The correction sweeping Canada's housing markets appears to be "broadly easing," pointing to a cyclical bottom as early as the spring in some cities.

This prediction, courtesy of a new Special Housing Report from Robert Hogue, Assistant Chief Economist at RBC, comes after a tumultuous year that saw prices and activity reach record highs before being dragged down by an onslaught of interest rate hikes.

The quiet end to 2022 gave way to a January coloured by persistently weak activity and continued price declines, and buyers across Canada are "clearly on the defensive," Hogue noted, with many still sidelined by strangled budgets and unaffordable mortgages.

Now, though, the monthly rates of decline for home resales and prices have begun to slow. The trend, along with RBC's expectation that the BoC has ended its rate hike campaign, point to a cyclical bottom around the spring or summer, although the timing will vary from market to market.

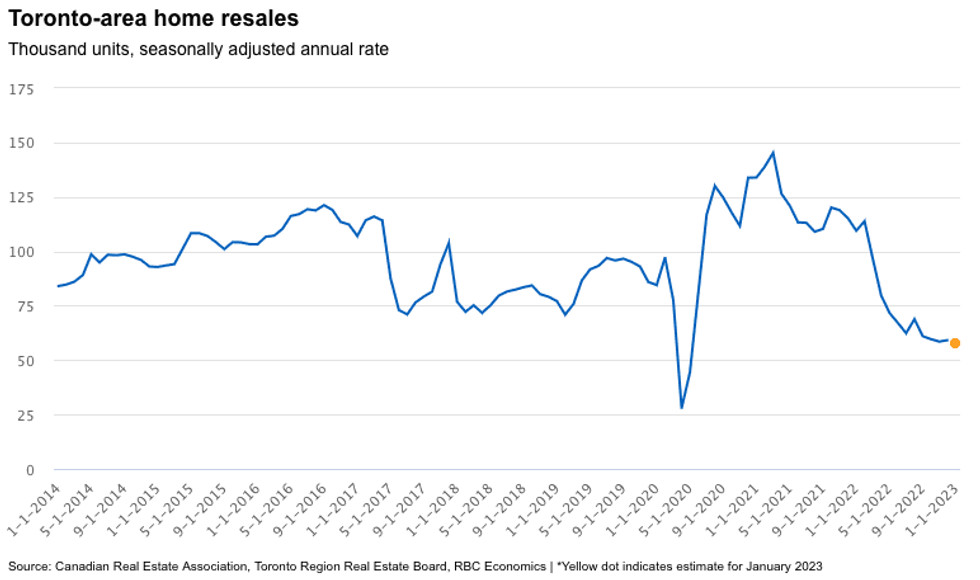

Toronto is "inching closer," with resale activity in January at its lowest level in 14 years (excluding the initial lockdown period of early 2020). However, the slide has slowed materially over the past few months, suggesting that "the cyclical bottom may be near," Hogue said. Between March and September 2022, home resales saw an average monthly drop of 8%, but that figure eased to about 1% between October and January.

The city's price correction will carry on, though. The MLS HPI has declined for 11 consecutive months, including a 0.2% drop from December to January, but has thus far reversed less than a third of the 57% gain amassed over the first two years of the pandemic.

"Affordability remains excessively stretched for most buyers," Hogue said of Toronto. "In the face of higher interest rates, we expect buyers to continue looking for more affordable options and drive down prices to fit their constrained budget."

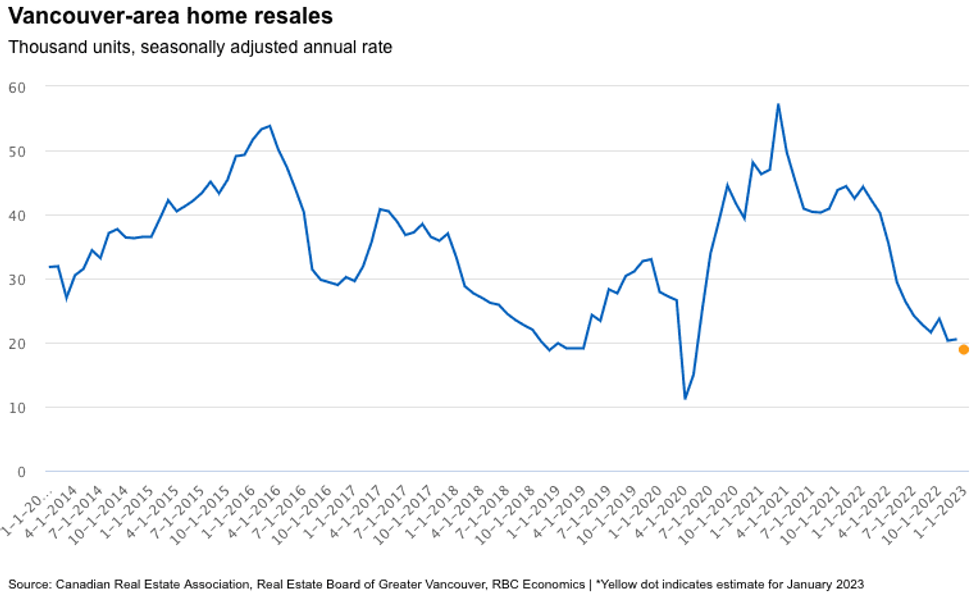

Said concessions are already occurring in Vancouver, where prices have been on a 10-month downfall. Since peaking in March 2022, the MLS HPI has fallen 12%, and further declines are required to ease the city's "extremely poor affordability conditions."

Despite a sharp increase in listings in January, resale activity in Vancouver is nearing its lowest point since the global financial crisis (again, excluding the 2020 lockdown period). Activity fell another 7% month-over-month in January, resulting in an annual decline of 55%.

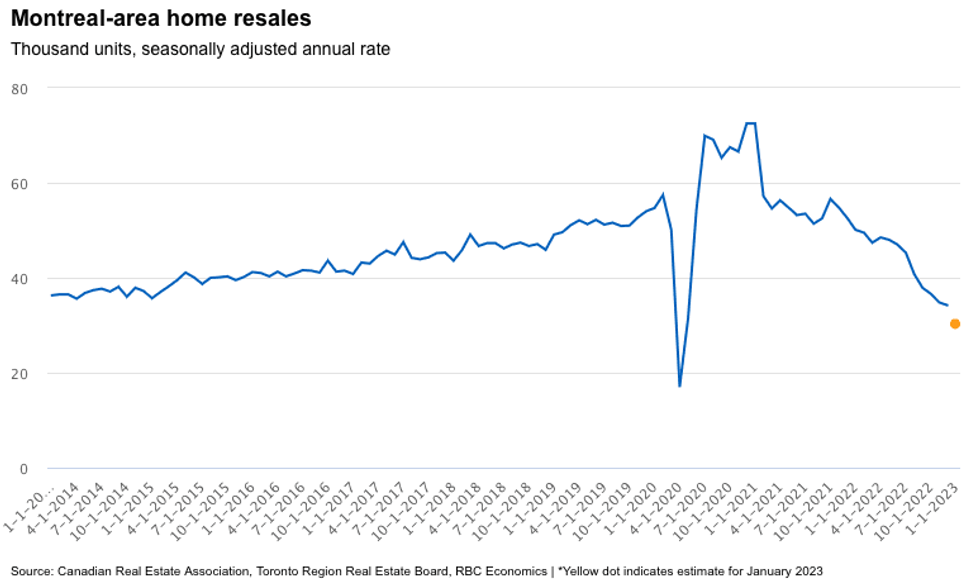

Despite initially lagging behind the aforementioned larger cities, Montreal's market slowdown has accelerated since August 2022. Declining 11% month-over-month, January resales were the softest since 2009. Since the April 2022 peak, median prices are down 10% for condos and 14% for single-family homes -- respective monthly declines of 1.3% and 2% were recorded in January -- and the erosion is expected to continue in the near-term.

"It will likely take a few more months for confidence to rebuild and market trends to stabilize," Hogue said.

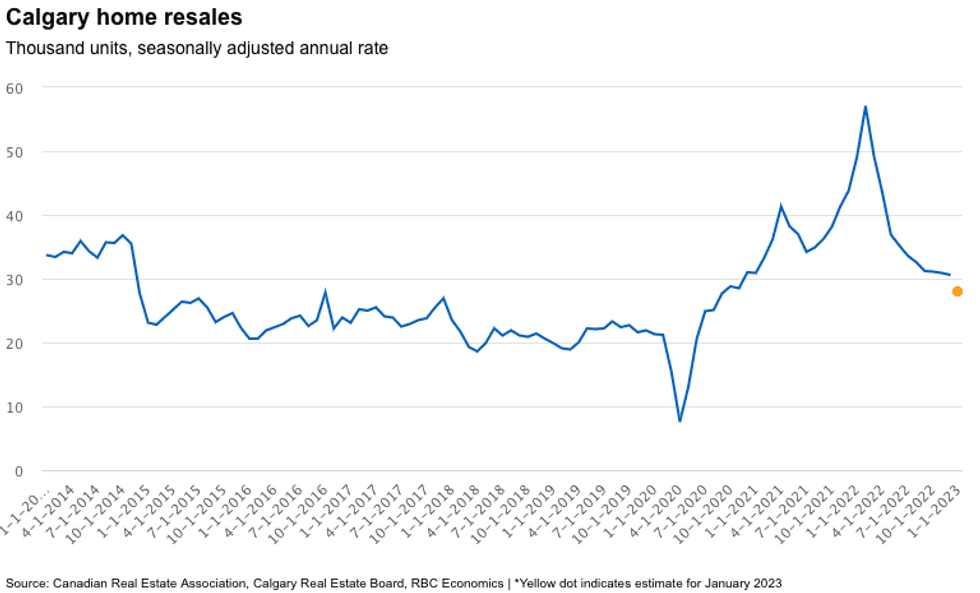

Meanwhile, Calgary finds itself in "soft landing mode" with the tightest demand-supply conditions in western Canada. Although home resales fell for the 11th straight month in January, they're still 32% above pre-pandemic levels. The 8% decline from December can be attributed to a drop in new listings.

The MLS HPI has been on a very gradual descent since May 2022, which should continue in the near-term, and remains above year-ago levels, although not for much longer, Hogue cautioned.

As cities reach their respective cyclical bottoms over the coming months, Hogue cautioned that the ensuing recovery will be "very gradual" at first.

"We expect the massive increase in interest rates will continue to hold back activity and compress purchasing budgets for some time," Hogue said.