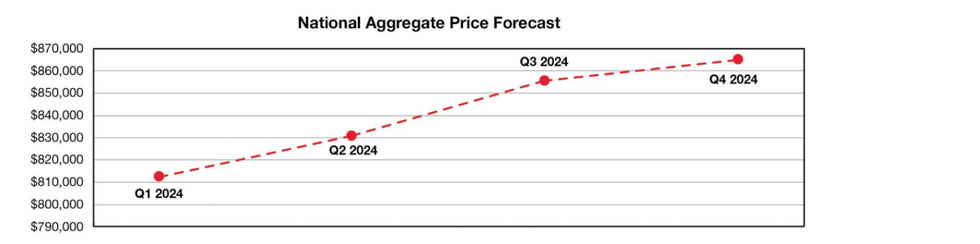

Royal LePage released its latest market forecast on Friday, and right off the top it reveals that the aggregate price of a home in Canada is expected to lift 9% year over year by the fourth quarter of 2024.

“The previous forecast has been revised upward to reflect a stronger-than-expected first quarter,” the Canadian real estate company says. “Nationally, home prices are forecast to see strong price appreciation through the second and third quarters, and taper off in the final months of the year, as is the seasonal norm.”

Royal LePage has additionally upgraded their previous forecasts in “most major markets,” with the Greater Toronto Area anticipated to see a steeper jump compared to what’s in store nationally, at 10% by the fourth quarter. Closely following the GTA is Montreal, where prices are expected to accelerate 8.5% year over year. After that, Royal LePage is forecasting that Calgary and Quebec City will see prices climb 8%, while Greater Vancouver is due to see a 5.5% jump.

“Many consumers, particularly first-time buyers, who have the capacity to transact have accepted and adapted to the higher borrowing cost environment. Thus, the modestly-rising home prices we are experiencing today,” says Royal LePage President Phil Soper in reference the fact that, as of the first quarter, the aggregate price of a home in Canada has increased 4.3% annually to $812,100.

“Once the central bank does make a move, and that first highly-anticipated cut to rates is made, even if it is only by 25 basis points, I expect we will see the price appreciation curve steepen upwards when the highly rate-focused crowd jumps into the market,” Soper adds.

Though the easing rate realities are bound to play a role in the uptick in prices, it won’t be the only factor at play. “It is the severe shortage of housing in markets small and large in virtually every part of the country that remains the main culprit,” says Soper.

He also warns that Canadian buyers and sellers are in for “a normally busy spring” and “an uncomfortably busy fall.”

“It is clear we are rapidly transitioning away from a buyers’ market and back to an environment where the seller has the upper hand,” he adds.

Looking forward a couple of years, Royal LePage's forecast notes that “almost all mortgages taken out before the Bank of Canada started raising its key lending rate in March of 2022, will have transitioned through a renewal cycle and into an elevated borrowing rate environment” by the end of 2026.

But that isn’t expected to be a “material drag” on Canadian housing, Soper says.

“Two years into the post-pandemic period, about half of mortgages have rolled off those record lows, and Canadians continue to meet obligations to their lenders, with the national mortgage default rate remaining at near historic lows,” he explains. “Further, income growth and the period of flat home prices have helped to mitigate the impact of increased mortgage costs. People will go to great lengths to hang onto their homes, so we can expect a pull-back in discretionary spending, including on travel and entertainment.”