On Monday, the Government of British Columbia, through BC Housing, unveiled the details of its Secondary Suite Incentive Program, which it hopes will quickly add a new influx of housing to the province.

Homeowners who qualify will be eligible to receive up to 50% of the construction cost for the necessary renovations, up to a maximum of $40,000, which will be a rebate administered as a forgivable loan that does not need to be repaid. The minimum loan amount is $10,000, which means the cost of creating a secondary suite must be at least $20,000.

To qualify, applicants have to be the registered owner of the property, a Canadian citizen or permanent resident, and use the property as their primary residence. All of the homeowners on the title have to have a combined gross annual income of less than $209,420.

The home itself also has to have a BC Assessment value below the Province's homeowner grant threshold, which is $2,125,000 for 2023.

BC Housing will begin accepting applications in April 2024 on a first-come-first-served basis, but homeowners can begin the process of planning and acquiring a building permit before then, so long as the building permit is dated on or after April 1, 2023.

The Province is allocating a total of $40M for the Secondary Suite Incentive Program, which means at least 1,000 applications will be accepted, and the program applies to basement suites, garden suites, and laneway homes.

Once the application is approved, homeowners must complete construction and then secure an occupancy permit from their municipal government before submitting the occupancy permit and proof of construction costs to the Province in order to receive the rebate.

Construction costs that can be covered include those associated with architectural and design, structural modification, electrical work, fixtures, appliances (50% of the actual cost to a maximum of $2,500), building and trade permits, obtaining certificates, drawings and specifications directly related to the eligible scope of work, materials, contractor labour (not including work done by the applicant or any member of the household), and taxes.

Extensions, conversions, and repair or replacement of items for the homeowners will not be covered. Landscaping costs and any work completed by the homeowner will also not be eligible

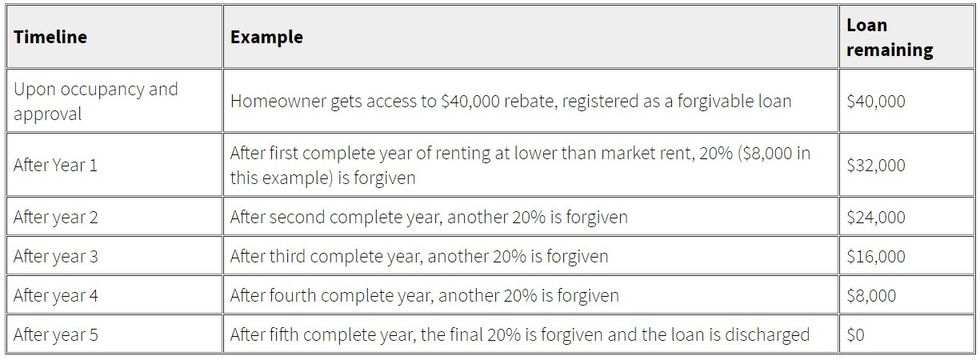

Following construction completion, homeowners are then required to rent out the secondary suite for a minimum of five years, with the loan being forgiven at 20% per year for that duration to ensure compliance.

Additionally, the secondary suite has to have been rented for at least 10 months in the preceding year, under a tenancy that complies with BC's Residential Tenancy Act on a month-to-month or one-year fixed-term basis — not a short-term rental.

If any of the above requirements are broken before the five years, including selling the property, then homeowners will be required to repay the outstanding amount on the loan, with interest.

The new secondary suite must have a kitchen and a full bathroom, and has to be rented out at or below limits that BC Housing sets annually, but that cap is lifted after the five years.

The tenant also cannot be an immediate family member (child, parent, sibling) of the homeowner.

To assist homeowners who are interested in the Secondary Suite Incentive Program, the Province has also published a "Home Suite Home" guide to help homeowners through the secondary suite creation process.