Buyer Representation Agreement

Learn what a Buyer Representation Agreement (BRA) is in Canadian real estate, what it includes, and why it's important for homebuyers seeking professional representation.

May 22, 2025

What is a Buyer Representation Agreement?

A Buyer Representation Agreement (BRA) is a legal contract between a homebuyer and a real estate brokerage that outlines the terms of the agency relationship, including services provided, obligations, and compensation.

Why Buyer Representation Agreements Matter in Real Estate

In Canadian real estate, a BRA formalizes the relationship between a buyer and their agent. By signing the agreement, the buyer authorizes the agent to represent their interests in property searches, negotiations, and transactions. It also ensures the agent owes fiduciary duties to the buyer, including loyalty, full disclosure, confidentiality, and accountability.

The agreement typically includes the duration of the contract, the geographic area where the agent will assist, the type of property sought, and how the agent will be compensated (usually through commission paid by the seller). In some cases, if a seller’s commission does not cover the full amount agreed upon in the BRA, the buyer may be responsible for the difference.

A BRA benefits buyers by ensuring dedicated representation and clarity about expectations. It also protects brokerages by preventing clients from working with multiple agents simultaneously. While not mandatory in all provinces, BRAs are strongly encouraged to solidify commitment and transparency between both parties.

It’s important for buyers to review the terms carefully before signing, especially with regard to termination clauses, exclusivity, and compensation. If issues arise, the agreement outlines a framework for resolving disputes.

Example of a Buyer Representation Agreement

A buyer signs a 90-day BRA with a licensed agent in Vancouver. During this time, the agent helps them find listings, book viewings, and submit offers. The buyer cannot work with another agent in the defined area unless the agreement is terminated.

Key Takeaways

- Formalizes the relationship between a buyer and their real estate agent.

- Outlines agent duties, service areas, and commission terms.

- Provides legal protection and accountability for both parties.

- Typically exclusive and time-bound.

- Buyers should understand compensation and termination terms before signing.

Related Terms

Buyer’s Agent- Agreement of Purchase and Sale

- Dual Agency

- Firm Offer

- Exclusive Listing Agreement

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

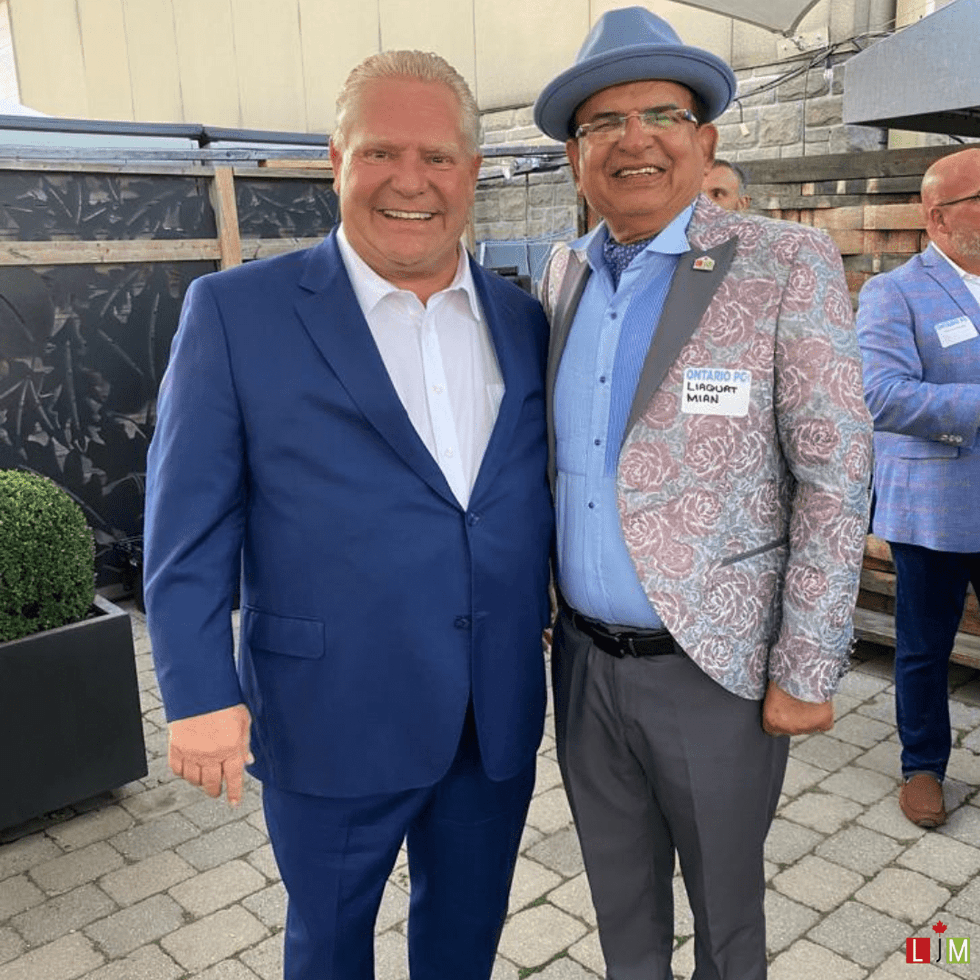

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)