Although construction increased during the pandemic, Canada's housing supply shortage worsened in 2022, with inventories of unsold new homes falling to historic lows across the country.

In Canada's six largest cities, the number of unabsorbed new units, which includes freehold houses and condominium units, declined by as much as 69% between the five years before the pandemic and 2022.

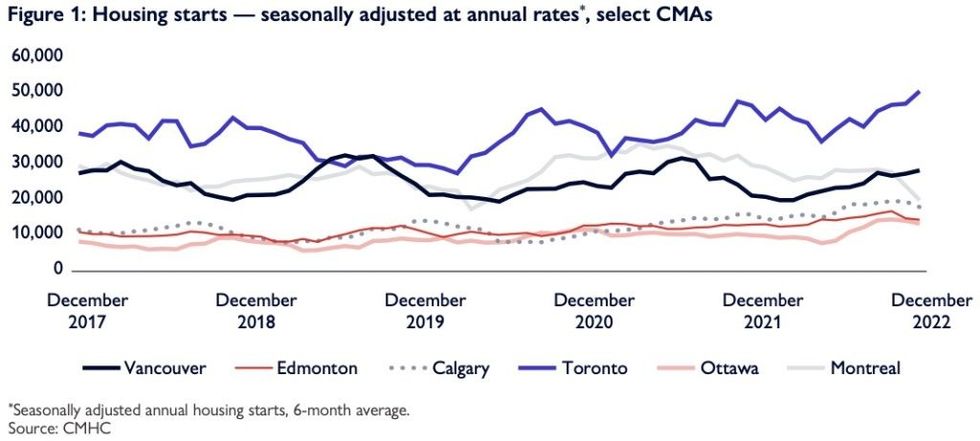

According to the Canada Mortgage and Housing Corporation (CMHC)'s latest Housing Supply Report, rising interest rates increasingly affected the actions of both homebuyers and developers in 2022, leading to a varied degree of growth in residential construction.

In Toronto, housing starts rose 7.7% annually to 45,109, their highest level since 2012. The jump was primarily due to elevated condo apartment construction, a result of two years of strong presales. Meanwhile, inventory of completed and unsold homes ended the year at 530 units, the second-lowest level on record.

In Ottawa, housing starts increased 7.9% to 11,032, an all-time high. As in Toronto, the total increase was spurred by a rise in apartment starts. For the first time in more than 20 years, the sector accounted for more than 50% of the total starts in the city.

In fact, apartment construction, whether purpose-built rentals or condos, increased in each of the six markets included in the report. Such increased densification is an "important tool" for improving housing affordability, CMHC noted.

With relatively affordable home prices, the strongest total annual growth rates were seen in Calgary and Edmonton. The former saw starts rise 15.2% to 17,306, while starts in the latter increased 16.3% to 14,586. Vancouver's 25,983 starts were relatively unchanged from 2021 levels, declining just 0.1%.

In contrast, housing starts in Montreal declined 25.3% to 24,149. Although the drop seems drastic, it follows a record number of starts in 2021, and falls back in line with recent averages.

While interest rates played a heavy hand on the rate of new construction in 2022, the report cautions that the full impact of elevated rates is yet to come.

"In some centres, seasonally adjusted housing starts began moving lower at the end of 2022 and early 2023," said Francis Cortellino, Senior Specialist for housing market analysis at CMHC.

"The higher interest rate environment will likely slow construction activity in more centres in 2023."

Current financing rates may render some projects unviable, or may make construction financing harder to obtain, noted Eric Bond, Senior Specialist for housing market analysis at CMHC.

The anticipated decline in housing starts over the coming year does not bode well for Canada's already dwindling supply. With inventory at a historic low in the new home market, demand will transfer to the resale and rental markets, CMHC warned. The shift puts upward pressure on prices, further eroding affordability in Canada's largest markets.

According to CMHC, Canada needs to increase the regular rate of housing construction by 3.5M units by 2030 in order to address growing affordability challenges.