Although it's clear that more housing is needed in heavily populated urban centres like Toronto and Vancouver, new data suggests that land to build on is remarkably scarce.

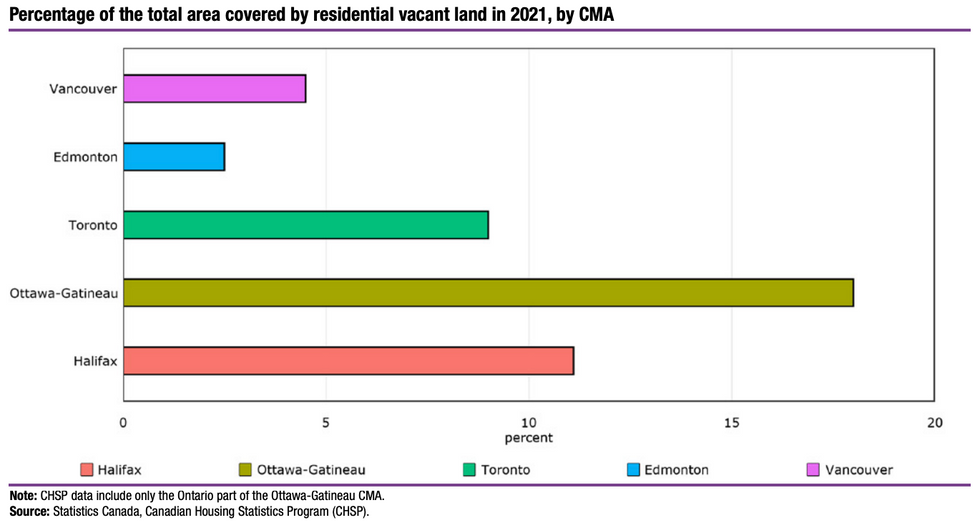

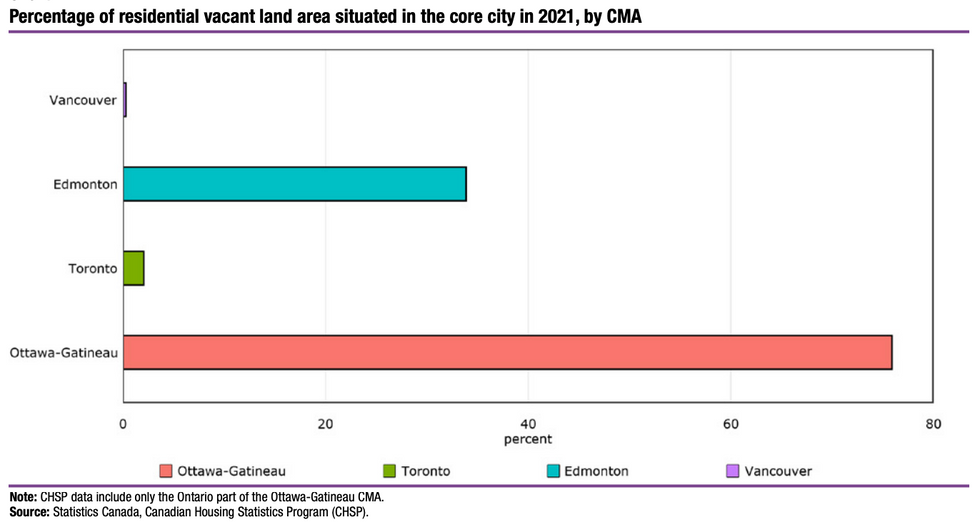

Statistics Canada (StatCan) revealed on Wednesday that residential vacant land accounts for just 9% of the entire Toronto Census Metropolitan Area (CMA) — translating to 131,000 acres — and that figure drops down to 2.1% within the city core. Those figures are as of 2021, which is the most recent year of available data.

Land availability is even tighter in Vancouver, where 4.5% of the CMA is residential vacant land, accounting for 32,000 acres. Again, that percentage plunges for the Vancouver city core, at just 0.3%.

“These figures show that even if a CMA features large stocks of residentially zoned vacant land, these stocks may be almost entirely outside the CMA’s core city,” said StatCan on Wednesday.

“This may have differing implications for housing supply, as it pertains both to the relative ease of developing previously built-over land ('greyfill'), as opposed to previously unbuilt parcels ('greenfill'), and to housing affordability.”

In contrast to Toronto and Vancouver, the Ottawa–Gatineau CMA has 18% — or 162,000 acres — of residential vacant land area, according to StatCan, with 75.9% of it situated within the city core.

While the Edmonton CMA has just 2.5% of residential vacant land area (accounting for 59,000 acres), 33.9% can be found within the limits of the city core.

“These percentages should be interpreted with care, however, since the total surface area of CMAs varies widely,” said StatCan.

“The CMA of Edmonton, for example, has a land area of 9,439 sq. km, compared with 2,883 sq. km for Vancouver. It is therefore not surprising that residential vacant land lots should account for less of the total in the former, despite there being more acres of residential vacant land in Edmonton than in Vancouver.”

StatCan’s data on vacant land is part of a larger ‘toolkit for understanding housing supply’ that highlights a number of indicators like vacant land availability, building costs, and construction labour force realities across select CMAs.