If one thing's for certain: COVID-19 has changed everything. In March, the economy tanked, unemployment surged, and immigration grounded to a halt. And as a result, the Toronto condo market has taken a hit, with demand for rentals and sales down significantly year-over-year, according to the Toronto Regional Real Estate Board (TRREB).

On Friday, TRREB released its Q2-2020 Market Reports, which took a look at both Toronto's condo rental and condo resale markets. The biggest takeaway from both reports is that the pandemic has clearly impacted the demand for condo rentals and sales.

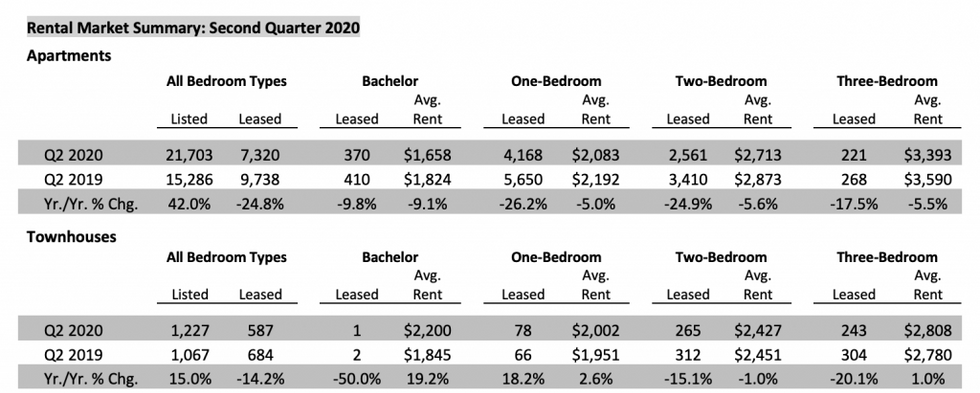

For the second quarter of 2020, 7,320 condominium apartment rentals were reported through TRREB's MLS system, which is down by 24.8% year-over-year. But what's interesting to note is that the number of condos listed for rent throughout Q2-2020 was up by 42% year-over-year, indicating that listings outperformed transactions, which led to a much more moderate pace of price growth.

“There are two key take-aways from the Q2 2020 rental market statistics. First, COVID-19 clearly impacted the demand for rental condominium apartments, due to restrictions on showing units and job losses across many sectors of the economy," said TRREB President Lisa Patel.

"Second, we saw the continuation of the pattern experienced over the past year, with year-over-year growth in rental listings far outstripping growth in rental transactions, resulting in a much better-supplied market and a moderating pace of rent growth.”

READ: New Condo Sales in GTA Hit Lowest Level Since 2009 Recession in Q2-2020

As for prices, the average rent for a one-bedroom condominium apartment reached $2,083 in Q2 2020 – down 5% from Q2 2019 – while the average two-bedroom condominium apartment rent was $2,713, representing a 5.6% decline year-over-year.

“Following very tight market conditions in 2018, we have seen a consistent trend toward balance in the GTA condominium apartment rental market over the past year-and-a-half," said Jason Mercer, TRREB’s Chief Market Analyst.

"Accelerating growth in rental listings were at the root of this trend, but the COVID-19-related drop-off in rental transactions had a marked impact as well. Increased choice led to more negotiating power for renters, resulting in year-over-year declines in average rents in the second quarter of 2020.”

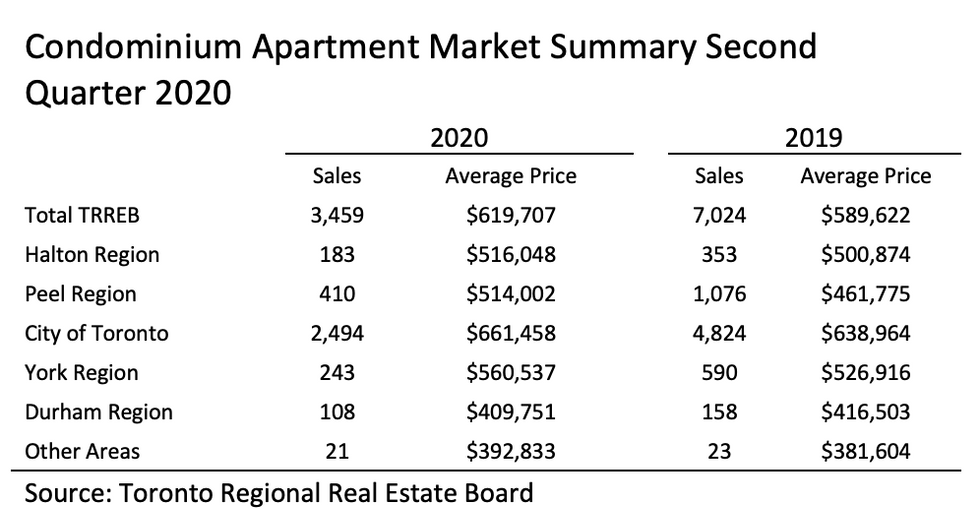

As for condominium apartment sales, TRREB reported 3,459 transactions in the second quarter – down 50.8% compared to 7,024 sales in Q2 2019. The number of new condominium apartment listings amounted to 8,717 in Q2 2020 – down 21.6% compared to 11,114 new listings entered in Q2 2019.

Like the rental market, Ms. Patel says the pandemic has caused sales and new listings to dip, as many potential buyers moved to the sidelines as a result of public health measures taken to combat COVID-19 and the resulting economic downturn.

However, with the overall housing market trending toward recovery in June, Patel says she expects that condo apartment sales will likely improve in the third quarter.

What's more, despite market conditions becoming more balanced in Q2-2020, TRREB says the average selling price for condo apartments was up 5.1% compared to Q2-2019 to $619,707.

During the second quarter, Toronto recorded the most sales, with 2,494 completed transactions, while the average price reached $661,458.

RELATED: The Toronto Rental Market Has Softened for the First Time in Years, Now What?

“It will be important to watch the relationship between condominium apartment sales and new listings as we move through the second half of 2020. If economic recovery is sustained, the demand for condo apartments will improve," said Mercer.

"However, the prospect of stricter regulations on short-term rentals and softer rental market conditions could fuel increased listings of investor-held units. If we see more balanced market conditions, condo price growth could be more moderate compared to low-rise home types.”