Sentiments have soured significantly across Canada’s housing markets, with sales and prices edging lower as high interest rates keep buyers on the sidelines. But despite the slowdown, economists warn an improvement in affordability is not on the horizon.

Home sales have been on the decline since the Bank of Canada resumed rate hikes in June, and slipped a further 1.9% from August to September, according to data from the Canadian Real Estate Association (CREA).

At the same time, the Aggregate Composite MLS Home Price Index (HPI) dipped 0.3% on a monthly basis to $753,900, the first decline since March. RBC’s Robert Hogue, Principal Economist, and Rachel Battaglia, Economist, predict, that this may be a "sign of things to come."

The pair point to Ontario as evidence — cities in and around the Greater Toronto Area posted the greatest declines in September, while price growth was relatively flat across the rest of the province. In British Columbia and Quebec, the rate of price appreciation has moderated, too.

"Higher interest rates, affordability challenges, and economic uncertainty are likely to keep homebuyer demand muted in the near term," Hogue and Battaglia said. "At the same time, higher interest costs may also exert increasing pressure on existing homeowners to sell."

This would lead to a further boost in new listings, which rose 6.3% on a monthly basis in September and have now climbed 35% since hitting a record-low in March. To Marc Desormeaux, Principal Economist at Desjardins, it’s this steady rise that implies many homeowners who purchased property when interest rates were significantly lower, as they were throughout 2020 and 2021, are now struggling with “sharply higher” borrowing costs.

"Despite pockets of strength, it’s clear that Canadian housing market sentiment has soured meaningfully since the spring," Desormeaux said. While he predicts demand will falter further in the months ahead under the weight of high interest rates and a slowing economy, "the well-documented longer-term supply shortfall accrued over multiple decades still means that a return to affordability isn’t imminent."

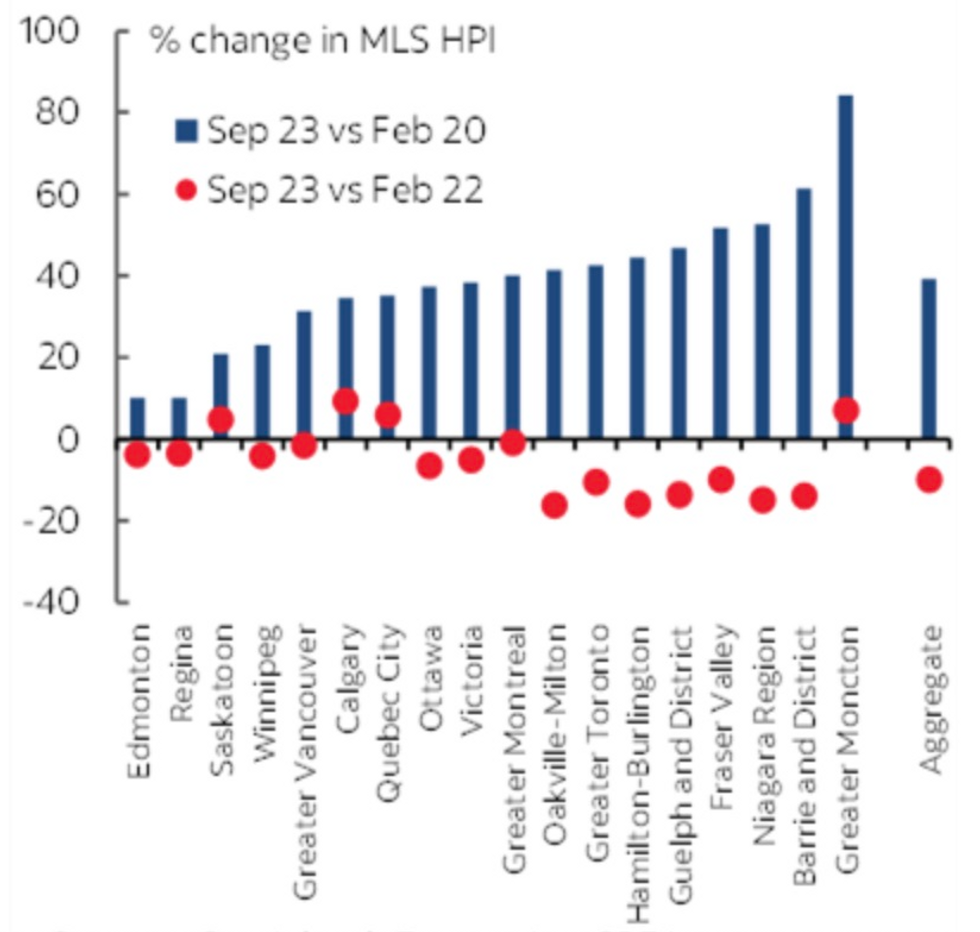

As Farah Omran, Senior Economist at Scotiabank, points out, the national aggregate home price is 39% above its pre-pandemic level. In several markets, including Calgary, Greater Moncton, and Quebec City, prices are even higher than they were in February 2022, the last month before rate hikes began. Nationally, prices are 10% below last year’s peak.

While Robert Kavcic, Senior Economist and Director of Economics at BMO, predicts, like RBC’s Hogue and Battaglia, that prices will continue to edge down, "tough market conditions" persist. Restrictive rates will keep demand dwindling in the absence of sizeable price declines.