We're halfway through 2025 and so much has happened that has created so much uncertainty that the Calgary Real Estate Board (CREB) is now downgrading its forecast for the year, according to a market update published earlier this week.

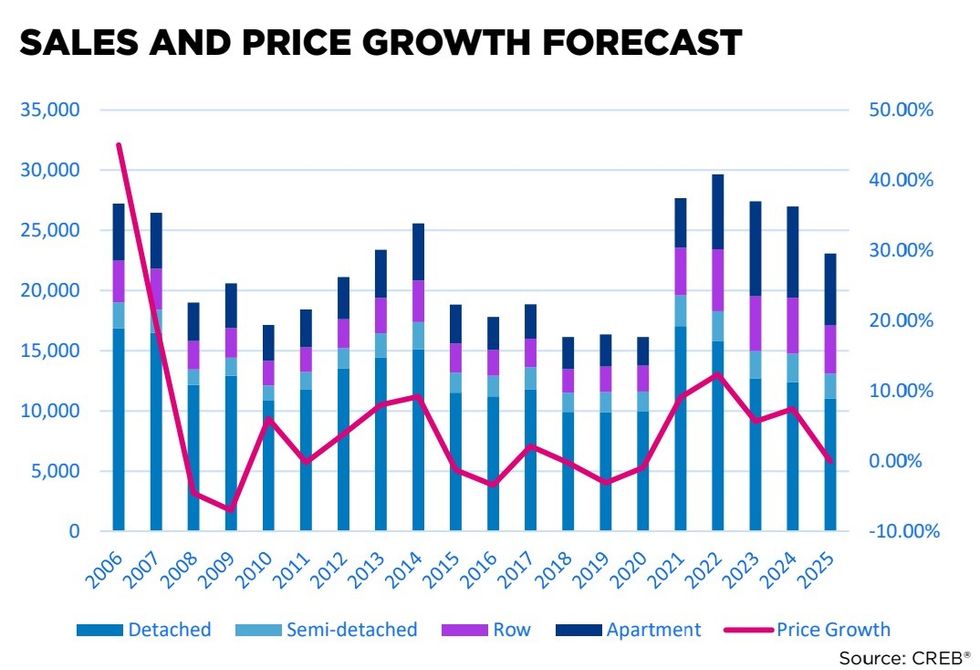

In January, the CREB published its forecast for the year, projecting that sales were expected to remain strong and exceed 26,000 units in 2025 — 20% higher than long-term trends.

"While we anticipate stable sales levels overall, market dynamics will shift as rental rate adjustments and supply improvements influence different segments of the housing market," said CREB Chief Economist Ann-Marie Lurie. "While the market is expected to be more balanced than in recent years, significant economic risks — such as potential tariffs — could impact activity. These risks will be crucial to watch as we navigate through 2025."

The latter has turned out to be prescient, as the market update published this week has reduced the projected number to about 23,000 as a result of the uncertainty created by the tariffs. The new forecast represents a downgrade of approximately 11.5%, although it should be noted that the projected decline is starting from a very high peak.

"Sales in Calgary were forecasted to ease slightly in 2025," said the CREB. "However, the heightened uncertainty throughout the spring months is expected to result in a higher than expected decline in annual sales. While sales are not expected to ease to the lower levels reported during the 2015-2020 period, sales are expected to slow to levels more consistent with long-term trends."

At the same time, housing starts are still at record highs and that is not expected to change in the second half of the year, with most of the supply coming in the form of multi-family rental buildings. The CREB says that this new supply will provide more options for renters, potential buyers, and existing homeowners, indirectly resulting in an increase in supply in the resale market.

With inventory expected to increase and sales projected to decline, prices are thus now being projected to cool off rather than see the modest growth that was projected at the outset of the year, with some nuance depending on the residential property type. The CREB says that this is expected to bring the resale market to more a balance compared to the "extreme seller's market" seen in the past two years.

Acccording to the CREB's forecast, prices are expected to grow by less than 2% for detached homes and semi-detached homes, after seeing jumps of over 10% in 2024, while prices are expected to decline by up to 2% for row houses and apartments, after seeing jumps of over 14% in 2024.

The biggest cause of the economic certainty remains the tariffs and trade war initiated by US President Donald Trump, according to the CREB. However, as is the case with other markets, the effect is not necessarily the direct impact of tariffs on the resale market and more so that the tariffs create concerns that result in reduced spending.

"While much of the most punitive tariffs on Canada have been on aluminum and steel, rising global tariffs have elevated uncertainty regarding energy prices, the impact on inflation and the overall economy," said the CREB. "Alberta is expected to lead the country in growth this year, as we are not facing the same near-term challenges experienced in provinces that are more directly impacted by the tariffs. However, we are not immune to the volatility facing the global economy, which is impacting oil prices, creating uncertainty and affecting consumer and business investment."

"Trade and economic uncertainty has contributed to slower sales in many housing markets across the country, including Calgary," the board added. "Here, earlier declines in energy prices combined with uncertainty regarding energy policies and a pause in rate declines likely also contributed to some of the stronger than expected pullback in activity in the early spring market. However, supportive population growth along with previous gains, resiliency in our job market and lower lending rates in the second half of the year should help offset some of the impact on demand felt throughout the spring."