Following an unexpectedly frenzied spring housing market, some provinces will be spared from the impending economic slowdown. At least, for now.

The "relative strength" of the rebound has led Marc Desormeaux and Hélène Bégin, Principal Economists at Desjardins, to alter their economic forecasts for some provinces and push the start of the downturn to 2024.

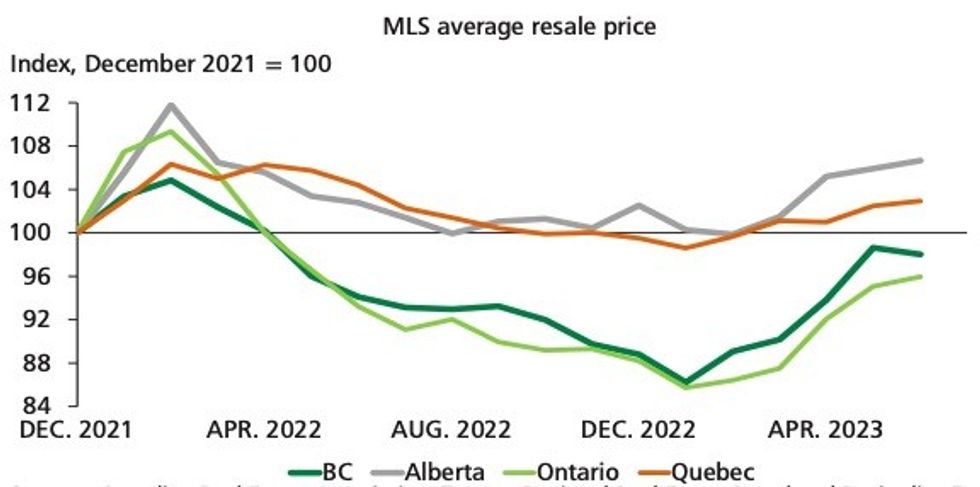

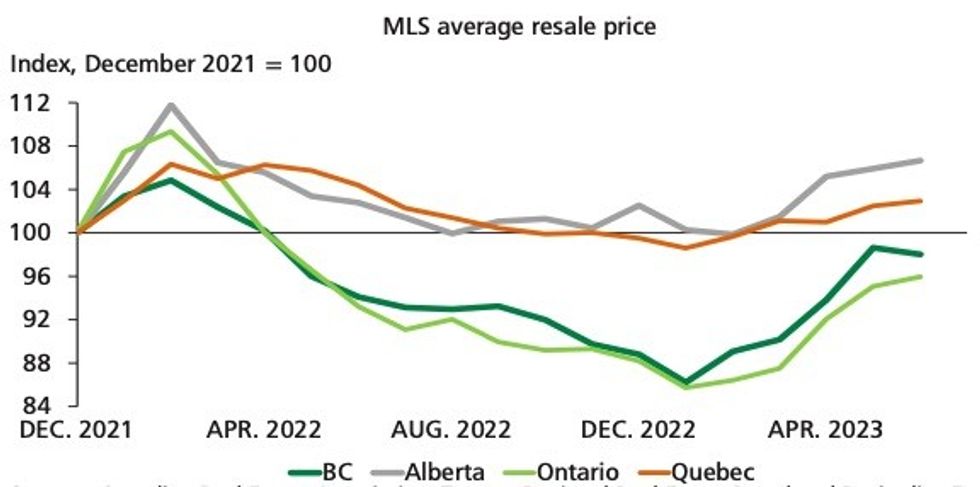

After the Bank of Canada (BoC) temporarily paused interest rate hikes, most provinces experienced an uptick in sales activity. But in Ontario and British Columbia -- where affordability is already stretched -- the "robustness of gains...has been striking."

As such, the economic forecasts for the two housing-oriented provinces have been revised significantly higher, with Ontario and BC expected to see real GDP grow by 1.6% and 1.5%, respectively, in 2023.

Meanwhile, the less severe market downturn seen in Quebec over the last several years has been followed by a similarly less pronounced bounce back, leading Desormeaux and Bégin to believe the province will experience more modest real GDP growth of 0.4% this year.

Oil-producing regions, like Alberta and Saskatchewan, are still expected to fare the best, with the economists predicting annual real GDP growth of 2.9% and 2.8% for the provinces, respectively, in 2023.

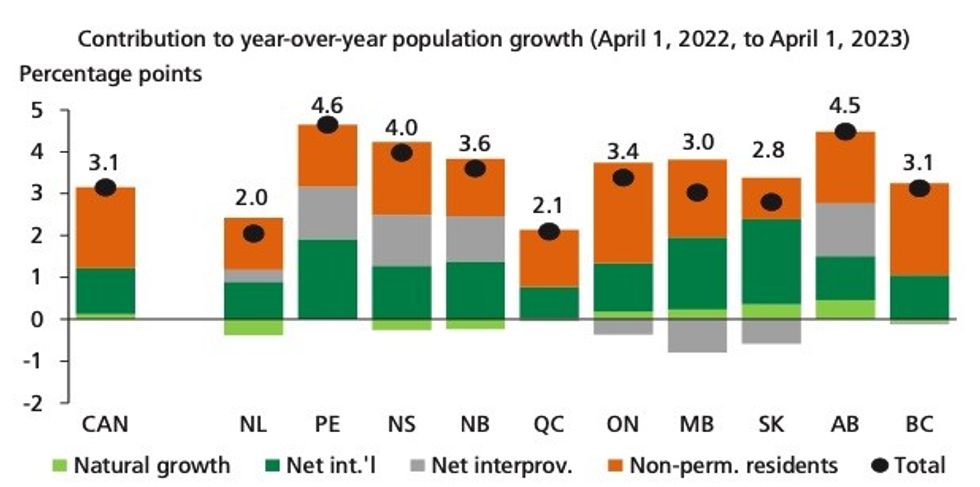

All provinces have experienced economic expansion thus far in 2023 due to soaring population growth, but the source of newcomers will have an effect on the province's growth rankings.

Ontario and BC have welcomed a record number of non-permanent residents, but if the economy slows, then the number of temporary foreign workers admitted to Canada could fall.

In contrast, population growth in Alberta and the Maritimes has been driven not just by non-permanent residents, but by international immigration and interprovincial migration, too. Partly the result of the regions' affordable home prices, the growth is more likely to be sustained.

While the boisterous housing market and increased population growth have aided the economic outlook for 2023, they have not prevented a downturn, Desormeaux and Bégin warn. Rather, they have just delayed it until 2024.

"Monetary policy works with a lag, and all regions should increasingly feel the dampening impacts of sharply higher interest rates in the coming months," the economists said.

"As we approach 2024, more housing‐oriented provincial economies should see the more significant slowdowns we’ve long been expecting."

Cracks are already beginning to show, particularly in Ontario and BC. After the BoC began hiking interest rates again in June, the largest housing markets in both provinces -- Toronto and Vancouver -- saw sales slow.

Desormeaux and Bégin expect the imminent economic slowdown to result in real GDP growth of 0.1% in Ontario, 0.2% in British Columbia, and 0.3% in Quebec in 2024.

Meanwhile, Newfoundland and Labrador will lead the economy on a national basis, with real GDP predicted to grow 1.1% in 2024. Alberta and Saskatchewan will follow, with real GDP expected to grow 1.0% and 0.9%, respectively, next year.