In light of the province-wide lockdowns that forced real estate agents to pivot to a virtual sales model, the nearly 9,000 new condo sales in 2020 that the City of Toronto recorded, wound up representing a more than 15-year low.

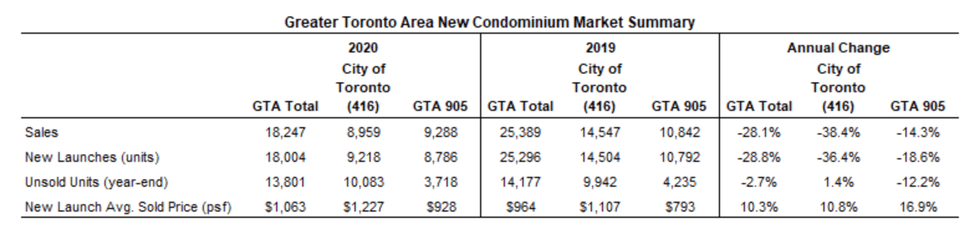

Urbanation, the leading source of information and analysis on the condominium market since 1981, released its year-end 2020 Condominium Market Survey results on Monday, which revealed new condominium apartment sales in the GTA declined 28% last year to 18,247 units, the lowest annual total since 2013 and 15% below the 10-year average (21,421).

Though, despite the notable drop, new condo sales remained in line with new launches of 18,004 units last year, down from 25,296 launches in 2019. The latest data also showed there were 4,642 new condo units sold in Q4, though this was down 43% year-over-year and 22% below the 10-year Q4 average of 5,960.

However, despite this, a "record" Q3 brought total units sold during the second half of the year to 11,031 units, which was above the 10-year average of 10,491 units for second-half sales.

READ: GTA Condo Sales Soared Over 20% in Q4 2020, But Prices and Rents Dropped

Last year, as city dwellers left the downtown core in search of more space and affordability -- a rapidly growing trend amid the pandemic -- the 905-region within the GTA became a very attractive market for buyers. Subsequently, for the first time ever, the 905-area represented more than half (51%) of new condo sales, after 9,288 units were sold in 2020.

Urbanation says this is the third-highest annual total on record behind 2019 (10,842) and 2017 (11,531). In the City of Toronto, sales declined 38% in 2020 to 8,959 units, representing a more than 15-year low.

“The GTA new condominium market recorded a respectable number of sales in 2020 as the industry pivoted to a virtual sales environment amid lockdowns caused by COVID-19," said Shaun Hildebrand, President of Urbanation.

Hildebrand noted the shift in activity to the 905 region accelerated last year as demand for relatively affordable suburban sites intensified alongside the broader real estate market.

In the 905 region, unsold inventory fell 12% year-over-year to 3,718 units, which was equal to 4.8 months of supply based on 2020 sales. Here in Toronto, unsold inventory increased 1.4% from year-end 2019 to 10,083 units, equal to 13.5 months of supply. Across the GTA, unsold inventory was priced at $1,126 psf in Q4-2020, up 5.2% annually.

As for prices, selling prices for new condominium units that launched for presale in 2020 reached a new average record of $1,063 psf, up 10.3% compared to average selling prices for new launches in 2019 ($964 psf). In the 905, average selling prices increased 16.9% to $928 psf, while the City of Toronto saw prices grow 10.8% to $1,227 psf.

Though, despite the shift in new condominium sales to the 905 region, Urbanation says the mix of new units brought to market last year became smaller.

In 2020, a 60% share of GTA new launches were represented by one bedroom and studio units, increasing from a 53% share of new launches in 2019. The average unit size of GTA new launches in 2020 was 688-sq.ft, down from an average of 715-sq.ft in 2019.

Interestingly, the average size of new launches in the City of Toronto increased from 676-sq.ft in 2019 to 706-sq.ft, in 2020, while the average size of new launches in the 905 region declined from 735-sq.ft in 2019 to 690-sq.ft in 2020.

While the pandemic brought the economy to a near standstill, it failed to slow down construction in the GTA last year. Construction starts for new condominium apartments reached their second-highest level on record in 2020 at 26,662 units, increasing 9% from 2019. At the same time, a record high of 22,473 new condominiums reached completion.

At the end of 2020, a record high 81,029 condominiums were under construction across the GTA.

While the past year has proven to be uncertain, the pandemic has also highlighted the resiliency of the industry and has left many feeling hopeful for what's to come in 2021.

With record-low mortgage rates and the continued rollout of the vaccine on the horizon, there's definitely a chance that Toronto’s condo market activity will continue to soar to new heights.