Canada's big six banks dominate the mortgage market. They also happen to cost a lot more when compared to smaller lenders.

According to a recent report from Mortgage Professionals Canada, 62 per cent of Canadian mortgages were obtained at a big bank. Brokers provided 28 per cent of mortgage loans last year while five and three per cent came from credit unions and insurance and trust companies, respectively. The remaining two per cent were secured through "other" sources.

READ: 9 Out Of 10 Builders Say The Mortgage Stress Test Impacted Sales

"The big banks never offer the lowest posted rates on the market, but Canadians aren't spending enough time researching rates before signing their mortgages, and that's potentially costing them thousands of dollars a year," Justin Thouin, CEO and Co-Founder of LowestRates.ca said in a release.

READ: Canadians Are Committed To Paying Down Their Mortgages Quickly

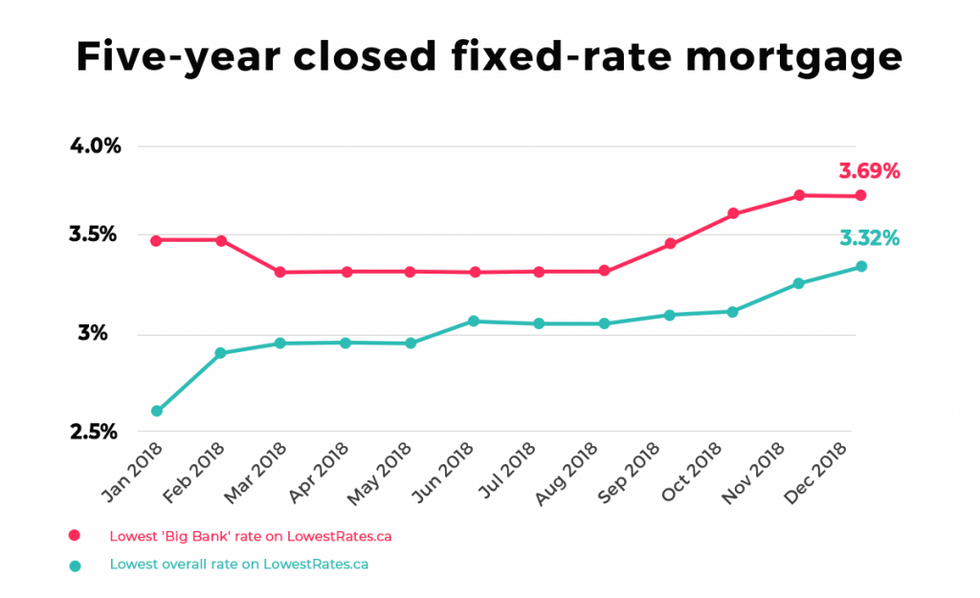

According to LowestRates.ca, the posted mortgage rates at Canada's big banks were consistently higher than the rates offered by smaller lenders in 2018.

While Canadians were quick to pay attention to RBC lowering its five-year fixed-rate mortgage to 3.74 per cent, Thouin points out smaller lenders and brokers continually offer more affordable rates.

"We compare prices when we do less costly things, like take a trip or buy a TV, but we don't shop around for rates for homes—one of the most expensive purchases we'll likely ever make—despite the fact that the money we can save on a vacation pales in comparison to what we can save on a mortgage," Thouin added.

READ: This Common Mistake Could Mean More Mortgage Payments

According to the online rate comparison site, consumers would pay $2,560 per month on a $500,000 mortgage with RBC's new rate but, if they shopped around, they could pay $2,426 monthly through another lender on the same terms. Though the savings is a modest $134 monthly, it can add up to $40,200 over the course of a 25-year mortgage.

Just as lenders rates rise, they also (occasionally) fall and when they do, consumers should see their rates change. Unfortunately, Thouin says that isn't always the case when it comes to big banks.

READ: Canadian Mortgage Growth Will Be Low This Year, CIBC CEO Says

"Brokers and smaller lenders often drop their rates first to be more competitive, and banks are slower to implement changes because they know they own the market," he explains. "This will only change when Canadians realize they're being overcharged and begin to shift away from the banks, and that will only happen as we increase awareness about the alternative market. The best deals are found online, not in your family's legacy bank branch."