After real estate developer Coromandel Properties filed for creditor protection under the Companies' Creditors Arrangement Act in February 2023, and then abruptly exited that protection the following month, almost all of its former assets have been the subject of receivership or foreclosure proceedings.

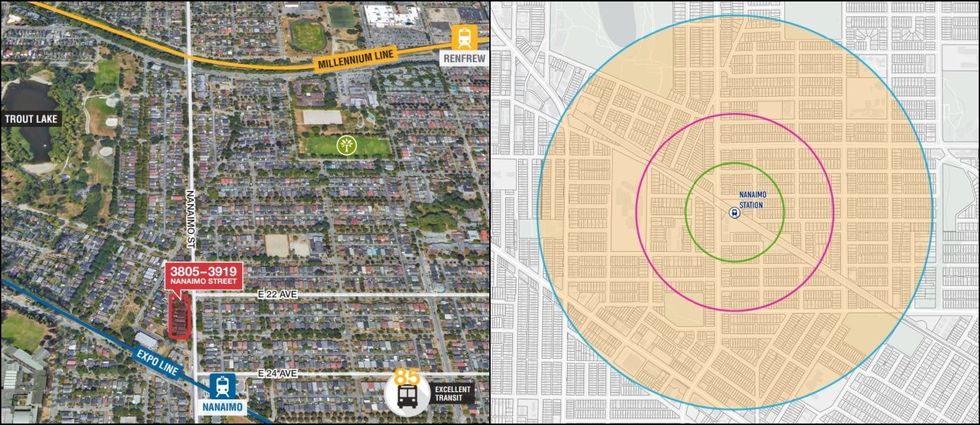

One of these properties was an 11-parcel land assembly — 3805, 3815, 3825, 3835, 3845, 3855, 3863, 3883, 3893, 3909, 3919 Nanaimo Street — in East Vancouver, just one block north from the Expo Line SkyTrain's Nanaimo Station.

The property was publicly reported as sold earlier this year, but the buyer was not disclosed. According to filings in the Supreme Court of British Columbia obtained by STOREYS, the buyer was the BC Transportation Financing Authority (BCTFA), a Crown corporation that was established in 1993 whose mandate is "to plan, acquire, construct, hold, improve, or operate transportation infrastructure throughout BC," according to its website.

"This court-ordered sale presented an opportunity for the province to acquire land with potential use as part of a future transit-oriented development," said the Ministry of Transportation and Infrastructure in a statement provided to STOREYS. "The Province will have to work with the city and other partners for future planning and development of the site."

The Foreclosure Proceedings

The foreclosure proceedings were initiated by Richmond-based Accountable Mortgage Investment Corp in February 2023, shortly after Coromandel Properties filed its petition to the court seeking creditor protection, with a claim that Coromandel owed $15,200,404 as of February 24, 2023, with interest accumulating at a daily rate of $7,408.

Accountable Mortgage Investment Corp's security was second-ranking, however, to Blueshore Financial Credit Union, who was claiming that Coromandel owed them $5,705,684 and $5,503,364 across two different first-ranking mortgages tied to the Nanaimo Street properties that were in default.

In late July, Accountable was able to obtain both an order nisi confirming the debt they were owed and an order for conduct of sale allowing them to sell the property to recover the debt.

Sam Nakhleh of NAI Commercial was retained to list, market, and sell the property. The property was listed for $30M in early August — in line with an appraisal given by Saran Appraisals & Consulting on March 8, 2023 — before being reduced to $27M in early September. The purchase and sale agreement with the BC Transportation Financing Authority — for $22,500,000 — was reached on October 4, approved by the Supreme Court on November 16, and closed on November 27, with the BCTFA taking possession of the property on November 29.

The proceeds of the sale first went towards paying off any arrears, commission to NAI Commercial, and GST, before first going to Blueshore and finally Accountable.

The Property and Bill 47

The final $22.5M sale price that was achieved appears to be higher than its BC Assessment valuations, which values each of the 11 parcels — currently occupied by single-family homes — at between $1.6M and $2M, for a total of $19,970,400. (The total was $18,759,100 based on 2023 assessments.)

According to Coromandel Properties' February 2023 petition seeking creditor protection, the company acquired the 11 parcels between 2016 and 2022 for a total of approximately $29.6M. Coromandel also said it received a $42.9M appraisal for the land assembly on January 17, 2022. Coromandel did not have any concrete plans for the site at the time and was holding on to the properties in hopes that increased density would one day be allowed due to the site's proximity to a SkyTrain station.

That day would come too late, in the fall, when the provincial government introduced Bill 47, the Housing Statutes (Transit-Oriented Areas) Amendment Act, which ended up factoring into the foreclosure proceedings.

On November 15, the day before the court was set to approve the sale to the BCTFA, Junchao Mo, who served as a guarantor for most of Coromandel's mortgages, objected to the sale saying that — at that point — only eight days had passed since the Province introduced the new legislation and that "more time is necessary for the market to absorb the news regarding Bill 47 and the proposed zoning changes."

"Bill 47 contemplates establishing a minimum allowable density of 5.0 FSR and a minimum allowable height of up to 20 stories for properties coming under the TOA Type 1A designation, under which the [3805-3919 Nanaimo Street property] will fall," Mo said. Based on the Province's TOA maps, a small portion of the property falls within 200 m of the station, allowing for the minimum Mo mentioned, but most of the property falls within 201-400 m of Nanaimo Station, which allows for a minimum density of 4.0 FSR and minimum height of 12 storeys.

Mo also submitted an opinion letter from Colliers' Hart Buck — who would later go on to handle the court-ordered sales of numerous other Coromandel sites — that recommended additional market exposure in order for potential buyers to absorb the new provincial legislation.

In an oral reasons for judgement, Justice Robertson said that Mo's belief "is speculative at best" and that there "is no indication that it will be passed into law or how long that will take." At that moment in time, Bill 47 had only reached the first reading stage, but there was never really any doubt that the legislation would pass.

"In the circumstances of this case, the evidence shows that there was media attention to the legislation prior to this application," the Justice concluded. "The argument is that anybody, including the 16 parties who had access to the data room and were specifically interested in this property would be aware of Bill 47. If the value of the property had increased between then and now as a result of Bill 47 receiving first reading those parties would have participated in the bid process."

Justice Robertson also noted that the $22.5M sale price would result in a "shortfall" for Accountable and that the shortfall could continue to grow as a result of interest, which was accumulating at about $3,000 a day.

"Circumstances do often change between the offer being accepted and the application being brought," the Justice added. "For example, and relevant in today's financial climate, interest rates change. An interest rate could decrease between offer acceptance and court approval, which means that the buying public may be able to afford a higher price. However, based on the continued exposure to the market from the time of acceptance to court approval, it would be reasonable that such changes would be taken into account by virtue of the competing bid process. [...] In short, anybody that would wish to capitalize on the speculation that Bill 47 may make development more lucrative, was able and could have come to this Court and submitted a competing bid."

The Supreme Court ultimately approved the sale, resulting in the Province potentially getting a good deal for the property. This is the second instance of a government entity making a bid for a foreclosed Coromandel Properties site. That other instance, coincidentally, was for a different land assembly also near Nanaimo Station — to the south — and saw the City of Vancouver end up in a bidding war for the 2415 -2483 East 26th Avenue property, which it ultimately lost.

Editor's Note: This article has been updated to include a statement provided by the Ministry of Transportation and Infrastructure.

- Foreclosed Coromandel Site On Cambie To Be Sold For $26M After $69M Appraisal ›

- Vancouver Kilborn Building To Be Sold In Foreclosure Proceedings Over $93M Debt ›

- Inside The Mass Exodus At Coromandel Properties ›

- Foreclosed Coromandel Properties Site In Cambie Corridor Sold For $11.2M ›

- BC Housing Granted Foreclosure Of Affordable Housing Project ›

- BC Gov Buys Former ICBC HQ In North Vancouver For TOD Project ›

- Conwest Proposing 24-Storey Tower In East Van, Their First Residential High-Rise ›

- City Of Richmond Pays $68M For Industrial Property Valued At $32M ›