When it comes to Canadian real estate, the word "cheap" isn't something you hear very often. In fact, it's usually more words like "unaffordable," "house poor," and "high barrier to entry" that come to mind. But not all Canadian cities are created equal, and neither are their real estate markets.

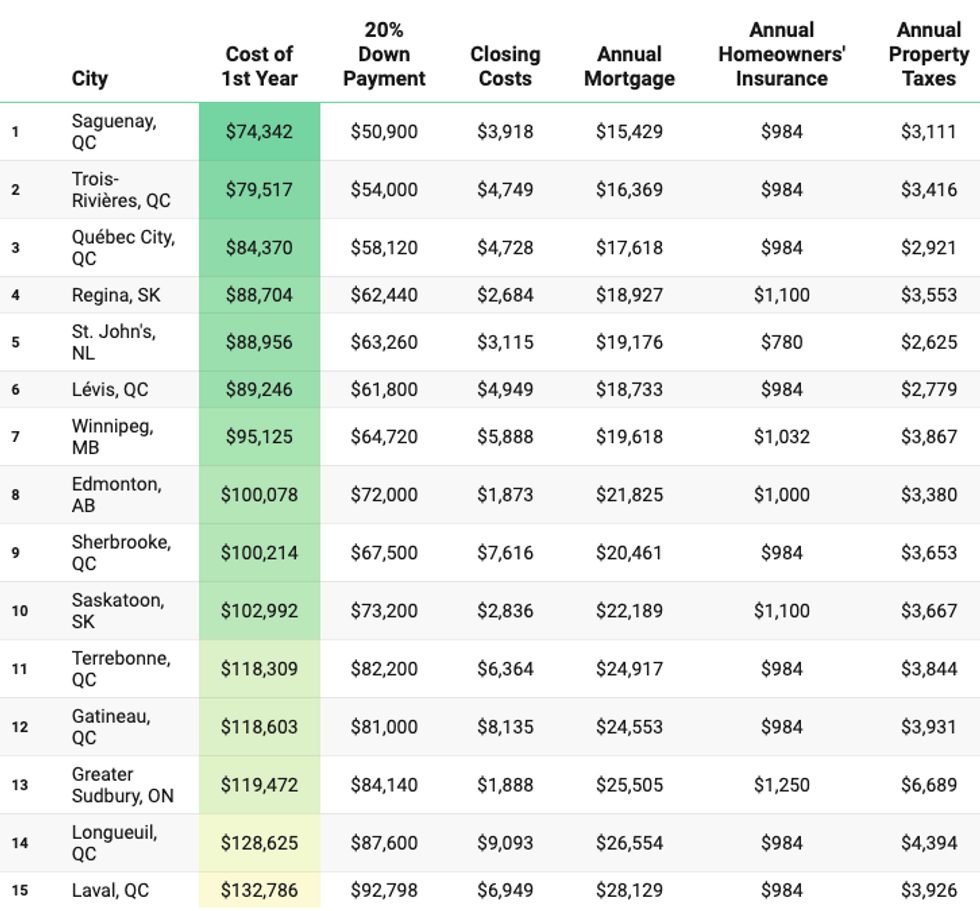

For those looking to purchase a home while shelling out a (relatively) smaller chunk of change, a new report from Point2Homes breaks down the 15 Canadian cities with the cheapest first year of homeownership.

The report writers analyzed the cost of homeownership in Canada's 50 most populous cities to determine which were the most affordable based on a combination of both upfront costs (closing costs and a 20% down payment on the city's benchmark home price) and annual recurring costs (mortgage payments, property tax, and homeowners' insurance).

To the surprise of no one, not a single city in British Columbia made it onto the list, while just one Ontario city -- albeit a mid-sized one in Northern Ontario -- squeaked by. In fact, Point2 found that the first year of homeownership averaged more than $315K in many BC and Ontario cities, with Richmond Hill, Ontario taking the cake as the most expensive, with ownership costs in the first year totalling more than $400K. Notably, this is significantly more than Vancouver ($331,638) and Toronto ($315,031).

So what's a frugal homebuyer to do? The answer appears to be to move to Quebec. The eastern province dominates the cheapest cities list, occupying the first three spots, with an additional six cities ranking lower down. Saguenay, located a few hours north of Quebec City, offers the cheapest first year of homeownership at $74,342. It's followed by Trois-Rivières at $79,517, and Quebec City at $84,370.

Regina, Saskatchewan ($88,704) and St. John's, Newfoundland ($88,956) round out the top five. Interestingly, Lévis, Quebec, despite ranking sixth, actually requires a smaller downpayment on the benchmark home there, but higher closing costs push its rank down.

The one Ontario city that made the list is Greater Sudbury, coming in 13th place with an estimated first year cost of $119,472. Sudbury also has both the highest home insurance prices and property taxes out of all 15 cities.

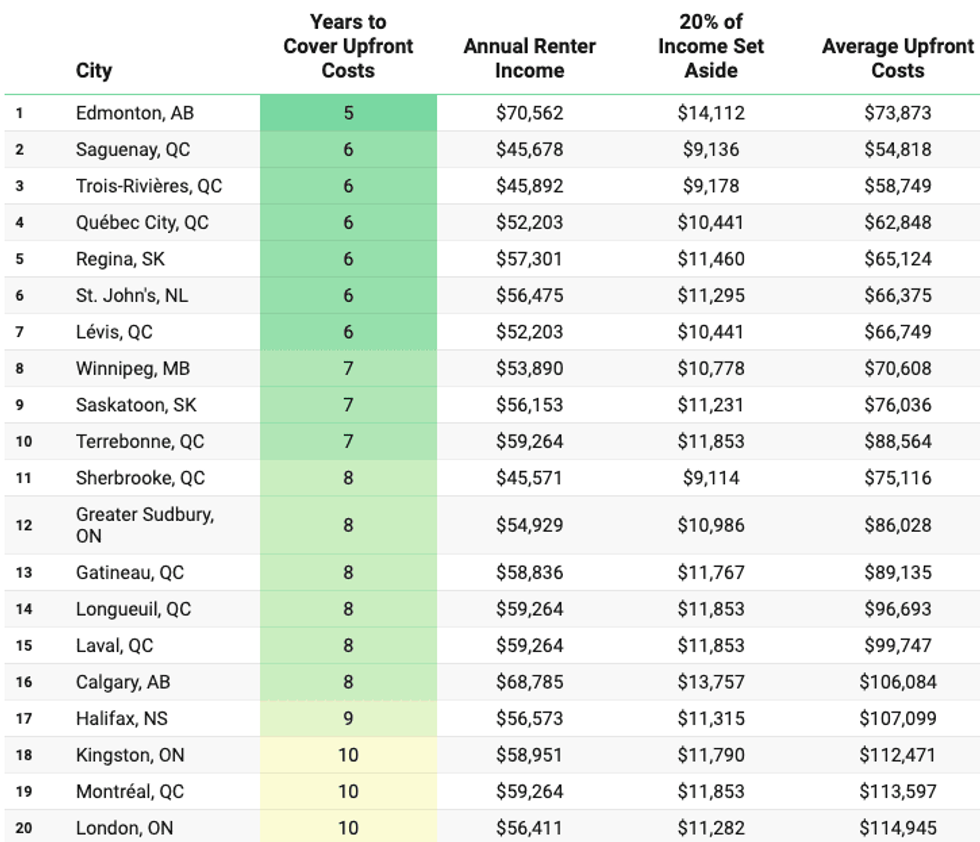

No matter what region you're buying in, the bulk of first year costs is going to come from the down payment, "which is particularly difficult for those without outside financial help," the report notes. To illustrate how challenging this can be, Point2 calculated how long a renter would need to save before being able to cover the upfront costs, assuming a savings of 20% of their annual income each year.

The results: it can take anywhere from five to 22 years to cover upfront costs in Canada's largest cities. Edmonton, which ranked eighth in terms of how cheap the first year of homeownership is, required the fewest years of savings at five years. Saguenay, while being ranked the cheapest, requires six years of savings.

The cities requiring 20 or more years of savings can unsurprisingly be found in Ontario, and include Richmond Hill, Markham, Oakville, and Vaughan. Toronto renters would need to save, on average, for 17 years before being able to cover the upfront costs.

"Never has the dream of becoming a homeowner in Canada felt just like that — a dream," the report reads. "As homeownership rates declined to a 20-year low back in 2021, potential buyers might still be inclined to postpone ownership plans due to ongoing inflation and out-of-reach home prices."

Point2 notes new measures that have been introduced in an attempt to make homeownership more attainable, such as the tax-free First Home Savings Account plan and the foreign buyer ban, which bring some "hope that ownership rates might start to inch up."

"But, despite financial aid programs and dwindling competition for already-scarce inventory, the costs of homeownership weigh on any potential buyer."