Regardless of what you get up to these days, be it dinner with friends or out for a walk with a colleague, it seems as if there are few topics as broadly discussed as Canada's real estate market.

Of course, there are a few reasons why Canadians are currently so real estate obsessed. Given that the pandemic forced a majority of Canadians to work remotely, there's been a significant focus on the home. With residents spending so much time at home, homebuyers took advantage of the historically low-interest rates and increased household savings to buy whatever properties were available.

With demand grossly outweighing supply in many markets across the country, prices continue to steadily increase, with the average price for a home in Canada now sitting at $679,051 -- a 25.9% year-over-year increase. As such, affordable real estate -- or a lack thereof -- is at the forefront of conversations these days.

As housing prices continue to rise, a new survey from RE/MAX found that 42% of Canadians believe the high price of real estate is a barrier to entry into the market and one in three (33%) Canadian homebuyers are now exploring alternative options to help them get a foot into the housing market.

READ: Fearing Affordability, Young Ontario Home Buyers Consider Leaving Like Never Before

Popular alternatives include renting out a portion of a primary residence (21%), pooling finances with friends or family to purchase a home (13%) or living with like-minded neighbours in a co-op/shared living arrangement (7%).

The survey is part of RE/MAX's 2021 Housing Affordability Report, which also found that among prospective homebuyers, millennials and Gen Z are most likely to consider alternative regions and communities, and/or financing options to keep affordability in play.

“While we wait for a nationally and municipally supported housing strategy based on an aggressive goal to boost our national inventory of affordable housing, there are regions across the country, especially in Western Canada, that remain accessible to first-time buyers looking to break into the market,” said Elton Ash, Regional Executive Vice President, RE/MAX of Western Canada.

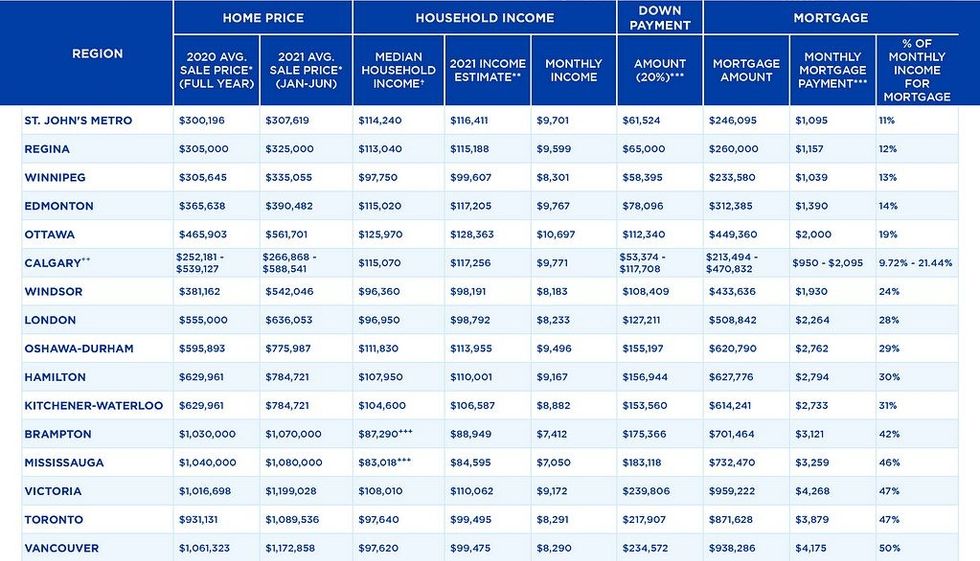

According to RE/MAX, St. John’s, NL has replaced Regina, SK as the most affordable Canadian city to buy a home in 2021. On the other end of the spectrum, Canada’s two largest cities, Toronto and Vancouver, remain the least affordable cities in the country. The two major markets have struggled with significant housing affordability challenges, mainly due to low supply and high demand spurred on by low-interest rates.

As it stands, housing in most of Canada’s major markets remains largely unaffordable for the average Canadian, though as Ash mentioned there are still some regions that offer more affordable real estate than others.

RE/MAX Canada analyzed house price to income ratio by various cities in Canada. Here’s how they ranked, from most to least affordable based on average sale price, monthly household income, and percentage allocated towards a mortgage.

- St. John's (Metro)

- Regina

- Winnipeg

- Edmonton

- Ottawa

- Calgary

- Windsor

- London

- Oshawa-Durham

- Hamilton

- Kitchener-Waterloo

- Brampton

- Victoria

- Toronto

- Vancouver

While there have been some measures introduced to help curb demand, it's been said that they do little to address some of the most challenges that are impacting housing affordability in Canada.

“The common means of solving Canada’s real estate challenges, such as the introduction of the stress test, solely addresses demand rather than finding a way to ensure there are enough homes for all Canadians," said Ash and Christopher Alexander, Chief Strategy Officer and Executive Vice-President, RE/MAX of Ontario-Atlantic Canada.

"Unfortunately, we have yet to tackle the real issue behind housing affordability in Canada, which is supply. We share the RE/MAX opinion that addressing supply must be our top consideration moving forward,” said Ash and Alexander.

You can read the full report here.