With help from the Bank of Canada, some of the steam has been taken out of home prices this year. That said, the price decline has been modest, and more of the same is anticipated for 2023.

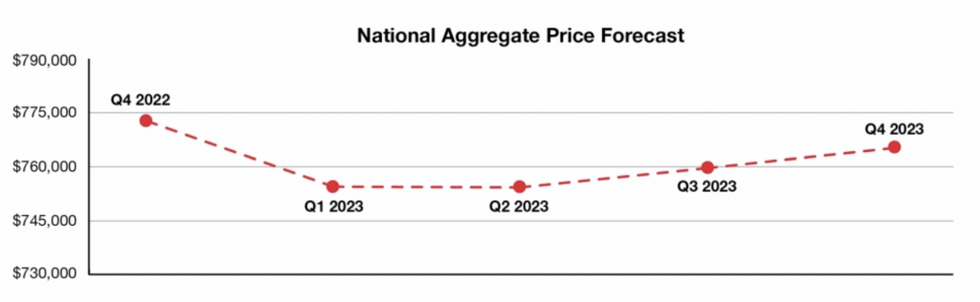

This is according to the Royal LePage Market Survey Forecast, released today, which estimates that the aggregate price of a home in Canada will decrease a mere 1% year over year in the fourth quarter of 2023, putting it at $765,171. Single-family detached properties and condominiums are projected to fall 2% and 1% to $781,256 and $568,933, respectively.

“After nearly two years of record price appreciation, fueled by a steep climb in household savings, very low borrowing costs and an overwhelming desire for more space during the COVID-19 pandemic, the frenzied housing market overshot and the inevitable downward slide or market correction began, intensified by rapidly rising borrowing rates,” said Phil Soper, President and CEO of Royal LePage. “In an era characterized by the unusual, this correction has not followed historical patterns. While the volume of homes trading hands has dropped steeply, home prices have held on, with relatively modest declines. We see this as a continuing trend.”

Soper goes on to say that, while the interest rate hikes were expected to temper prices, as they historically have, not enough focus has been directed at the factors that are keeping prices high.

Low housing inventory has kept demand steady. And while new supply is plainly needed, very little has materialized. On top of that, demand for smaller household sizes, such as condos, means that more housing units are needed per capita than in the past.

There is also Canada’s near-record-low unemployment rate to consider -- in November, it dropped to 5.1%, down 1.92% month over month and 16.39% from the year prior -- which is atypical of a market downturn.

“Traditional wisdom says that a recession triggers widespread job losses and missed mortgage payments. People are forced to sell or the bank forecloses and lists the property, flooding the market with new listings when demand is weak. In this post-pandemic period, people have kept their jobs. In fact, they have seen wages and salaries rise,” said Soper. “We simply don’t see the factors at play that would result in a large drop in home values.”

Royal LePage forecasts that, year over year, prices will be down 12% in Q1, 7.5% in Q2, 2% in Q3, and just 1% in Q4.

“Comparing prices to the previous year, the first quarter of 2023 should show the deepest decline in home values,” continued Soper. “At that time, we will be comparing 2022’s final weeks of pandemic housing market excess – when home prices reached historically high levels – to a much quieter market, where values have had a full year to moderate. We expect year-over-year comparisons to show progressively less price decline as the year goes on, with small week-to-week improvements in the third and fourth quarters, allowing Canadian home values to end 2023 essentially flat to where we are today.”