A residential redevelopment opportunity is up for grabs in North York — if you have nearly $19M to spare, that is.

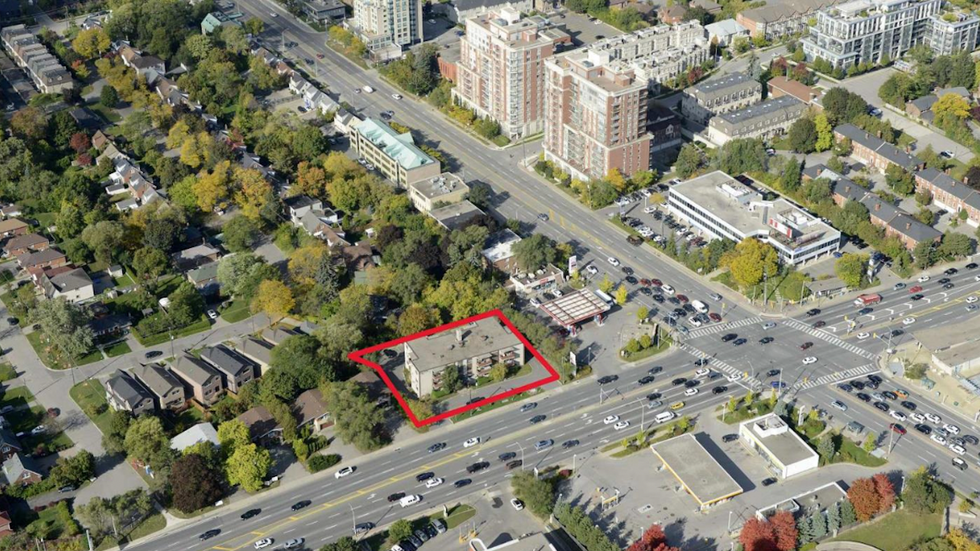

At the end of last week, a 0.55-acre site at 2818 Bayview Avenue hit the market under a power of sale. According to the listing, which is being handled by Cushman & Wakefield, the spot is “well-positioned for near-term redevelopment,” thanks to its proximity to the Bayview subway station and Highway 401 on-ramp.

Even more compellingly, the property is just five minutes away from Bayview Village, which is the site of a massive redevelopment project that is sure to give real estate in the surrounding area something of a boost. The Bayview Village project is ushering much more density into uptown Toronto after all, in the form of six new condo and purpose-built rental towers that will be integrated into the existing shopping centre through adaptive reuse.

In addition, the listing says that the property poses the opportunity for “interim holding income” given the three-storey residential building that’s already on the site. The 19,500 sq.-ft building contains 20 residential units — including 10 one-bedrooms and 10-two-bedrooms, each with a private balcony — most of which are vacant. As well, the site includes “ample surface parking.”

Although a definitive selling price hasn’t been specified by Cushman & Wakefield — the commercial real estate firm only says that the price is “negotiable” — realtor.ca has the property listed for $18.9M.

If you peruse any listing platform these days, you’ll notice that there are no shortage of properties across the Greater Toronto Area — from freehold houses to condo units to “shovel-ready” land — that are being offloaded under powers of sale.

This could be chalked up to a sign of the times: many property owners have found themselves over-leveraged given the interest rate realities that have characterized the past few years, and lenders, as a result, are doing what they can to recoup costs. Although defaulting on mortgage payments is the most common reason for a power of sale, this remedy can be initiated by the lender if the borrower has breached any covenant of their loan.

Nonetheless, this means that there are some good investment opportunities to be had, if you’re in the position for a big-ticket purchase.