Canadian homeowners don’t have buyer’s remorse – at least, not when it comes to the roof over their heads, they don’t. New stats from a Wahi survey of Angus Reid Forum members reveal that the country’s homeowners who purchased a home in recent years have no regrets, even amid the rising cost of living and higher mortgage rates.

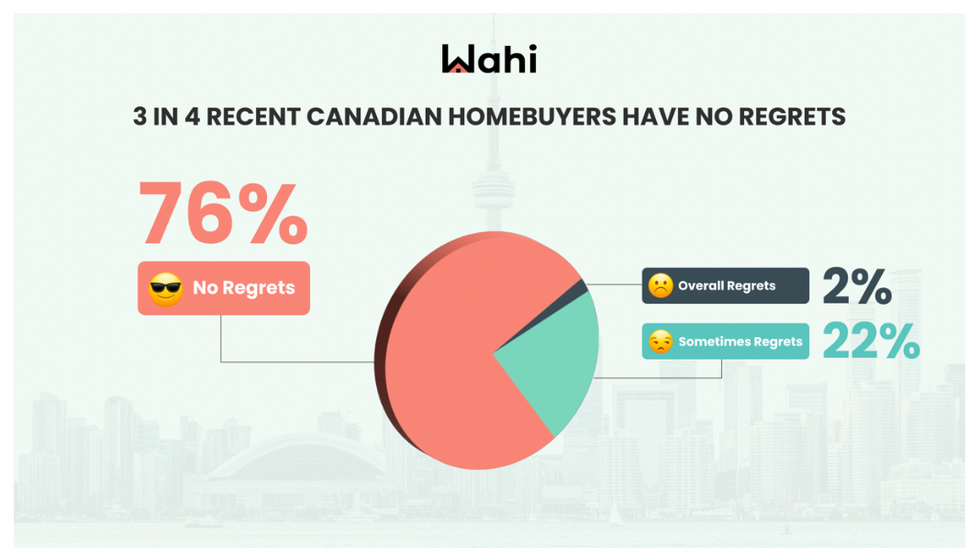

Overall, 76% of Canadians who have purchased a home since 2019 – a very different time on the interest rate front – say they don’t regret the decision at all, according to Wahi’s 2024 Homeowner Happiness Survey.

“While some homeowners are undeniably facing challenges today, there are a variety of reasons for them to feel confident in their decisions,” says Wahi CEO Benjy Katchen. Owning a home is deeply ingrained in the culture, as Canada’s homeownership rate sits at 66.5%, he adds.

While homeownership is not without its stresses – everything from financial pressures to maintenance issues – recent StatCan research has shown that homeowners report a better quality of life than the renting set. Furthermore, previous Wahi research has found that one in three Canadians who bought a home with a partner say it improved their relationship.

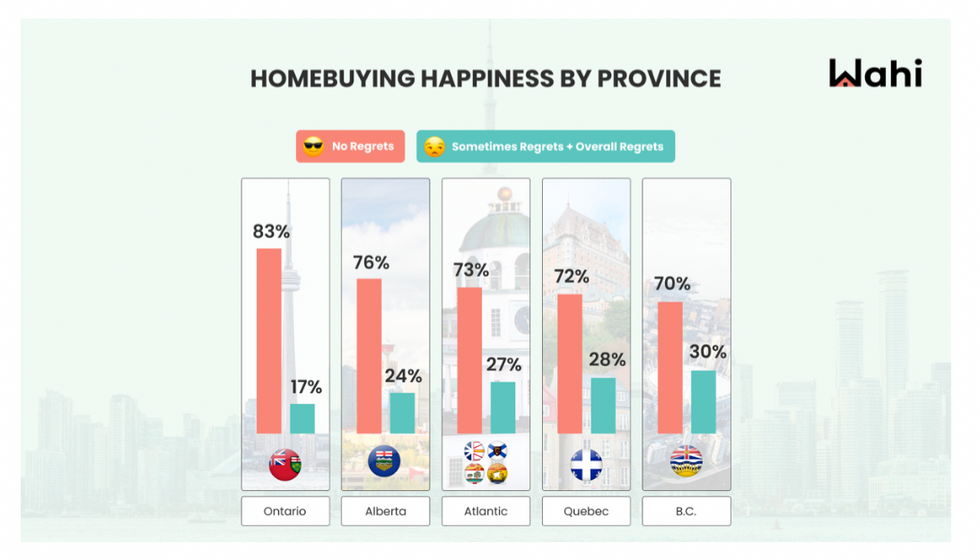

Somewhat surprising, buyers in Ontario – a province that has some of the priciest housing markets in the country – have the least regrets when it comes to the purchase of their home. According to the survey, just 17% of Ontarians say they either sometimes regret (15%) or regret their decision overall (2%).

In British Columbia (BC) – Canada’s other notoriously pricey province – however, homebuyers don’t exactly share the sentiment. Homebuying regrets were strongest in BC, where 30% say they have occasional (26%) or overall regrets (4%).

As it turns out, the younger generation of new homeowners has fewest regrets about their big purchase.

Approximately eight in 10 Canadians (79%) aged 18-34 who have purchased a home since 2019 say they have no regrets about the decision, versus 68% of respondents aged 35-54 and 80% of those aged 55 and up. As the findings highlight, younger homeowners may be excited to have reached the (increasingly rare) ownership milestone, while the 55-and-up demographic could be more financially established and therefore less concerned with affordability or carrying costs.

Picking the wrong home or location – things that often aren’t realized immediately, rather, over time – are cited as the biggest regrets among homeowners. Among respondents who say they sometimes or regularly regret buying a home, realizing a different home or area would’ve been better is the most common reason (33%). That’s followed by the burden of repairs and maintenance (31%) and the mortgage rate increasing (24%). Men were most likely to regret the specific home or area (42%), while women were most likely to regret the burden of maintenance or repairs (39%).

Despite the dramatic economic climate, the great Canadian dream of home ownership remains strong. Nearly one in five Canadians aged 18 and up say they probably will or may buy a home this year. In order to achieve this dream in our increasingly unaffordable markets, Canadians simply (or not so simply) plan to work more and spend less.

According to the survey results, some 45% of potential homebuyers say they are cutting back on spending to set themselves up financially for purchasing a home in 2024, making it the most common sacrifice (respondents could choose multiple answers).

Canadians with homebuying intentions this year also say they are planning to work more hours (21%) or take on a gig-economy job, such as driving for Uber (8%). If there’s a will there’s a way, it appears – perhaps not without the bank of the parents in some parts of the country (let's be honest).

Whatever the case, countless Canadian homeowners will have their eyes on tomorrow’s Bank of Canada interest rate announcement – whether they regret the purchase of their home or not.