It may not be a shock to many, but it’s confirmed: Toronto’s housing market officially has a higher bubble risk than anywhere else in the world.

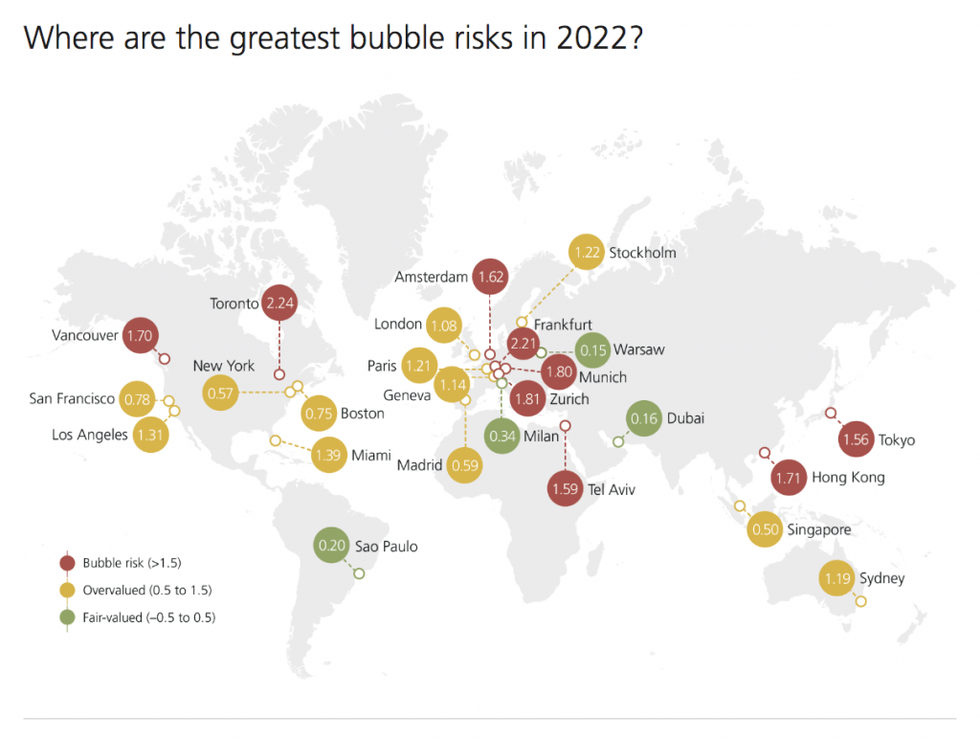

This is according to the UBS Global Real Estate Bubble Index for 2022, released yesterday, which showed that Toronto’s bubble risk has expanded to a score of 2.24 this year, up from 2.02 in 2021 and 1.96 in 2022. UBS’s metric puts any score above 1.5 at bubble risk.

In previous years, Frankfurt and Munich have snagged that top spot, but as housing prices in Toronto have more than tripled in the last 25 years -- amid chronic inventory shortfalls and a growing population -- the 6ix has unsurprisingly inched to the not-so-coveted number one spot.

That said, Toronto is not an outlier in Canada. Thanks to a lot of the same factors facing Toronto, Vancouver also showed significant bubble risk with a score of 1.70.

“The index has been flashing warning signals in the last couple of years,” UBS’s report explains. “The most recent housing frenzy that began in 2019 as mortgage rates fell has continued into 2021. Property price growth in Vancouver and Toronto accelerated to its highest rate in five years, with house prices now respectively 14% and 17% higher than a year ago.

“Up-sizing during the pandemic on the back of strong income growth has done its part in pushing up demand. Households have also been leveraging up at the fastest pace since before the financial crisis. And although the rental market is running hot with rents climbing by more than double their five-year average rates, they could not keep up with the pace in the owner-occupied market.”

The report goes on to further explain that already-stretched housing affordability has been exacerbated by the recent Bank of Canada rate hikes, calling those “the last straw that broke the camel’s back.”

“New buyers and owners during mortgage renegotiations not only need to pay higher interest rates but are also required to provide more income to qualify for a mortgage. Price correction is already in the making.”

With home values being what they are, and the threat of more interest rate hikes looming, Canadians are waiting with bated breath on when and to what extent the bubble will burst.

Canada aside, it seems that bubble conditions are intensifying throughout the world. Of the 25 cities assessed in UBS’s report, nine had a bubble risk, and all nine have seen their scores increase from last year. In addition, Paris, Tel Aviv, and Tokyo have joined the bubble-risk-ranks, contrary to last year.