While housing affordability continues to deteriorate across the country, with prices rising in larger cities and suburbs, homeownership is a hot-button topic for Canadians, especially millennials -- those aged 25 to 40 -- who aspire to buy homes.

And while the rising cost of homes has halted many Canadians' plans of buying a home, it hasn't necessarily stopped everyone, including millennial buyers, who continue to be active in Canada's housing market. Of course, where millennials are more likely to buy a home varies greatly throughout the country and it's very dependable on affordability.

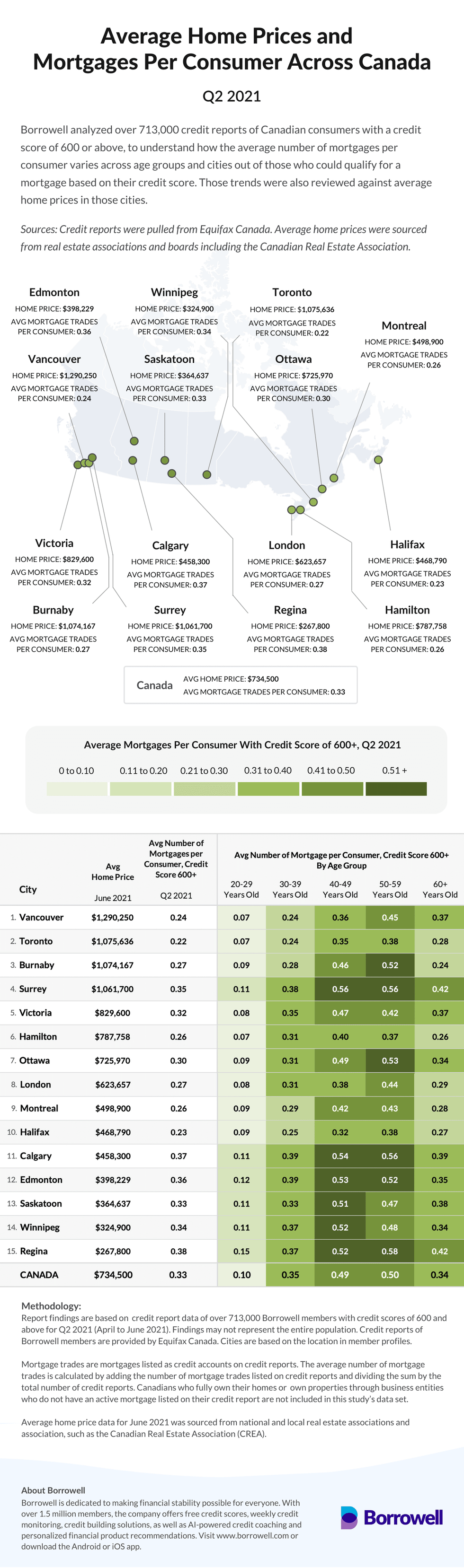

To get a better understanding of what homeownership trends exist in Canada, Borrowell analyzed over 713,000 credit reports of its members to learn how the average number of mortgages per consumer (an indication of homeownership, especially for younger buyers who have not yet paid off their mortgage) varies across age groups and cities.

The reviewed credit reports were of members who had scores of 600 and above -- the minimum credit score required by the Canadian Mortgage and Housing Corporation (CMHC) for mortgage loan insurance -- so that figures reflected those who could potentially qualify for a mortgage based on their credit score.

READ: Nearly 20% of GTA Homeowners Under 35 Own More Than One Property

On average, Borrowell found that 1 in every 3 consumers with a credit score of 600 or above has a mortgage on their credit report. That said, this varies notably by city and age group.

According to the findings, cities with higher home prices generally had lower ownership rates. Case in point: Toronto has the lowest homeownership rate (0.22 average mortgage trades per consumer) and the second-highest average home price of $1,075,636 among cities in the study.

On the other hand, Regina has the highest rate of homeownership, roughly 1.7x more than Toronto (0.38 average mortgage trades per consumer vs. 0.22), along with the lowest average home price of $267,800.

When it comes to millennial homeowners, Toronto and Vancouver have the lowest homeownership rates amongst older millennials aged 30-39 -- 0.24 average mortgage trades per consumer. In comparison, older millennials in prairie cities like Edmonton and Calgary have the highest homeownership rates, with roughly 1.6x more than Toronto and Vancouver (0.39 average mortgage trades per consumer vs. 0.24).

What's more, the findings found that middle-aged Canadians who are 40-59 years old are 1.4x more likely to have a mortgage than older Millennials (30-39 years old ), with 0.50 average mortgage trades per consumer vs. 0.35.

Additionally, middle-aged Canadians are 5x more likely to have a mortgage than younger Millennials and Gen Z consumers aged 20-29 years old, with 0.50 average mortgage trades per consumer vs. 0.10.

“The pandemic has activated homebuyers across the country in large metropolitans and smaller suburbs, which has led to considerable demand and housing price increases across the board,” says Andrew Graham, co-founder and CEO of Borrowell.

“Since the pandemic started, many more Canadians have sought out homes with larger square footage and green space, often in smaller towns and cities. With more Canadians than usual setting their eyes on the suburbs, local buyers and millennials looking for their first home have faced more competition, especially as real estate prices continue rising," said Graham.

That said, Graham noted that it's clear that millennials in certain cities face bigger hurdles than ever before when it comes to purchasing a home, even if they have a good credit score.

You can read the full report here.