As of Tuesday morning, property assessments for BC homeowners are in the mail, and homeowners can expect to receive them in the coming days. But before anyone get's too excited, there are a few important things to know about these assessments.

As assessments will note, the value listed reflects the valuation of a property as of July 1, 2022, not January 1, 2023. That was half a year ago, and a lot can -- and has -- happened in that time.

"Since July 1, we know that the real estate market has changed as interest rates continue to rise and overall sales volume has declined," BC Assessment Assessor Bryan Murao said in last month's preview of the assessments. "As a result, your next property assessment will likely be higher than what the current market value might be,but that will be the same for everyone."

Murao noted that again on Tuesday, but added that "despite the real estate market peaking last spring and showing signs of cooling down by summer, homes were still selling notably higher around July 1, 2022 compared to the previous year." He says homeowners can expect about a 10% increase in value in Greater Vancouver and about a 15% increase in the Fraser Valley, but the key phrase here is compared to the previous year, which is technically referring to July 1, 2021.

This begs the question: if it's almost a given that property valuations go up every year, and the values are simultaneously fairly dated, what purpose do they serve?

Property Assessments and Property Taxes

The first thing to know is that the property assessments BC Assessment generates are really not for individual homeowners. Though homeowners are sent assessment notices, they are generated primarily for tax jurisdictions, such as "municipal governments, regional districts, and Ministries of Education and Health," according to BC Assessment.

Independent of BC Assessment, those entities then use the assessments as the foundation for dividing up and levying property taxes in order to fund services for their respective communities.

Property valuations are determined by numerous factors, including but not limited to: size, age, quality, location, present use, property type, and land value, but an increase in your property's value is not a guarantee that you will be paying more in property taxes.

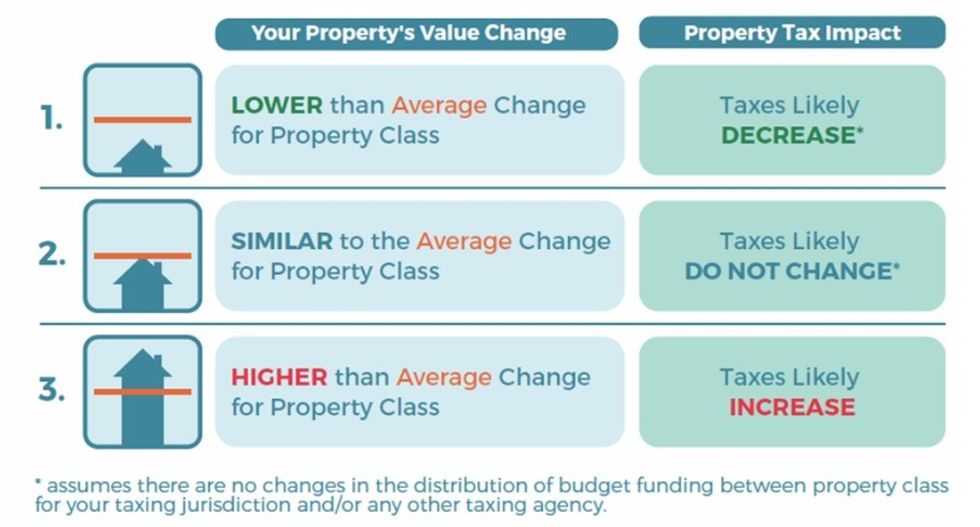

"It is important to understand that changes in property assessments do not automatically translate into a corresponding change in property taxes," BC Assessment Assessor Bryan Murao said in a press release on Tuesday. "As noted on your Assessment Notice, how your assessment changes relative to the average change in your community is what may affect your property taxes."

As mentioned, your latest property assessment has likely gone up compared to the previous one. However, all your neighbours likely saw theirs go up, too, which means the amount of property taxes you pay will very likely not change based on the increased assessment value alone. (But it could change as a result of your municipality changing their tax rate.)

A scenario where the amount of property taxes you have to pay would be increased is if, for example, you live in a townhouse and your property value has increased by an amount higher than the average for townhouses in your region.

Property Assessments and Market Value

For those who are thinking about being active in the real estate market, seeing a government valuation (BC Assessment is a Crown corporation) of your property may naturally result in you thinking that your valuation is what you'd get -- perhaps at the very least -- if you put your house on the market. Not so fast, though.

A small snapshot of how the market has changed since the summer: in August, the Real Estate Board of Greater Vancouver (REBGV) registered 1,870 residential sales, while in December, they recorded nearly one-third fewer sales with a total of 1,295. In terms of prices, the benchmark prices for all residential properties in August was $1,180,500, but dropped to $1,114,300 in December. (Interest rates increased from 2.5% to 4.25% in that same span.)

Even putting aside the fact that market conditions have changed, it's generally not recommended to use your BC Assessment as a measure of market value.

"A lot of people don't understand the purpose of BC Assessment," Kevin O’Toole, a Vancouver-based Managing Broker at Sotheby’s International Realty Canada tells STOREYS. "It's more for municipalities and how they will divide property taxes among municipalities. Whether your value goes up or down, it rarely affects property taxes [and] I would never use it to gauge market value. It's not intended for market use."

"The valuation means very little," O'Toole added. "Almost nothing."

Asked whether this is because of how BC Assessment goes about the assessments, or whether it's because the assessments are dated to July 1, O'Toole says it's a bit of both and that even if BC Assessment assessed your property today, it may not be accurate.

Anecdotally, O'Toole -- who has been a realtor in Vancouver for over 15 years -- says he has seen BC Assessment assess a home that was sold on July 1, at a different price then what it actually sold for.

None of this is to disparage BC Assessment, as he says assessors for BC Assessment do the best they can, but are generally just not on the ground and often don't look at certain factors that can affect market value, such as presentation and staging.

So, how should homeowners take their assessments? Are they of any use?

O'Toole says that the assessments are "a snapshot of a moment in time." Where they could possibly be of use to homeowners, he says, is if homeowners looked at the trajectory of the property's valuation over a number of years, which could provide a better picture of equity. (The BC Assessment values are also directly used to determine whether homeowners are eligible for the Province's Home Owner Grant.)

If you're thinking about putting your property on the market and want to get a valuation, O'Toole says, it's still best to bring in a realtor or property appraiser.

And for those worried about the assessments impacting their property taxes, O'Toole points out BC Assessment's appeal process, but notes that the deadline -- Tuesday, January 31 -- is quickly approaching. It may seem like an arduous process, but O'Toole says he has been involved with appeals and has seen some successful ones.