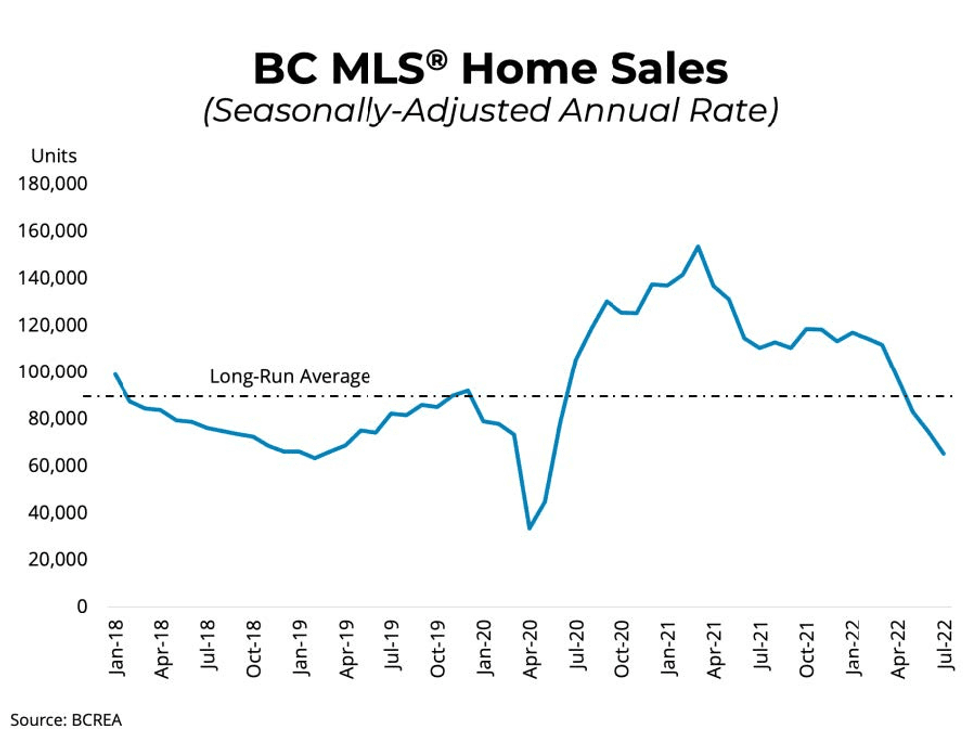

The British Columbia (BC) real estate market has seen a cooling as of late, as a sense of calm rolled in with the summer weather.

The notoriously pricey province’s home sales continued to slow for the month of July. Properties are now staying on the market longer after a red-hot run that began shortly after the onset of COVID-19.

The British Columbia Real Estate Association (BCREA) reports that a total of 5,572 residential unit sales were recorded by the Multiple Listing Service® (MLS®) in July 2022, a decrease of 42.45% from July 2021. The average MLS® residential price in BC was $923,449, a 3.6% increase from $891,376 recorded in July 2021. Total sales dollar volume was $5.1 billion, a 40.3% decline from the same time last year.

BCREA points to how high mortgage rates across the country continue to impact BC’s home sales in recent months. Most recently, the Bank of Canada hiked its rates a shocking 100 basis points in July.

“High mortgage rates continued to lower sales activity in July,” said BCREA Chief Economist Brendon Ogmundson in the report. “Many regions around the province have seen sales slip to levels well below normal for this time of year.”

As the pace of sales activity declines below normal levels, inventory is accumulating in BC. Provincial active listings rose 28% year over year, though from a very low level in July 2021. Inventories remain quite low, but the slow pace of sales has tipped some markets into balanced or even buyers’ market territory, says BCREA.

Year-to-date, BC residential sales dollar volume was down 20% from the same period in 2021 to $58.7B. Residential unit sales were down 29.3% to 56,801 units.

Despite the cooling of the BC market, homes still cost a pretty penny in the scenic province. Year-to-date, the average MLS® residential price was up 13.2% from 2021 to $1.03M.