Canada’s annual rate of inflation edged up in August, driven by rising rents and costly fuel.

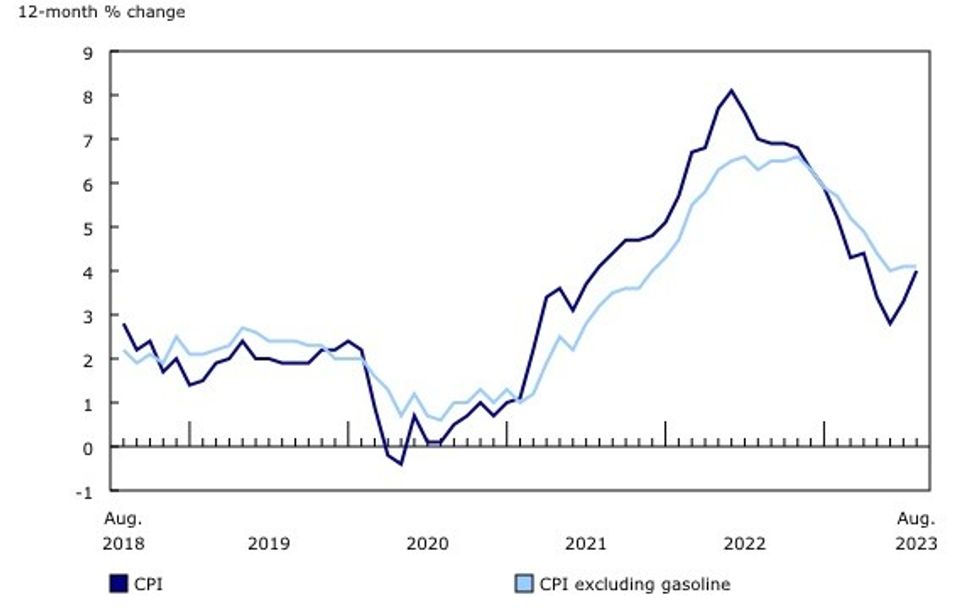

According to Statistics Canada's latest Consumer Price Index (CPI), inflation rose 4% year over year in August, up from 3.3% in July. On a monthly basis, CPI increased 0.4% in August.

A significant contributor to headline inflation was the acceleration of shelter prices, which increased 6% annually in August, following a 5.1% jump in July.

High interest rates stood in the way of homeownership for many Canadians, placing upward pressure on the rent index. As such, it rose 6.5% year over year nationally in August, on the heels of a 5.5% increase in July.

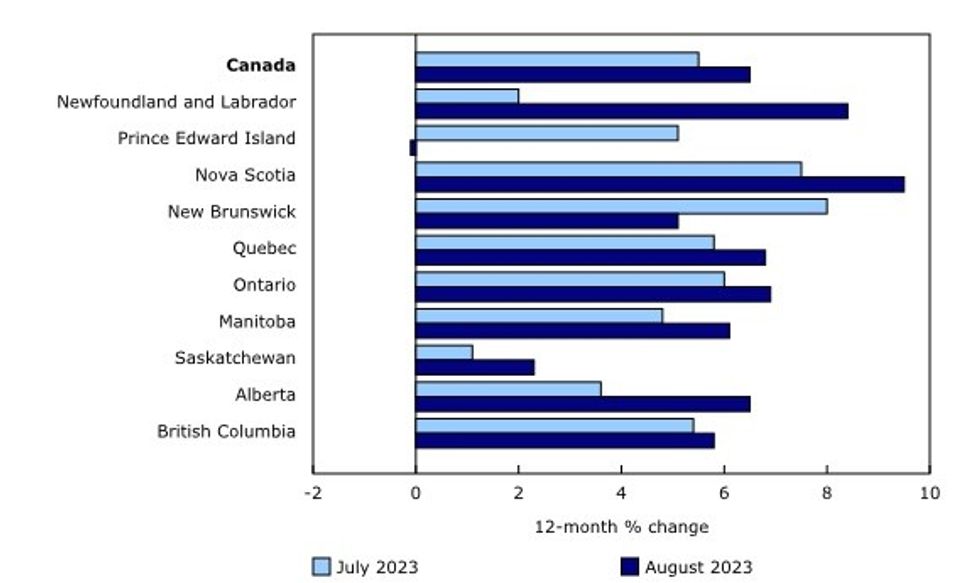

Locally, rent prices increased in eight provinces, with the fastest price growth seen in Nova Scotia (9.5%), Newfoundland and Labrador (8.4%), and Ontario (6.9%).

Meanwhile, the mortgage interest cost index rose 30.9% in August, slightly faster than July’s 30.6%, marking the sixth-straight month to register the largest increase on record.

Despite the ever-rising cost of shelter, the largest factor driving the acceleration in headline inflation in August was higher year-over-year prices for gasoline. Gas prices rose 0.8% annually — the first yearly increase since January — compared to a 12.9% drop in July.

The annual gain in gas prices was partly driven by a base-year effect; in August 2022, prices dropped 9.6% on a monthly basis amidst a higher global production of oil. But, in August 2023, gas prices increased 4.6% month over month as major oil-producing countries slashed production of crude oil.

On a provincial level, energy prices increased the most in Alberta, at 13.3% year over year. Electricity costs jumped 121.7% annually, following a 127.8% increase in July, as provincial rebates that were introduced last summer came to an end. Natural gas prices fell 12.5% year over year, a smaller decline compared to July.

Annual price growth for groceries slowed in August, rising 6.9% annually compared with an 8.5% increase in July, but costs remain elevated. On a monthly basis, prices fell 0.4%.

The deceleration was driven by a slower annual pace of growth in the price of fresh fruit (0.2%), fresh or frozen chicken (8.9%), and cereal products (9.8%), compared with July. However, Canadians paid more for coffee and tea (9%), sugar and confectionery products (10.9%), and fresh or frozen beef (11.9%) in August.