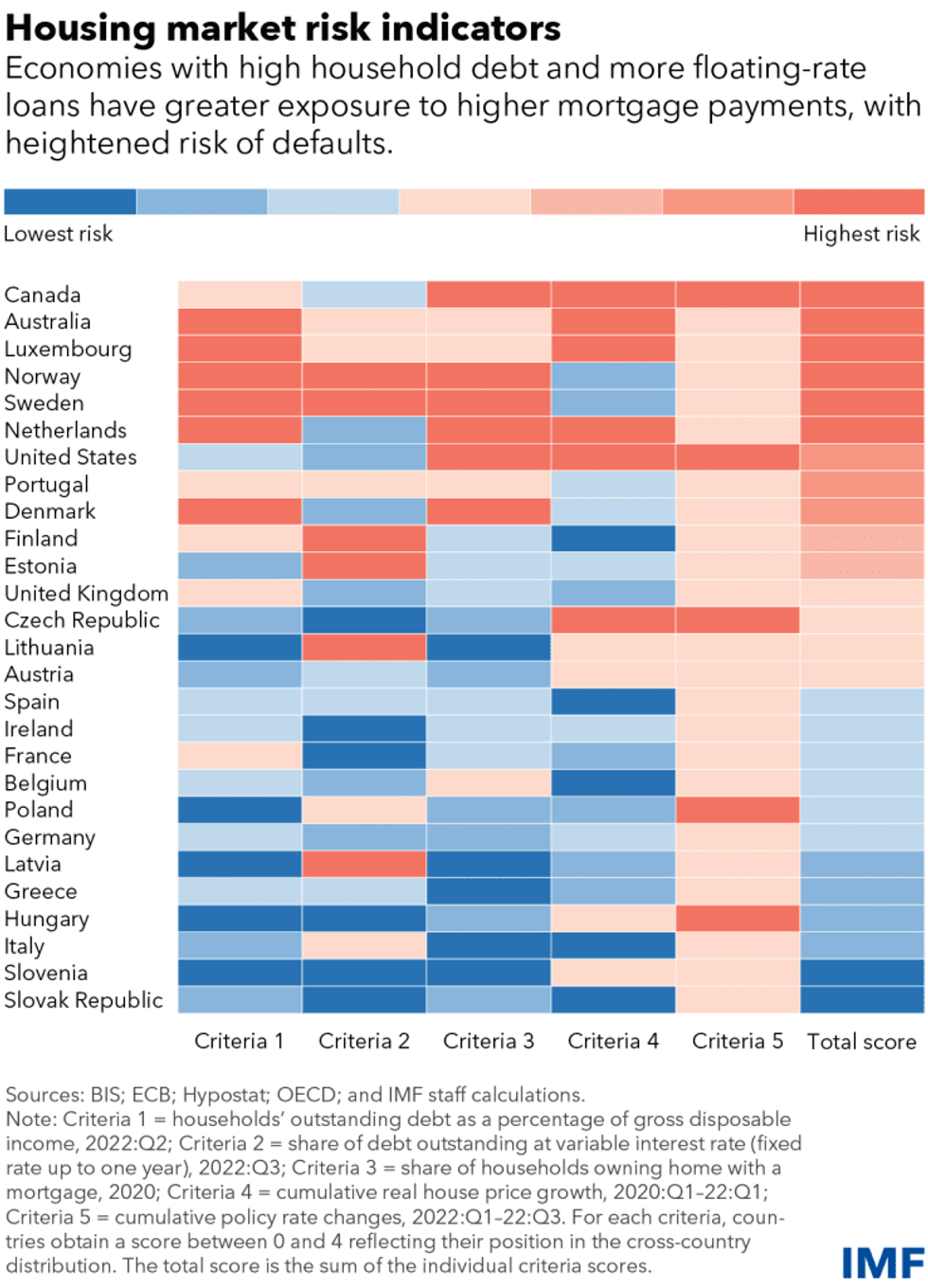

Canada topped a list of countries most at risk of mortgage defaults in a new report from the United Nation's International Monetary Fund (IMF).

Using data from the Organisation for Economic Co-operation and Development, IMF analyzed the mortgage default risk faced by 38 "mostly advanced economies" based on five criteria: households' outstanding debt as a percentage of gross disposable income; share of debt outstanding at a variable interest rate; share of households owning a home with a mortgage; cumulative real house price growth; and cumulative policy rate changes.

Canada was ranked as having the highest risk level on the latter three categories, with a medium risk level on outstanding debt as a percentage of disposable income and a medium-low risk on share of debt outstanding at a variable interest rate.

"As the [chart] shows, countries with high levels of household debt and a large share of borrowing issued at floating rates are more exposed to higher mortgage payments resulting in a higher risk of defaults," IMF said.

Canada was joined in its high-risk rank by Australia, Luxembourg, Norway, Sweden, and the Netherlands.

IMF notes that in countries where housing prices grew rapidly — which Canada certainly saw in 2021 and early 2022 — “price declines in the runup to the current monetary policy tightening cycle could improve affordability.” Unfortunately, as Canadians know all too well, that doesn’t seem to be playing out here as high real estate costs and pricey mortgage payments continue to limit homebuyers.

The report also notes that although the average household debt-to-income ratio across countries is about the same as in 2007, there are important conditions that are different between now and the global financial crisis.

“In most cases, while it is unlikely that falling home prices will spark a financial crisis, a sharp drop in house prices could dim the economic outlook. And the build-up of vulnerabilities warrants close monitoring in coming years — and possibly even intervention by policymakers,” IMF says. “Banks are better capitalized than before the global financial crisis, and underwriting standards in many advanced economies are tighter today than before the crisis.