Across Ontario, development projects are being placed under receivership seemingly every week, and while each case has its own unique circumstances, there is one commonality that holds true for just about all of them: the mortgaged property is a piece of development land.

There are three key reasons for this, says Colliers Executive Vice President Jeremiah Shamess, who founded Colliers Private Capital Investment Group, which specializes in the sale of buildings and development land in the Greater Toronto and Hamilton Area (GTHA).

"Development land typically has short-term debt on it," says Shamess. "That short-term debt is connected to loan-to-value [ratios] and is connected to progressing the project."

This means that when the short-term debt is due, developers have to either pay cash or refinance, and the latter has become increasingly difficult.

"The number two reason is that the revenue side of the business is basically 80% off of highs, so condos are not being sold — they're about 20% of last year's market," says Shamess.

In April, a report published by Urbanation found that only four new projects in the GTHA came to market in Q1 2024 and that 60 condo projects have been put on hold over the last 24 months. Because the financing developers need to begin construction is often tied to presales, projects are having trouble getting to the construction stage.

"The third reason is that development charges have continued to increase and it's destroying the value of land, along with 57% increase in financing cost since 2020," he says. "That is all hitting the bottom line of what development land is worth, so if the lender believes they are about to refinance a parcel of land and the value is lower, that means the developer has to put more money into the deal, along with uncertainty about where the revenue is."

Earlier this month, condo development fees in Toronto increased as a result of provincial changes to the Development Charge Act, and this came after the City of Toronto had already increased the fees in May.

All of this is why many of the development projects that have fallen into distress are sites where condos were planned, such as the church conversion project at 248-260 High Park Avenue and several projects by Vandyk.

"There are a few that are rental, but generally speaking, the rental projects have been funded by pension funds so there haven't been as much issues like with the condos," says Shamess, who has been involved in several court-ordered sales in recent months.

And in many of those cases, the condo developers have generally been smaller and have had multiple projects in the entitlement and zoning stage simultaneously.

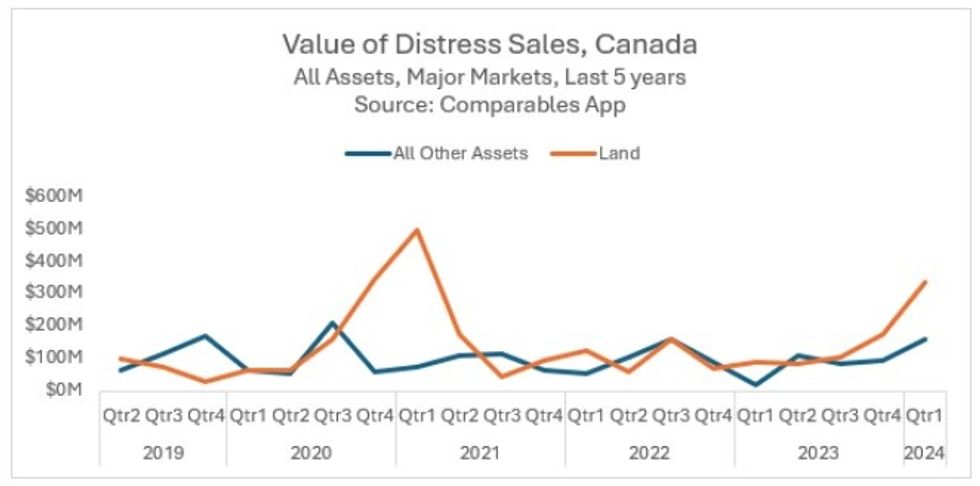

Shamess says that market conditions have made it tougher to find buyers for these distressed assets, but that deals are still happening and that resetting the value of assets in the market is not necessarily a bad thing. As for whether he sees an end in sight with all the distress, he believes the current state of things will be continuing for some time.

"If you look at history, generally these cycles take a couple of years to get through," he says. "Until [sales] demand for housing turns back on, it's going to be a very difficult market."

- ‘A Lull In The Market’: High-Density Land Sales Plunge To A 10-Year Low In GTA ›

- Colliers' Hart Buck & Jennifer Darling On The Uptick In Court-Ordered Sales ›

- 60 GTHA Condo Projects On Hold Indefinitely As Developers Pull Back "Dramatically" ›

- Brampton, Caledon Development Lands In Receivership Over $90M Debt ›

- 30-Storey Connolly Tower In Hamilton Placed Under Receivership A Second Time ›