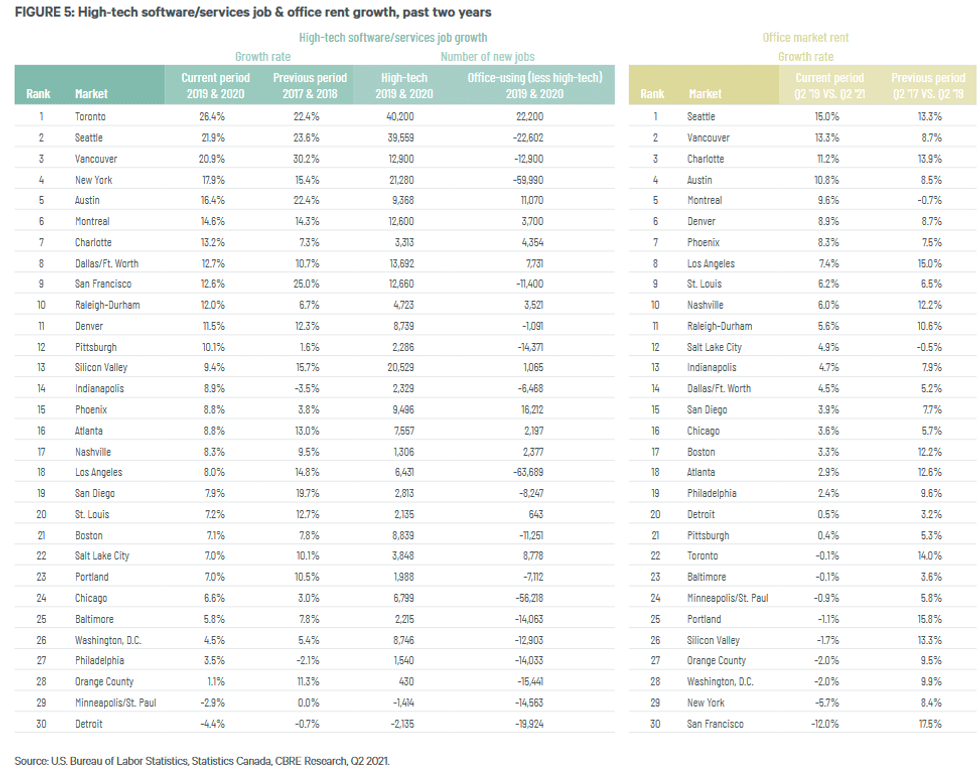

The 2021 Tech-30 report indicates that 11 markets saw faster high-tech job growth in 2019 and 2020 than in the previous two years, including Toronto, Montreal, Dallas, and Charlotte. Toronto led the pack with a 26% growth rate and 40,200 new jobs added, making it the top high-tech job growth market. Seattle and Vancouver ranked second and third, respectively.

Now in its 10th year, the annual report from CBRE looks at the high-tech industry’s impact on employment and office space in 30 leading Canadian and American tech markets. Findings are divided into two areas: tech job growth and office space availability for that tech growth. Emerging markets are also examined, with this year’s results highlighting Waterloo and Ottawa as the top two tech-heavy markets to watch.

The North American market saw 1.6M jobs created from 2010 to August 2021, according to CBRE. Tech jobs declined slightly from March 2020 to May 2020 but rebounded with 219,000 jobs added from May 2020 to August 2021.

“Job growth has returned for the high-tech industry, so this means a rebound in the recovery of office space,” says CBRE Vancouver’s managing director, Jason Kiselbach.

Tech job growth is strongly associated with office rent growth in Tech-30 markets, with four markets seeing rent growth of 10% or more between Q2 2019 and Q2 2021 -- Seattle, Vancouver, Charlotte, and Austin, followed by high single-digit growth in Montreal, Denver, Phoenix, and Los Angeles.

Kiselbach says the report categorizes office space in North America as hitting the ‘stable phase’ in the second quarter of 2019 and beginning a contraction phase -- a period of lower demand and rising supply -- over the past year as more people began working from home.

Key Indicators of Tech Growth

The Nasdaq Index is correlated to high-tech job growth and provides a one-year leading indicator of employment levels. How a publicly traded company performs on the Nasdaq can predict office growth for that company. Venture capital investment also influences job growth, and in 2020, VC investment hit a record high of $133 billion. According to CBRE, this record high has been surpassed as of third quarter 2021.

In Canada, major venture capital firms in the space (based on size of total rounds) include BDC Capital, Inovia Capital, Investissement Québec, Desjardins Capital, and Real Ventures, as per findings from the Canadian Venture Capital and Private Equity Association (CVCA).

Tech companies currently account for 23% of available sublease space across the Tech-30 markets, up from 14% in 2019. These companies make up 23% of the 134 million square feet of currently available sublease space in the US and Canada, according to CBRE.

READ: Menkes on the Evolution of Toronto’s Waterfront Commercial Real Estate Scene

As a rule of thumb, Kiselbach says 150 square feet of office space should be allocated to each employee, although offices could be denser depending on how businesses use them.

“Hybrid work will have lasting impact on future demand. And the potential for decreased office space per employee will likely be offset by job creation,” says Kiselbach. “Although we might require fewer square feet per person, the fact that we will have more jobs than we did prior to the pandemic will offset that cost.”

Net absorption (the change in occupied space) was positive in six overall markets and 12 submarkets, which were all located in the US. This positive absorption means more space was leased than added to the market as new supply. As a whole, the Tech-30 markets saw office rents stabilize in their top tech submarkets. And all markets saw vacancy increase.

“Twenty-one markets showed positive office rent growth compared to two years ago,” says Colin Yasukochi, executive director of CBRE Tech Insights Center.

But there are markets at risk, especially San Francisco, he says.

“San Francisco has the highest amount of sublease space as a percentage (11%) of the market," says Yasukochi. “Additionally, about 40% of all available office space on the market is sublease space and the other 60% is direct from the building owner. This sublease space has influenced the San Francisco market more than any other."

“While still high in San Francisco, sublease space has declined as this space gets leased to other tenants, returned to landlords, or taken off the market by tenants intending to reoccupy the space,” he adds.

As for Canada, Yasukochi says most of the Canadian markets are doing well and are at the top of CBRE’s tech job growth rankings.

Canada’s Appeal

Canada continues to receive interest from US tech companies looking to expand their footprint. Kiselbach says this interest has increased over the past few years because of a surge in a skilled labour force from Canada’s immigration policy efforts in attracting talent as well as the skilled talent developed through Canadian universities.

“American companies realized they could get skilled labour at a significant discount, with wages and the currency change working in their favour,” says Kiselbach.

READ: Richmond, BC Has Always Been More of a Business Park-Focused Office Market – That’s Changing

“Toronto, Vancouver, and Montreal got some of the highest growth in terms of new jobs in tech, so three of the five lowest cost markets on the report based on wages for high-tech workers and office space were seeing this opportunity for growth."

Up-and-coming markets, including Waterloo and Ottawa, are also seeing an uptick. Tech companies are starting to locate to these cities, creating a flywheel effect of skilled labour being developed.

“You see a high lease rate, which is leading to lower rent rate, too,” says Kiselbach. “Also, secondary markets are seeing growth because people are moving away from expensive coastal cities.”

Methodology

The CBRE methodology assesses and defines the high-tech industry via industry employment statistics, taken from resources like software publishers, computer systems, ecommerce, and web search portals. Three personnel were dedicated to producing the report, and CBRE included people from each of the thirty markets covered for research information and market intel.