Covenant (Real Estate)

Explore covenants in Canadian real estate — what they are, how they affect property use, and why they’re important for land control.

July 27, 2025

What is a Covenant?

A covenant in real estate is a legally binding promise or restriction placed on a property’s use, typically recorded on title and enforceable by law or contract.

Why a Covenant Matters in Real Estate

In Canadian property law, covenants help regulate land use, protect property value, and maintain community standards.

Types of covenants:

- Restrictive covenant: limits property use (e.g., no further subdivision)

- Affirmative covenant: obligates action (e.g., maintain fence)

Covenants run with the land, meaning they bind future owners until removed or modified legally.

Example of a Covenant in Action

The title search revealed a restrictive covenant prohibiting the construction of additional dwellings on the lot.

Key Takeaways

- Legal promise tied to property use

- Can restrict or require certain actions

- Binds current and future owners

- Recorded on property title

- May require legal process to change

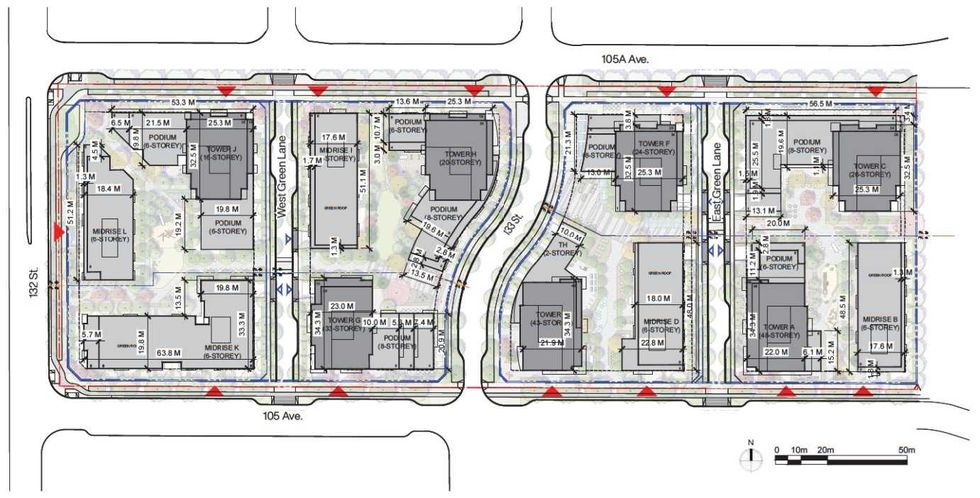

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)