After months of speculation as to when Canada's housing market correction would run its course, it appears a cyclical bottom has been reached.

With activity ramping up and prices edging higher in markets across the country, April "pretty much sealed the deal," Robert Hogue, Assistant Chief Economist at RBC, proclaimed in a new housing market update.

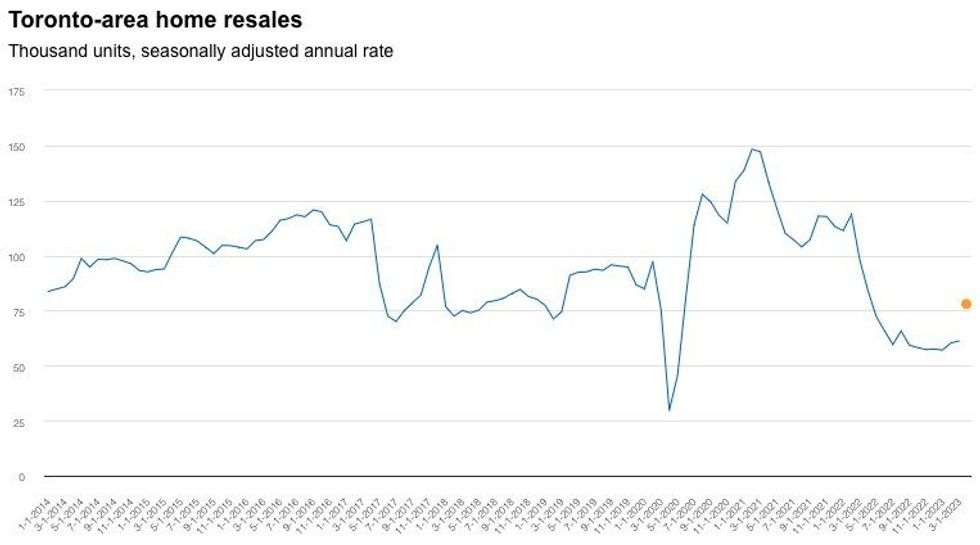

Toronto helped lead the upswing, with resales rising 27% month over month on a seasonally-adjusted basis. New listings rose just 6.5% from March, tightening demand-supply conditions for a fifth straight month and pushing the GTA's MLS HPI up 2.4% on a monthly basis.

As inventory remains low, the trajectory of the Toronto market relies heavily on sellers' return, Hogue said. It is expected, though, that the recent rise in property values will spur more listings, which in turn should keep price growth "relatively contained."

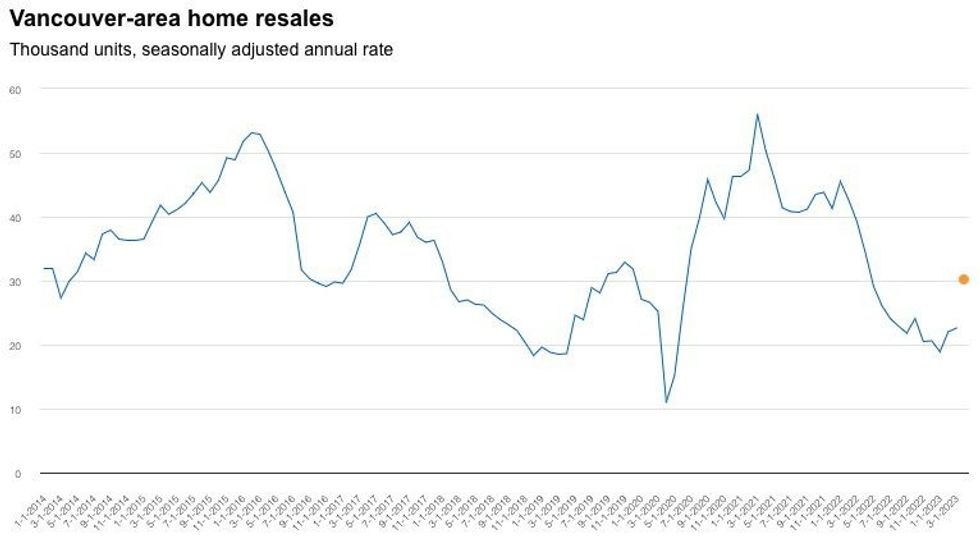

Vancouver saw a "solid" increase in activity, with resales rising an estimated 30% month over month (seasonally adjusted). As with Toronto, demand outpaced supply -- new listings rose 9% on a monthly basis, propelling the city's MLS HPI up 2.3%, the second consecutive monthly increase. Hogue predicts that prices will continue to rise, although "extremely poor affordability" will put a cap on gains.

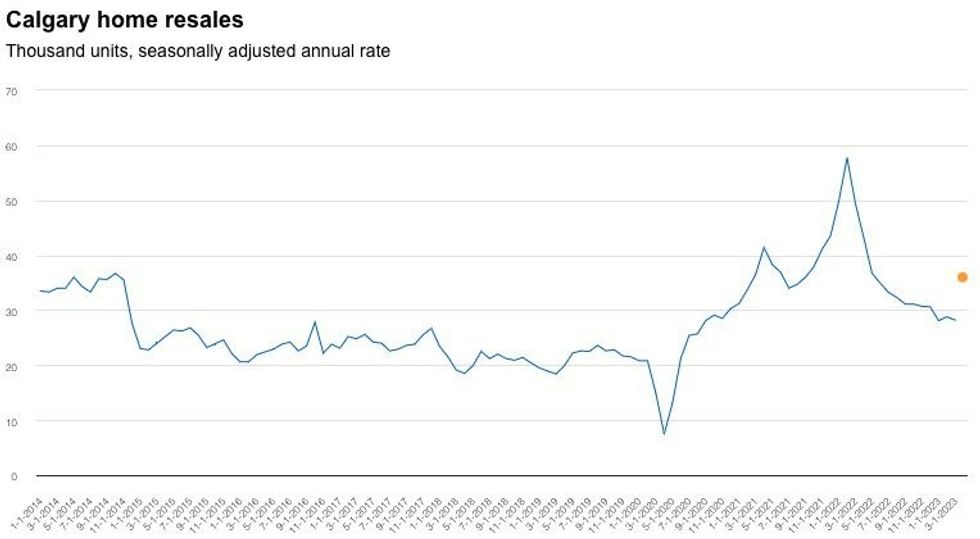

Even in Calgary, which never saw much of a downturn to begin with, conditions improved in April. Home resales jumped 28% month over month on a seasonally adjusted basis -- Hogue noted they never fell below pre-pandemic levels despite a sharp drop in activity over the last year -- while the MLS HPI was up 1.2% annually. Prices are expected to rise further as conditions have tightened over the last three months.

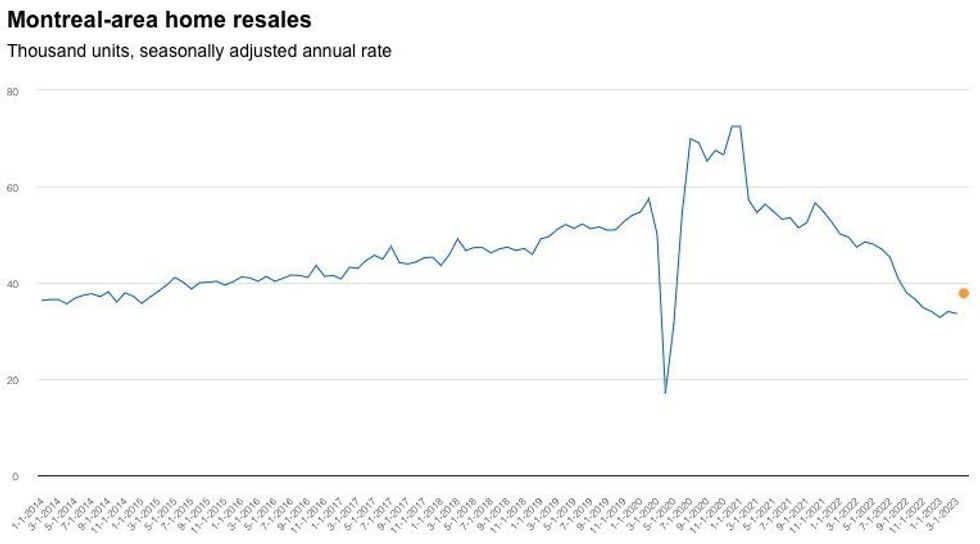

Montreal was pulled out of a "deep slumber" in April, with resales rising an estimated 12% month over month. Despite the growing perception of a bottom, sellers were more subdued which led to fiercer competition between buyers. Tight demand-supply conditions put an end to Montreal's year-long price decline in April, and should support further, albeit slight, gains.

"The coming months should be quite interesting," Hogue said.

Although buyers are still burdened by a "sharp" loss of affordability, the Bank of Canada's decision to pause rate hikes has given them more confidence in the market. The end of the price correction will also snap some into action.

Meanwhile, shifting market conditions offer a more hospitable environment for sellers, which will hopefully lead to more supply.

While rising prices and an increase in inventory would sustain, or even extend, April's gains, Hogue said the lack of affordability will continue to be a "huge issue," especially for first-time buyers, and will "significantly limit" any recovery for the time being.