Canada Mortgage and Housing Corporation (CMHC) just released its latest Housing Market Outlook (HMO) -- and it promises (some) relief for first-time homebuyers on the price front. But it still won't be easy for newcomers to the market to purchase property in the coming years.

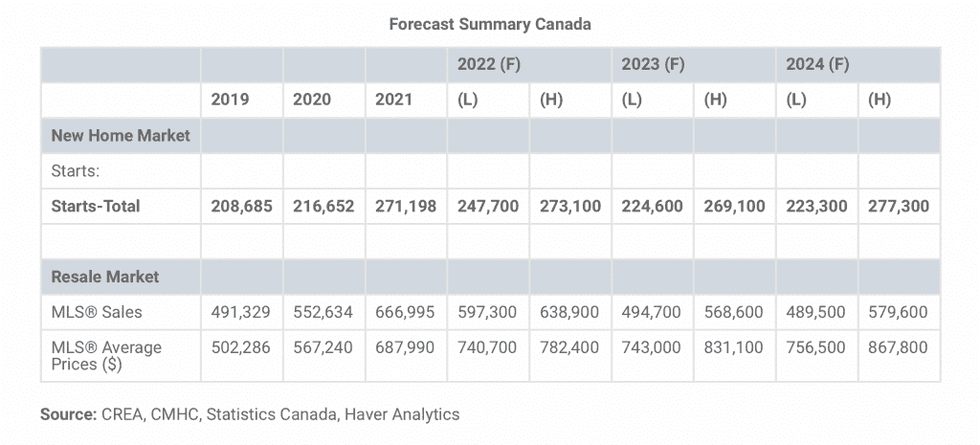

In general, the national housing agency predicts that growth in prices, sales levels, and housing starts will moderate in 2022 from recent highs in 2021.

The level of home sales and the pace of price growth will remain elevated compared to long-run averages, but will moderate from their red-hot 2021 peaks, says CMHC. Thanks to higher mortgage rates and lower affordability on housing demand, they predict that these trends will continue.

According to Crown Corporation, housing sales and price growth will fall more in line with historical averages by late 2023 or early 2024, but elevated price levels will persist since price growth will remain positive. These factors will place greater pressure on the affordability of entering homeownership. So, while the record-breaking run may have slowed, the only bubble to burst will be those of many first-time homebuyers.

“We expect the growth in prices, sales levels, and housing starts to moderate from recent highs, but remain elevated in 2022,” said Bob Dugan, Chief Economist for CMHC in the report. “Improving levels of employment and immigration are expected to be key factors, as the impact of pandemic restrictions continue to recede. In 2023 and 2024, the growth in prices will trend closer to long-run averages, with sales and starts activity expected to remain above five- and 10-year averages. Price growth will likely continue to be led by markets with low listings, including Vancouver, Toronto, and Montreal.”

Housing starts will also moderate from 2021 highs but remain above historical averages, says CMHC. This reflects expected support for new home construction to address current and growing housing supply gaps. However, supply constraints on construction will continue to impact Toronto and Vancouver; this will highlight the central role of housing supply in determining affordability.

Ontario, Quebec, and British Columbia will likely see the strongest price gains in 2022. This will largely reflect tighter supply constraints than in the rest of Canada. The growth in prices is expected to slow by the end of 2024.

Meanwhile, CMHC predicts that the Prairie provinces, led by Alberta, will likely see relatively strong sales and starts levels and be stimulated by energy sector investments and higher energy and commodities prices. In the Prairies, the growth in prices is predicted to remain well below the national average, something that reflects a greater balance between supply and demand than in other regions.

According to the HMO, Atlantic region will likely see continued upward pressure on housing activity and growth in prices from high inter-provincial migration. The level of home prices will remain relatively low in comparison to the overall Canadian average.

Despite moderating prices throughout the country, climbing interest rates will make it difficult for many to enter the market.

“The economy has rebounded quite strongly from the pandemic. Real GDP in 2021 came in at 4.6%, and that follows a decline of about 5.2% back in 2020,” said Dugan this morning on a call with journalists. “The strong growth in the economy has been reflected in the steady decline in the unemployment rate to 5.3%, its lowest level in more than 40 years. The strong rate of growth has exhausted any excess capacity in the economy, which, together with supply chain disruptions and pressure on food and energy prices due to the war in Ukraine are causing inflation rates to reach three-decades highs."

Dugan highlights yesterday’s news that Consumer price index for March was up 6.7% compared to a year earlier.

“When we look ahead, we expect the economy to continue to expand at a fairly strong pace,” said Dugan. “GDP growth is forecast at 4.3% in 2022 and a further 3.1% in 2023. This continued pace of above-potential GDP growth implies that the economy will move into excess demand; meaning that upward pressure on CPI will continue, which means in turn that interest rates will continue to rise.” Dugan highlights that, in its base case forecast, CMHC assumes that short-term interest rates will increase by a further 125 basis points by the third quarter of 2023.

"A very real risk though to this base case is that more significant interest rate increases will be required to slow the economy sufficiently to reduce the excess demand we expect to build in the economy, so that inflation can move back to the 2% target," said Dugan. "Longer-term interest rates are also forecast to continue rising, the result being that homebuyers will face higher mortgage rates in the years ahead. The rise in mortgage rates is the key reason why we expect activity in the housing market to moderate from exceptionally strong levels in 2021. More specifically, we expect existing home sales to moderate in this year and next, but will nevertheless will remain near historically high levels. Likewise, new home construction will slow, but housing starts will remain at extraordinary high levels over the next several years."

Dugan says the decrease in activity will bring some relief to the pace of house price growth, but prices are still expected to grow (again, no bubble burst here). "Following 21.3% increase in prices back in 2021, the growth in the average prices is expected to slow in 2022 and 2023, but we do nevertheless expect continued price growth," he says. Dugan points to an alarming lack of housing stock for exasperating affordability challenges not only for aspiring homeowners, but for renters as well, and says "much more" supply is needed. "Many of these aspiring homeowners may remain in the rental market," he says.

In the rental market, recent market trends in the Canadian market are also expected to continue over the forecast period. Downward pressure on rental vacancy rates and upward pressure on average rents will likely continue to affect rental affordability, according to Dugan. That is, unless new supply can offset these demand pressures, he says.