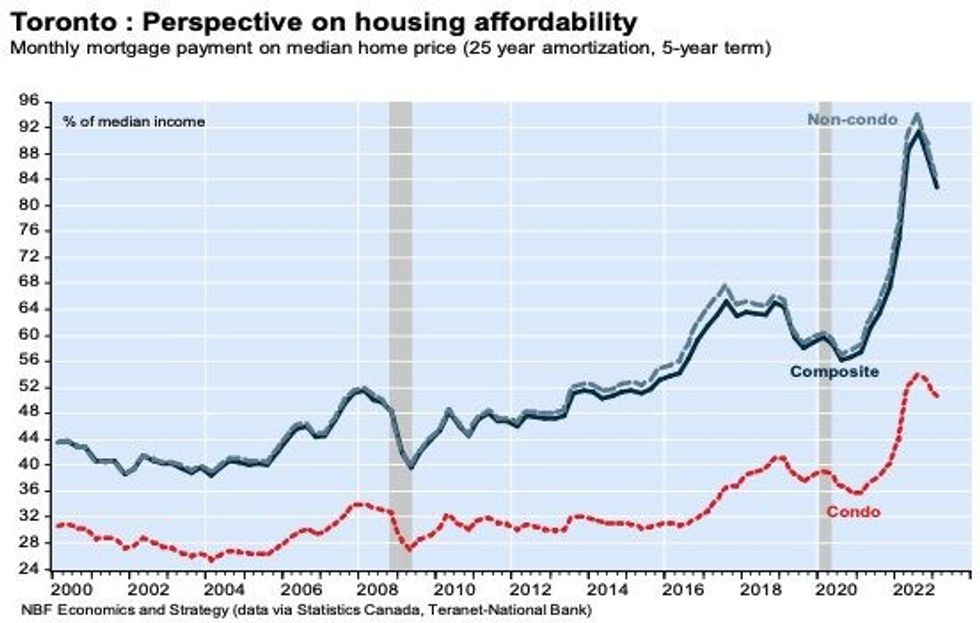

After more than two years of deterioration, housing affordability in Toronto improved at the start of 2023. However, it still takes roughly 25 years to save for a down payment in the city.

According to the National Bank of Canada's latest Housing Affordability Monitor, the mortgage payment as a percentage of income (MPPI) in the Greater Toronto Area dropped 4.6 percentage points to 82.8% in Q1 2023. Despite the improvement, the measurement remained "well-above" the region's historical average of 51.4%, and was still up 7.5 percentage points on an annual basis.

The MPPI is measured as the monthly mortgage payment on a median-priced home assuming a 25-year amortization period and a five-year term. The figure is presented as a percentage of median household income, the data for which is sourced from Statistics Canada.

The non-condo segment, which includes single-detached and semi-detached homes, saw the greatest improvement in affordability in Q1 2023, with the MPPI dropping five percentage points to 84.7%. Within the condo segment, the measurement declined 2.1 percentage points to 50.6%.

The overall improvement in affordability across the GTA stemmed from a 1.4% quarterly increase in income, a slight drop in interest rates, and a 2.6% decline in home prices from Q4 2022.

Despite the decline, the median price of a non-condo property in the GTA remains amongst the highest in Canada, at $1,163,670.

Based on National Bank's assumption that a household devotes 32% of its pre-tax earnings to mortgage payments, an annual income of $236,221 is required to afford such a home. According to data from the City of Toronto, the average annual income in the region is $97K.

Those who do earn the qualifying salary would need to save 10% of their income for 304 months, or 25.3 years, to afford the down payment.

Torontonians eyeing condo living would need to save for 58 months, or 4.8 years, to afford a down payment on a median-priced $695,691 unit. They'd also need to earn $165,220 per year.

Amongst all dwellings in the city, 297.2 months of saving are required for a downpayment.

The lengthy process is eclipsed only by Vancouver, where hopeful homeowners must save for 454 months (37.8 years) to afford a down payment -- and earn $322,245 per year -- while condo-dwellers need to save 10% of their $171,052 annual salary for 67 months (5.5 years). Looking at all dwelling types, 340.8 months of saving are necessary for a down payment.

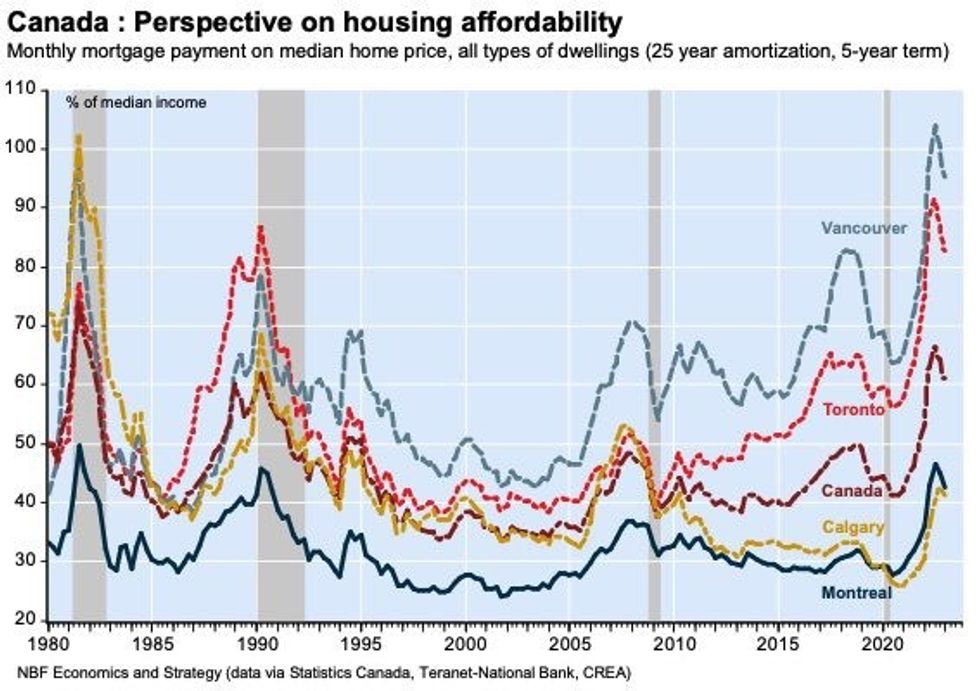

On a quarterly basis, Vancouver's MPPI declined 5.3 percentage points to 94.9% in Q1 2023. The figure stood at 126.4% in the non-condo segment, and at 57.4% in the condo segment.

Although housing affordability remains strained in Toronto and Vancouver, the cities saw some of the most significant improvements across Canada in Q1 2023. In fact, for the first time since Q3 2020, all ten markets included in National Bank's report registered an improvement in housing affordability. Quebec saw the smallest improvement, with the MPPI declining 0.9 percentage points to 30.2%.

Nationally, the MPPI dropped 3.2 percentage points quarter over quarter to 60.9%, marking the largest improvement in housing affordability in nearly four years. However, the measurement is still up 7.4 percentage points year over year.