city cores, the greatest effects could be felt in some of Canada’s already most expensive markets. However, this has a ripple effect and if the housing market in a major city like Toronto becomes even more saturated, it will impact the GTA and smaller cities outside of the region.”