The Greater Toronto Area’s housing story was pretty much the same in May as it has been so far this spring, characterized by sleepy sales, flatlining prices, and a surplus of inventory — both new and active. All that considered, the Toronto Regional Real Estate Board (TRREB) said in their monthly report on Wednesday that the market has “experienced an improvement in affordability,” with buyers having an edge.

However, with only 6,244 home sales reported, it seems many buyers opted to keep their purchasing plans shelved. May’s sales were down 13.3% compared to the 7,206 sales recorded in May 2024, highlighting how trade uncertainty has weighed on the market. But sales were also up 11.7% compared to the 5,585 sales recorded in April 2025. “This was the second monthly increase in a row,” said TRREB.

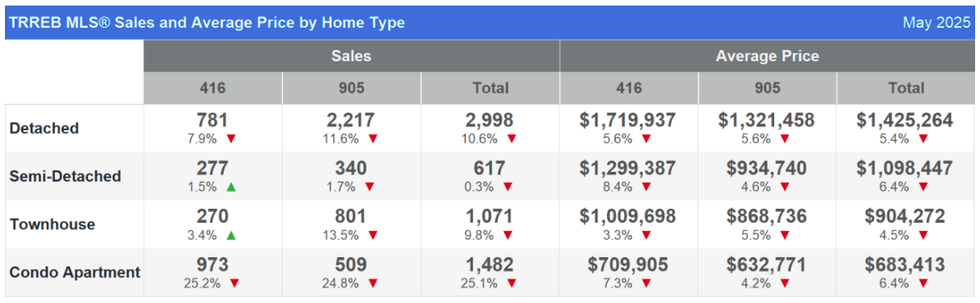

Most of May’s transactions were concentrated in the detached home segment, with 2,998 sales recorded (down 10.6% year over year), compared to 1,482 condo apartment sales (down 25.1%), 1,071 townhouse sales, (down 9.8%), and 617 semi-detached sales (down 0.3%).

TRREB also reported that there were 21,819 new listings in the month, marking a 14% rise over last May’s level and a 15.8% increase month over month. New listings were higher than they’ve been since March 2021, when there were 22,709 reported.

But the real kicker in the May report was active listings, with a staggering 30,964 on the market at the end of May, representing a 41.5% increase year over year and a 13% rise month over month. According to TRREB’s archived reports, this is the highest the metric has been since at least August 2002, which is when the real estate board changed its reports to reflect new and active listing counts as of the end of each month. Prior to this, TRREB's listing categories accounted for any listing on the market at any time during the month.

In addition, the next highest number of active listings observed over the past 23 years was in September 2008 (27,373 active listings) coinciding with the onset of the global financial crisis.

Wednesday’s report also shows that the average selling price, at $1,120,879, slipped by 4% year over year, but rose by 1.2% month over month. Seasonally adjusted, the MLS® Home Price Index Composite benchmark was down by 4.5% compared to May 2024.

“Homeownership costs are more affordable this year compared to last. Average selling prices are lower, and so too are borrowing costs. All else being equal, sales should be up relative to 2024,” said TRREB’s Chief Information Officer Jason Mercer in a press release. “The issue is a lack of economic confidence. Once households are convinced that trade stability with the United States will be established and/or real options to mitigate our reliance on the United States exist, home sales will pick up. Further cuts in borrowing costs would also be welcome news to homebuyers.”

- GTA Sees Slowest Non-Pandemic April For Home Sales In Nearly 30 Years ›

- A “Normal” Spring For Toronto’s Housing Market? Maybe Next Year ›

- How Toronto Landlords Are Filling Units Amid Low Demand ›

- Toronto Condos At 60% Of Inventory, Leaving Future Supply In Trouble ›

- Canadian Home Sales See First Monthly Gain Since Late 2024 ›

- What The Toronto Real Estate Market Will Look Like This Summer ›

- GTA Active Listings Hit Another High With 31,600 Units On Market ›

- Toronto Realtors Report Most July Home Sales Since 2021 ›

- TRREB Calls For More Rate Cuts As GTA Housing Market Shows Fragile Recovery ›