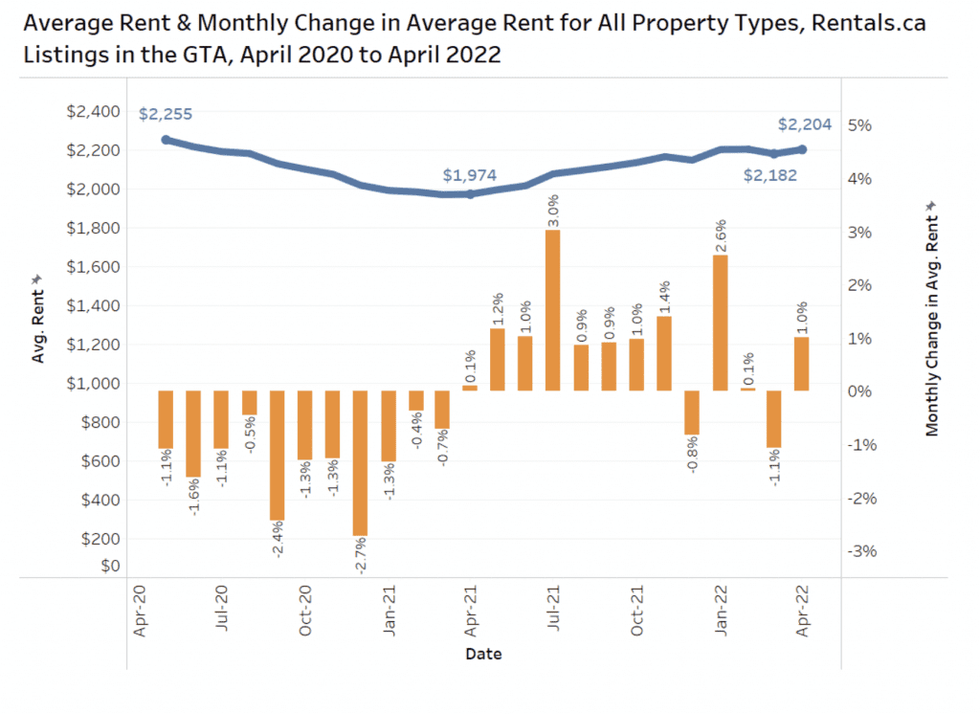

Demand for rentals in the Greater Toronto Area continues to grow post pandemic, with the latest data showing average rents for all property types rose 12% year over year in April to $2,204 from $1,974 in 2021, and up 1% from March.

That’s the eighth consecutive month of increases, according to Bullpen Research & Consulting and TorontoRentals.com.

It’s a sharp turnaround from the COVID-induced declines seen throughout most of 2020 and the start of 2021; however, the report notes, rent growth is expected to calm from the sizzling growth rate experienced in the second half of 2021.

“Overall, the GTA rental market has flattened out this year, however, the downtown condo rental market is hotter than any period since the fall of 2019,” said Ben Myers, President of Bullpen Research & Consulting. “GTA condo rents are up 21 per cent annually, with select projects in Toronto’s core up by over 30 per cent from April of last year.”

Condo Rentals Still Sizzle in the Core

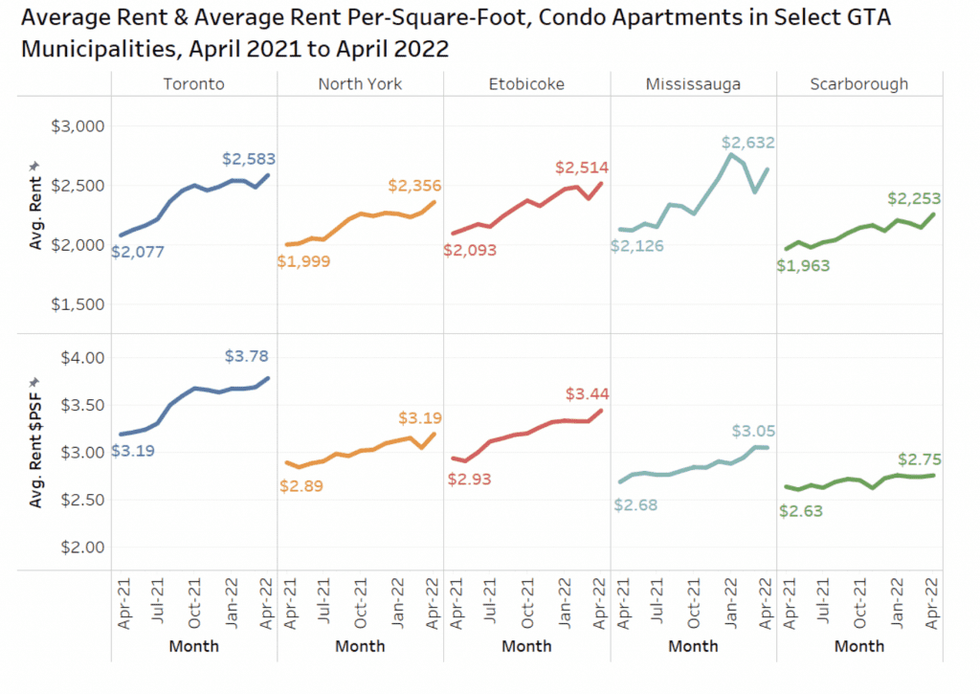

Indeed, condos rental types located in Toronto’s downtown core are leading the resurgence; the city had the highest annual increase of 24%, with an average unit renting for $2,583 (working out to $3.78 psf). Demand also remained hot for Mississauga-area units, which also rose 24% year over year to an average of $2,632 ($3.05 psf), as well as in Etobicoke, up 20% to an average of $2,514 (3.44 psf). Scarborough condo rents saw the lowest rate of growth for the segment in the GTA, though still up a robust 15% to $2,253 (2.75 psf).

Condo apartment rentals in general saw rents rise 21% year over year, to an average of $2,509, and up 3.6% from March. That’s also officially outpaced average pre-pandemic rent levels, which hit $2,473 in February 2020, reflecting the segment is recovering quickly, despite being the hardest hit at the onset of the COVID-19 lockdowns.

Non-condo rental apartments rose 6% year over year, to $1,996 per unit. Rents for two-bedroom units rose the most, up 12% annually, followed by studio units (9%) and one-bedroom units (8%). In Toronto and Etobicoke specifically, many of the largest annual increases were found in units with a rounded size between 500 square feet and 1,000 square feet.

Curiously, Burlington stands out as an outlier in terms of unit price growth, with the average rental apartment rising 17% to $2,211, compared to 9% growth in the City of Toronto, to $2,139. On the other end of the spectrum, Brampton and Scarborough actually saw average apartment rents each dip 2% to $1,817 and $1,726, respectively.

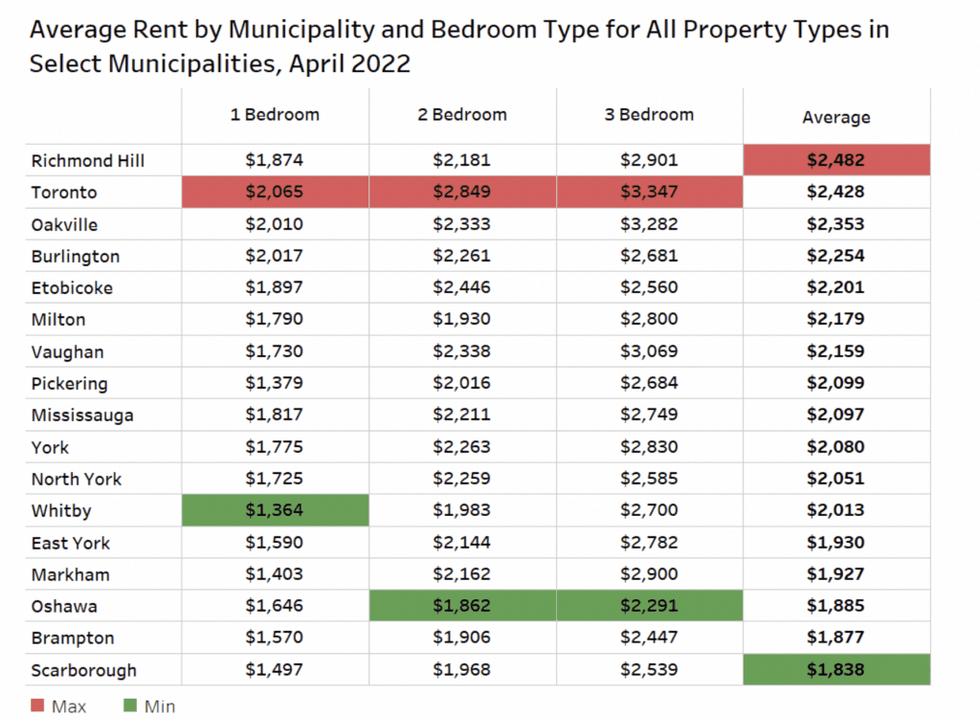

Overall, the priciest rents for all property types in the GTA can be found in Richmond Hill -- which Rentals.ca and Bullpen attribute to having a greater proportion of bigger units -- with an average price of $2,482, across all property types. Toronto comes in next at $2,428. Again, those seeking a deal on a unit can look to Scarborough; it came in with the lowest average, at $1,838.

The report points out that, “If the ownership market continues to soften, expect rents to pick up, especially downtown and in transit-friendly neighbourhoods.”

Ownership market home sales and prices have started to soften in recent months, as the impact of rising interest rates, along with three-decade-high inflation, reduce prospective buyers’ purchasing power. According to the Toronto Regional Real Estate Board, GTA home sales fell 41% year over year in April, and 27% from March. While affordability remains elusive -- hitting a 40-year low over the last 12 months -- prices are starting to follow suit, especially in the 905-area markets.

READ: Get Ready for Another Jumbo Rate Hike on Wednesday

Analysts are unanimously calling for another outsized half-point hike on June 1, to be followed by at least one more 0.5% increase before relaxing into a series of quarter-point hikes to finish out the year. That sets the stage for further rent price growth as more buyers wait out today’s tightening interest rate environment.