Are we or aren’t we heading for a recession? That seems to be the trillion-dollar question among both economists and regular Canadians.

In a climate of inflation, climbing interest rates, pandemic recovery, and an ongoing war, it’s a fair question and concern.

According to a new report from The Conference Board of Canada (CBoC), we can breathe a collective sigh of relief -- well, sort of.

While the not-for-profit think tank acknowledges the many challenges that are facing the economy, it says that a combination of high commodity prices, high job vacancy rates, and high consumer savings will help Canada avoid a recession.

According to the CBoC, market expectations built into the yield curve suggest the probability of a recession in Canada over the next 12 months stands at about 50-50. The organization says it’s a challenge right now to forecast where the economy is headed, given the global situation and the many risks it poses. “Those risks include a loss of credibility in central banks’ ability to quell inflation; a collapse in asset values due to higher interest rates; further COVID-related health measures; and an escalation of Russia’s war on Ukraine,” writes the report’s author, Pedro Antunes, chief economist at CBoC.

With that said, Antunes points to a tight labour market, high levels of household savings, and solid business profits as factors that will help Canada avert a recession.

The report highlights how the “most probable path” for Canada’s economy looks relatively solid: the real GDP is forecast to post growth of 3.5% in 2022 and 1.9% in 2023. While nobody can deny that perpetually climbing inflation is eating away at the purchasing power of Canadians, the CBoC says that consumer spending is “at the backbone” of their relatively optimistic forecast.

In the absence of things like travel, concerts, and even a daily commute, many Canadian households managed to amass plenty of savings over the past two years, and bankruptcy rates are at record lows. Furthermore, a tight labour market has resulted in an acceleration in wage increases -- although they still lag behind inflation.

Assuming no new COVID-related health restrictions (something Ontarians may be particularly weary of), the CBoChighlights how a pent-up demand for services and travel will continue to drive a rebound in those sectors. With consumer spending holding up despite inflation, the commodity price boom that is driving inflation will serve to boost Canadian exports, writes Antunes.

In particular, high prices for oil, gas, wheat, canola, and potash (to name a few, says the CBoC) are boosting profit and output for Canadian exporters.

Our climate of high inflation, coupled with a massive rebound in resource-sector profits and royalties, is also helping to replenish provincial and federal coffers, says the CBoC.

“For these reasons, we believe Canada’s economy will outperform that of many other countries around the world, assuming that nothing goes terribly wrong,” writes Antunes.

So, what could go terribly wrong? The think tank points to a slew of potential factors that could provide a challenge in the months ahead due to their ramifications. These include lost credibility (i.e. will monetary policy succeed in quelling inflation without hitting the economy too hard?); the collapse of asset values; a potential seventh wave of COVID-19; and the escalation of the war between Russia and Ukraine.

The next rate hike from the Bank of Canada is expected on September 7. In the meantime, the media is rife with banter of a seventh wave of COVID-19 (for those who are still paying attention, at least). And tensions don't seem to be easing between Russia and Ukraine any time soon.

So, there's no reason to celebrate quite yet. Rather, we can be cautiously optimistic, the report suggests.

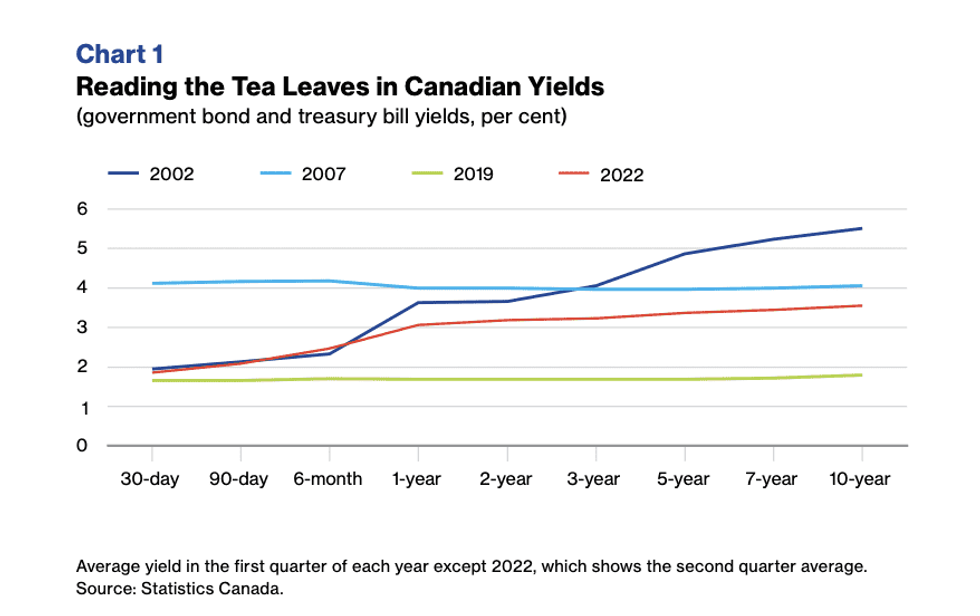

Another telling indication of the potential of a looming election can be found in the bond yield curve. Historically, an inverted or flat yield curve indicates a looming recession, however, not all inverted yield curves have in fact resulted in one. Right now, this curve is relatively flat, indicating that markets are pricing in higher interest rates in the short-term, before a move to lower rates after 2023. That model points to a 50% chance of recession, says the board.

At the end of the day, however, the direction we head could actually come down to mass mindset.

"Still, it's important to understand that market expectations can become a self-fulfilling prophecy: If enough people believe a recession is coming, this on its own could reduce investment and consumer spending enough to result in a recession," writes Antunes. "Perhaps this is an additional risk we’re living with today."

Here's to hoping for the best-case scenario all around (just putting the good vibes out there).